What is a Maryland Promissory Note?

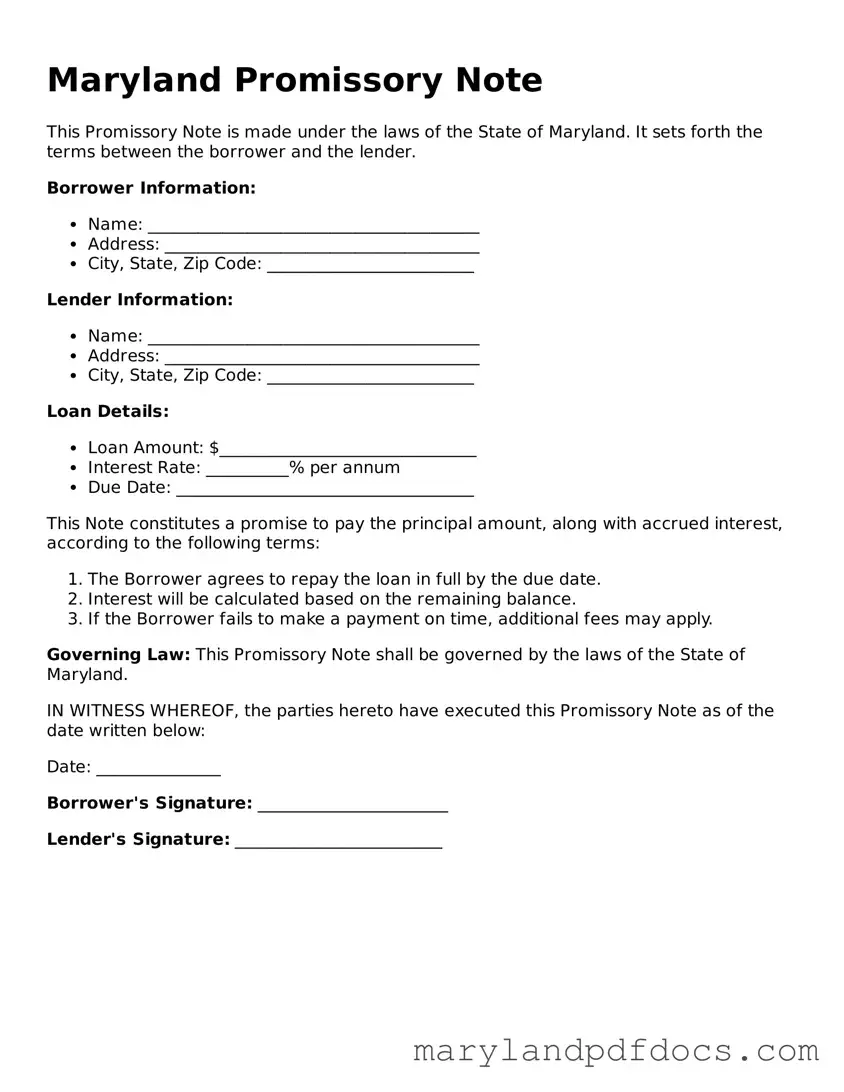

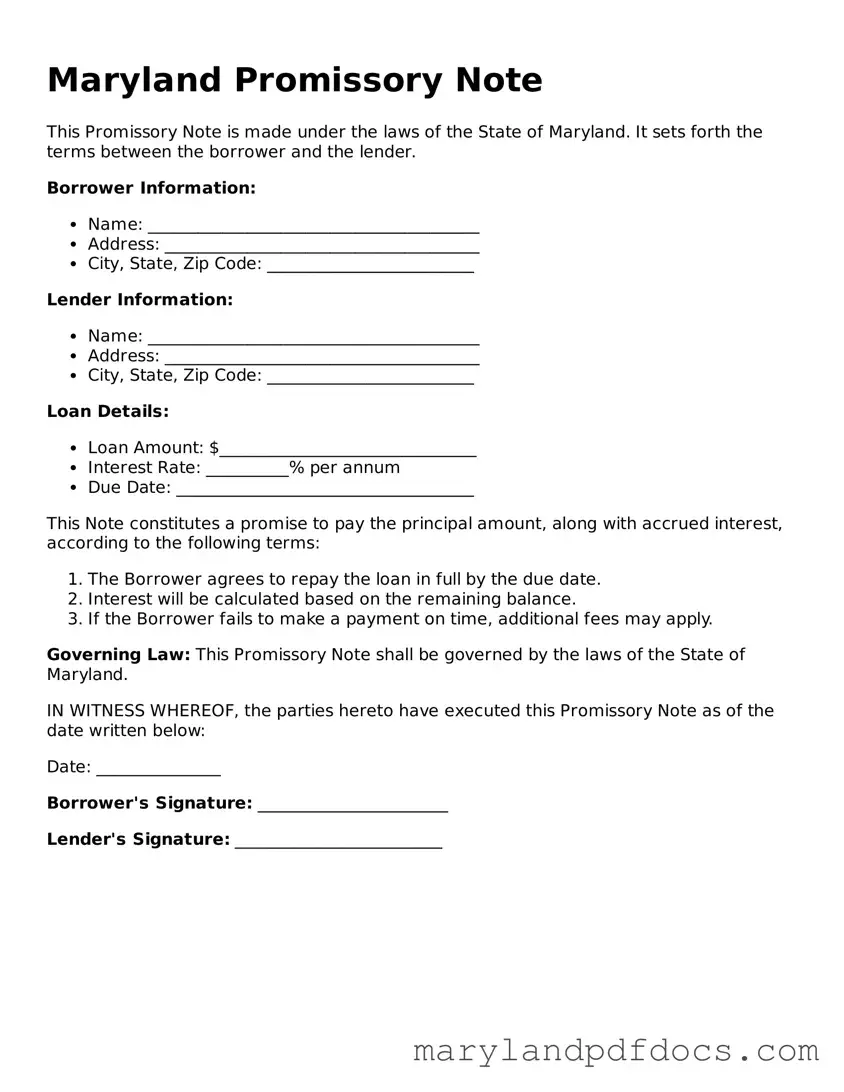

A Maryland Promissory Note is a legal document that outlines a promise to pay a specific amount of money to a lender or a third party. This note serves as evidence of a debt and includes details such as the principal amount, interest rate, repayment schedule, and any penalties for late payments. It is essential for both parties to understand the terms outlined in the document to avoid disputes later on.

Who uses a Promissory Note in Maryland?

Individuals and businesses often use Promissory Notes in Maryland. They can be used for personal loans between friends or family members, business loans, or any situation where one party borrows money from another. The document is beneficial for both the lender and borrower, as it provides a clear record of the loan agreement.

What are the key components of a Maryland Promissory Note?

A typical Maryland Promissory Note includes several key components: the names and addresses of both the borrower and lender, the loan amount, the interest rate, the repayment schedule, and any late fees or penalties. Additionally, it may contain clauses regarding default and what actions can be taken if the borrower fails to repay the loan.

Is a Maryland Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding in Maryland. For it to be enforceable, it must be signed by the borrower, and both parties should retain a copy. If disputes arise, this document can be presented in court as evidence of the agreement.

Do I need a lawyer to create a Promissory Note in Maryland?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can ensure that the document meets all legal requirements and adequately protects your interests. For simple agreements, many templates are available online that can be customized to fit your needs.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make the required payments, the lender has the right to take legal action. This may involve sending a demand letter or filing a lawsuit to recover the owed amount. The terms of the Promissory Note typically outline the steps the lender can take in the event of default.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This helps to avoid misunderstandings and ensures that everyone is on the same page.

What are the interest rate limits for Promissory Notes in Maryland?

Maryland has specific laws regarding interest rates on loans. Generally, the maximum interest rate allowed is 6% unless otherwise agreed upon in writing. For certain types of loans, such as those involving consumer credit, different regulations may apply. Always check current state laws to ensure compliance.

Are there any tax implications for using a Promissory Note?

Yes, there can be tax implications when using a Promissory Note. The lender may need to report the interest income received, while the borrower may be able to deduct interest payments on their taxes, depending on the nature of the loan. It is advisable to consult with a tax professional to understand the specific implications for your situation.

Where can I find a Maryland Promissory Note template?

Templates for Maryland Promissory Notes can be found online through various legal websites, local government resources, or legal stationery stores. Ensure that any template you choose complies with Maryland laws and includes all necessary components to protect both parties involved.