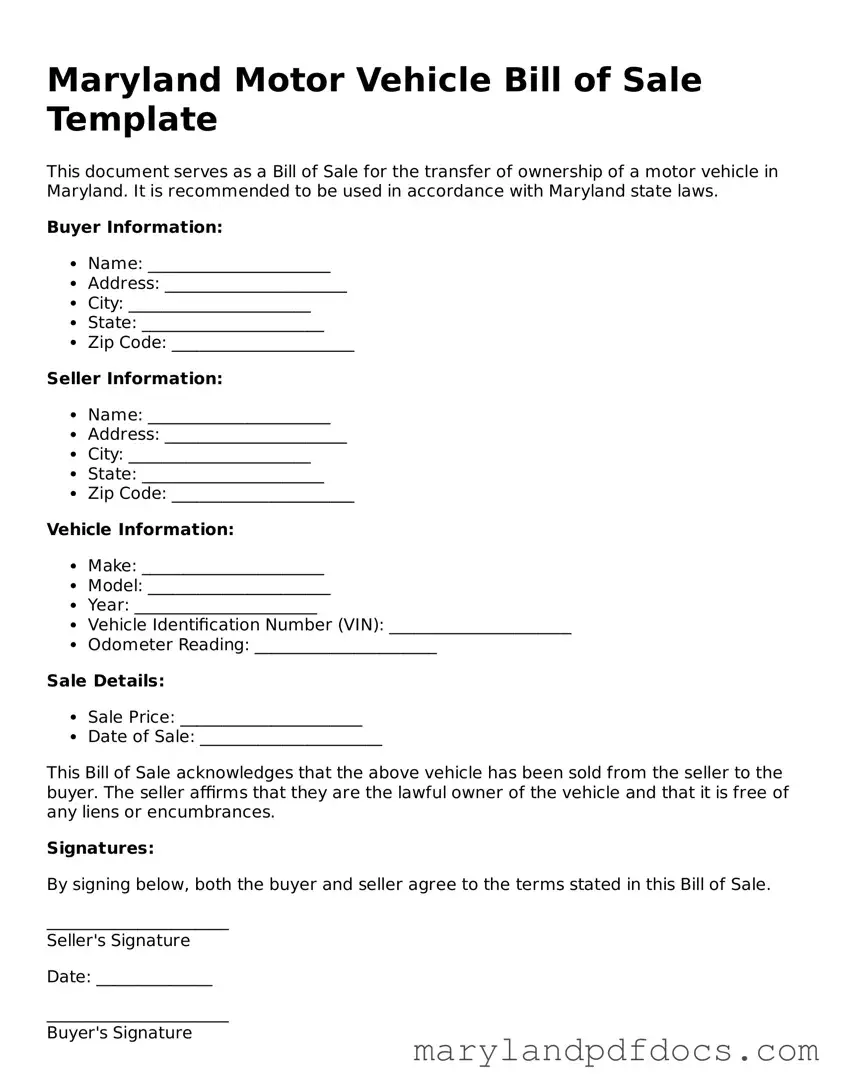

What is a Maryland Motor Vehicle Bill of Sale?

A Maryland Motor Vehicle Bill of Sale is a legal document that records the sale of a motor vehicle between a seller and a buyer. This form includes important details such as the vehicle's identification number (VIN), make, model, year, and the sale price. It serves as proof of ownership transfer and may be required for vehicle registration and title transfer in Maryland.

Is the Maryland Motor Vehicle Bill of Sale required by law?

While a Bill of Sale is not legally required for all vehicle transactions in Maryland, it is highly recommended. This document provides protection for both the seller and the buyer by documenting the details of the sale. It can also be useful in case of disputes or for tax purposes.

Where can I obtain a Maryland Motor Vehicle Bill of Sale form?

The Maryland Motor Vehicle Bill of Sale form can be obtained from various sources. It is available online through the Maryland Department of Transportation Motor Vehicle Administration (MDOT MVA) website. Additionally, local county offices or vehicle dealerships may provide copies of the form.

What information is required on the Bill of Sale?

The Bill of Sale should include the following information: the names and addresses of both the seller and buyer, the vehicle's VIN, make, model, year, odometer reading at the time of sale, sale price, and the date of the transaction. Both parties should sign the document to validate the sale.

Do I need to have the Bill of Sale notarized?

Notarization of the Maryland Motor Vehicle Bill of Sale is not a requirement. However, having the document notarized can provide an additional layer of verification and may be beneficial in certain situations, especially for high-value transactions.

Can I use a Bill of Sale from another state for a vehicle sold in Maryland?

Using a Bill of Sale from another state is generally not advisable. Each state has its own requirements and forms. It is best to use the Maryland-specific Bill of Sale to ensure compliance with local regulations and to facilitate the title transfer process.

What should I do with the Bill of Sale after the transaction?

After completing the transaction, both the buyer and seller should retain a copy of the Bill of Sale for their records. The buyer will need it for vehicle registration and title transfer, while the seller may need it for tax purposes or to prove the sale in case of future disputes.

Is there a fee associated with the Bill of Sale?

There is no fee for creating or obtaining a Maryland Motor Vehicle Bill of Sale. However, fees may apply when registering the vehicle or transferring the title at the MDOT MVA. It is important to check with the local office for any applicable fees related to these processes.

What if the vehicle has a lien on it?

If the vehicle has a lien, the seller must disclose this information to the buyer. The lien must be satisfied before the sale can be completed. The Bill of Sale should indicate whether the lien has been paid off or if the buyer will be assuming responsibility for the lien.

What happens if I lose the Bill of Sale?

If the Bill of Sale is lost, obtaining a replacement can be challenging. It is advisable to keep a digital and physical copy of the document. If a replacement is necessary, both parties may need to create a new Bill of Sale and sign it again, documenting the original sale details.