What is a Transfer-on-Death Deed in Maryland?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real property to a designated beneficiary upon the individual's death. This deed is particularly beneficial because it bypasses the probate process, enabling a smoother transition of property ownership. In Maryland, this form must be properly executed and recorded to be effective, ensuring that the designated beneficiary receives the property without delay or complication after the owner's passing.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Maryland can utilize a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals holding property in their name. However, it is important to note that the individual must have the legal capacity to execute the deed, meaning they should be of sound mind and at least 18 years old. Additionally, the deed can only transfer property that is solely owned by the individual, not property held jointly or in a trust.

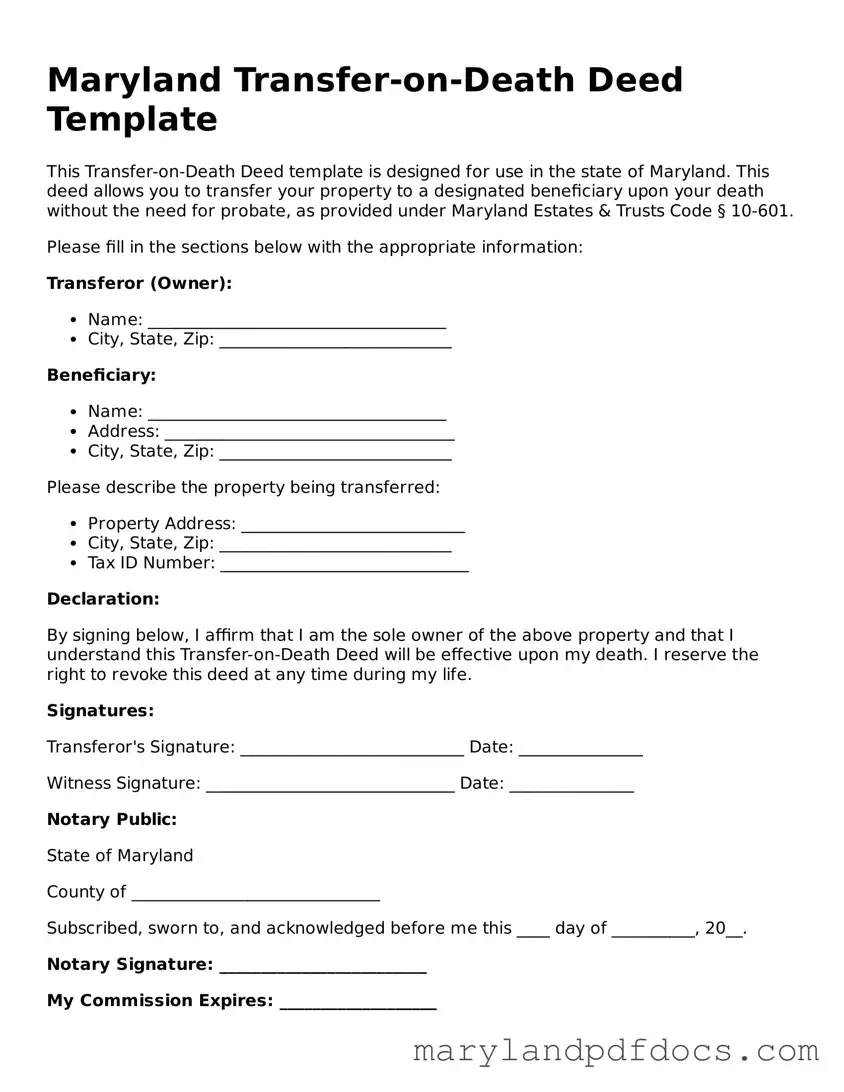

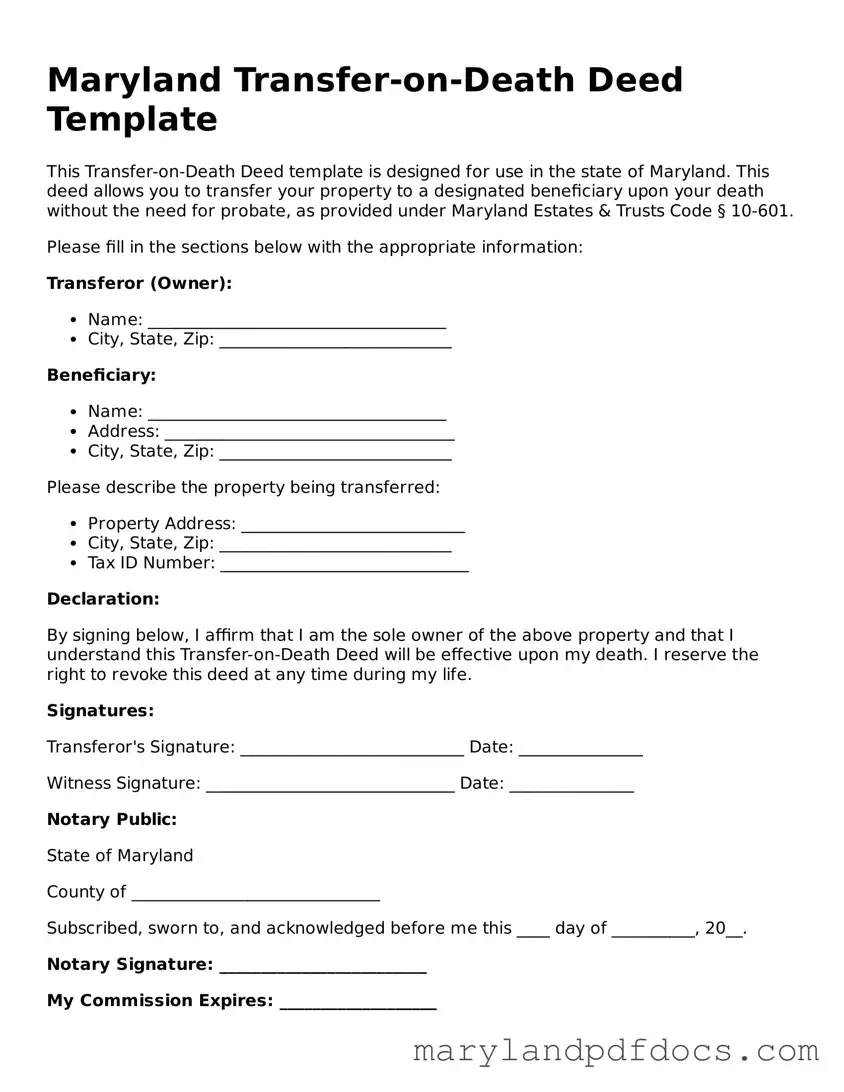

How do I complete a Transfer-on-Death Deed?

Completing a Transfer-on-Death Deed involves several steps. First, you must obtain the official form, which is available through the Maryland State government or local county offices. Next, you will need to fill out the form with accurate information, including your name, the name of the beneficiary, and a description of the property. After filling out the form, it must be signed in the presence of a notary public. Finally, to ensure the deed is legally binding, it must be recorded with the local land records office in the county where the property is located.

Can I change or revoke a Transfer-on-Death Deed after it has been executed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do so, you must execute a new deed that explicitly states the changes or revoke the previous deed entirely. It is crucial to record any new or revocation deeds with the local land records office to ensure that the changes are legally recognized. This flexibility allows property owners to adapt their estate plans as circumstances change, such as the death of a beneficiary or changes in personal relationships.

What happens if the beneficiary predeceases me?

If the designated beneficiary of a Transfer-on-Death Deed passes away before the property owner, the deed does not automatically transfer the property to the beneficiary's heirs. In this case, the property will remain part of the owner's estate and will need to be addressed according to the owner's will or, if there is no will, according to Maryland's intestacy laws. It is advisable to name an alternate beneficiary in the deed to avoid potential complications and ensure that the property is transferred as intended.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. The property remains part of the owner's estate until death, and the transfer occurs outside of probate. However, beneficiaries may be subject to capital gains taxes when they sell the property, depending on the property’s value at the time of the owner's death compared to its original purchase price. Consulting with a tax professional can provide clarity on specific situations and potential tax liabilities.

Is legal assistance necessary to create a Transfer-on-Death Deed?