Fill Out Your Resale Certificate Maryland Template

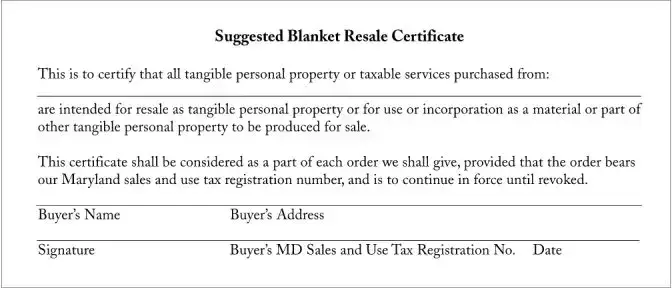

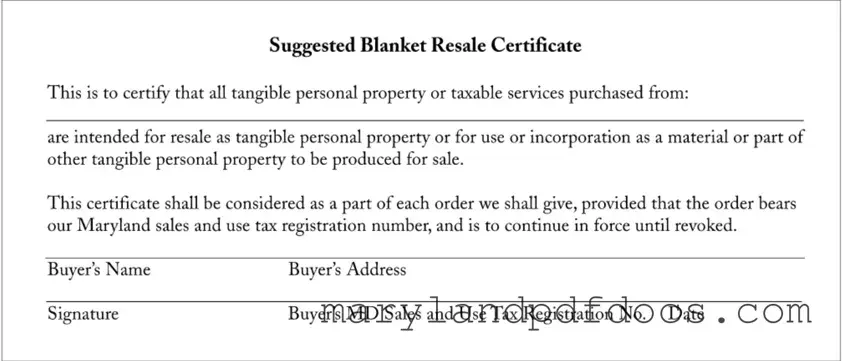

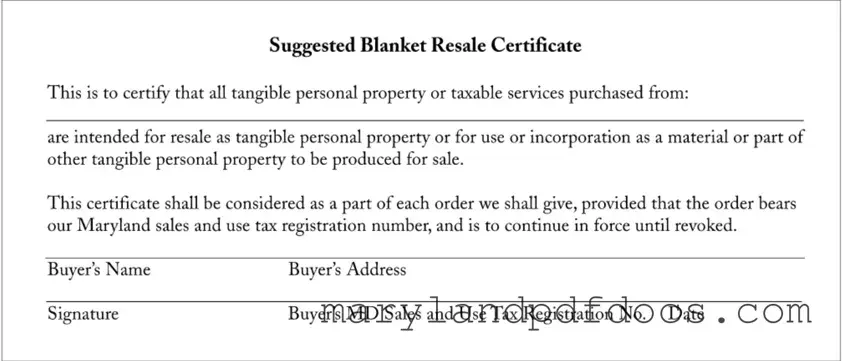

The Resale Certificate Maryland form is a document that certifies tangible personal property or taxable services are purchased for resale purposes. This certificate simplifies the purchasing process by allowing buyers to exempt these transactions from sales tax, provided they are intended for resale or incorporation into other products. To ensure compliance and proper use, it is essential to fill out the form accurately.

Ready to complete your Resale Certificate Maryland form? Click the button below!

Launch Resale Certificate Maryland Editor

Fill Out Your Resale Certificate Maryland Template

Launch Resale Certificate Maryland Editor

Launch Resale Certificate Maryland Editor

or

Free Resale Certificate Maryland PDF

You’ve already started — finish it

Fill out Resale Certificate Maryland digitally in just minutes.