What is a Small Estate Affidavit in Maryland?

A Small Estate Affidavit is a legal document that allows a person to claim assets of a deceased individual without going through the full probate process. In Maryland, this option is available when the total value of the estate is under a certain threshold, which is currently set at $50,000 for personal property and $100,000 for real property. This form simplifies the process for settling small estates.

Who can use the Small Estate Affidavit?

The Small Estate Affidavit can be used by an individual who is a beneficiary or an heir of the deceased person. Typically, this would be a spouse, child, parent, or sibling. However, anyone who is entitled to inherit under Maryland law can complete and submit this affidavit, as long as they meet the requirements.

What assets can be claimed using the Small Estate Affidavit?

You can claim personal property such as bank accounts, vehicles, and other tangible assets. However, real property, like a house or land, can only be claimed if the total value of the estate is under $100,000. If the estate exceeds these limits, the full probate process must be followed.

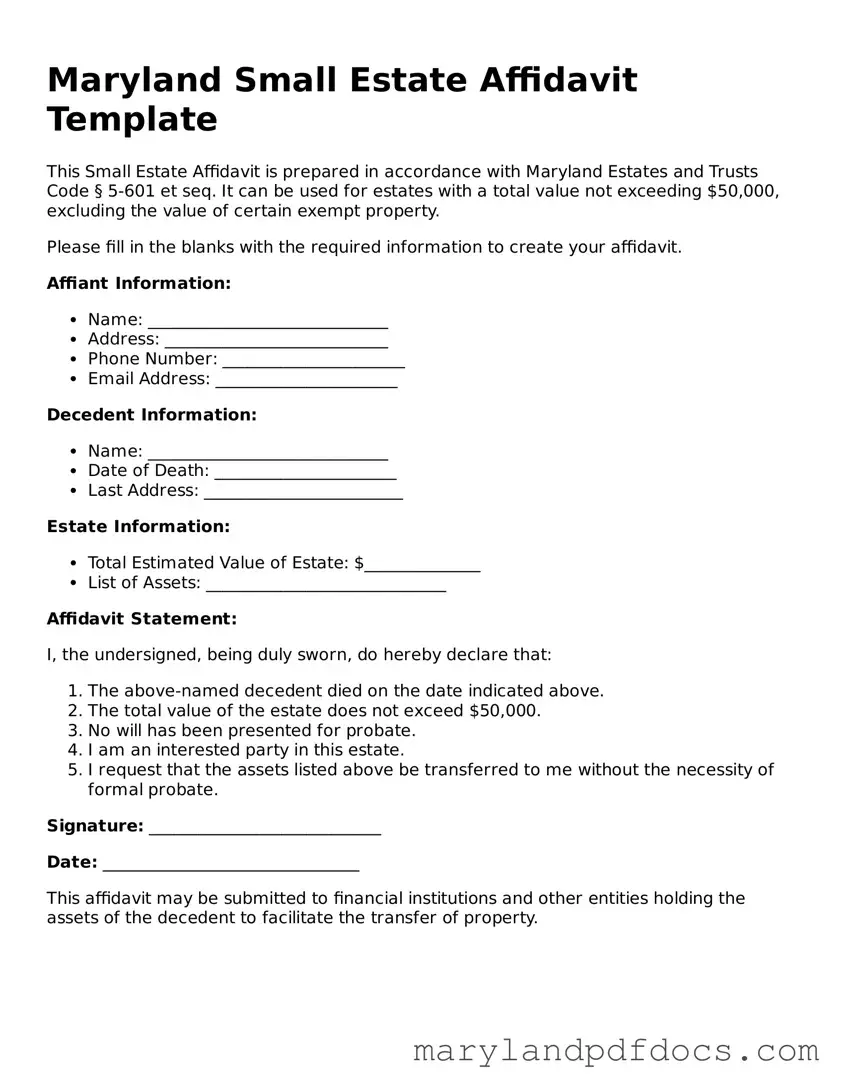

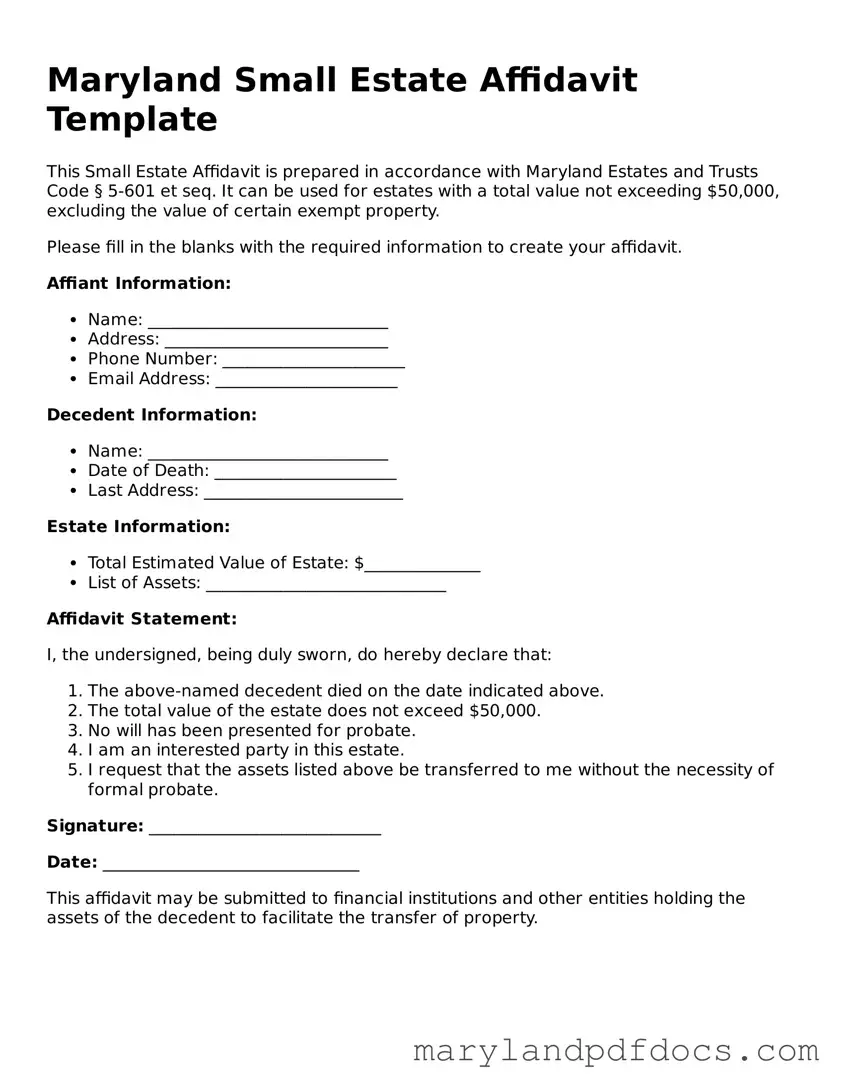

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you need to fill out the form with details about the deceased and the assets you are claiming. This includes providing information about the deceased’s estate, the names of the heirs, and the value of the assets. It's important to ensure that all information is accurate and complete to avoid delays.

Do I need to file the Small Estate Affidavit with the court?

No, you do not need to file the Small Estate Affidavit with the court. Instead, you present it directly to the institutions or entities that hold the deceased's assets, such as banks or motor vehicle administrations. They will use the affidavit to release the assets to you.

Is there a fee associated with the Small Estate Affidavit?

There is no fee for completing the Small Estate Affidavit itself. However, some institutions may charge a fee to process the release of assets. It’s a good idea to check with each institution to understand any potential costs involved.

How long does it take to receive the assets after submitting the affidavit?

The time it takes to receive the assets can vary. Once you submit the Small Estate Affidavit to the relevant institutions, they typically process it within a few weeks. However, delays can occur depending on the institution’s policies and the complexity of the estate.

What if the deceased had debts?

If the deceased had debts, those must be settled before the assets can be distributed. The Small Estate Affidavit does not protect you from the deceased's creditors. You may need to address any outstanding debts before you can claim the assets.

Can the Small Estate Affidavit be contested?

Where can I obtain the Small Estate Affidavit form?

The Small Estate Affidavit form can be obtained from the Maryland State Judiciary website or local circuit court offices. It's important to use the most current version of the form to ensure compliance with Maryland laws.