Fill Out Your Maryland Wage Claim Template

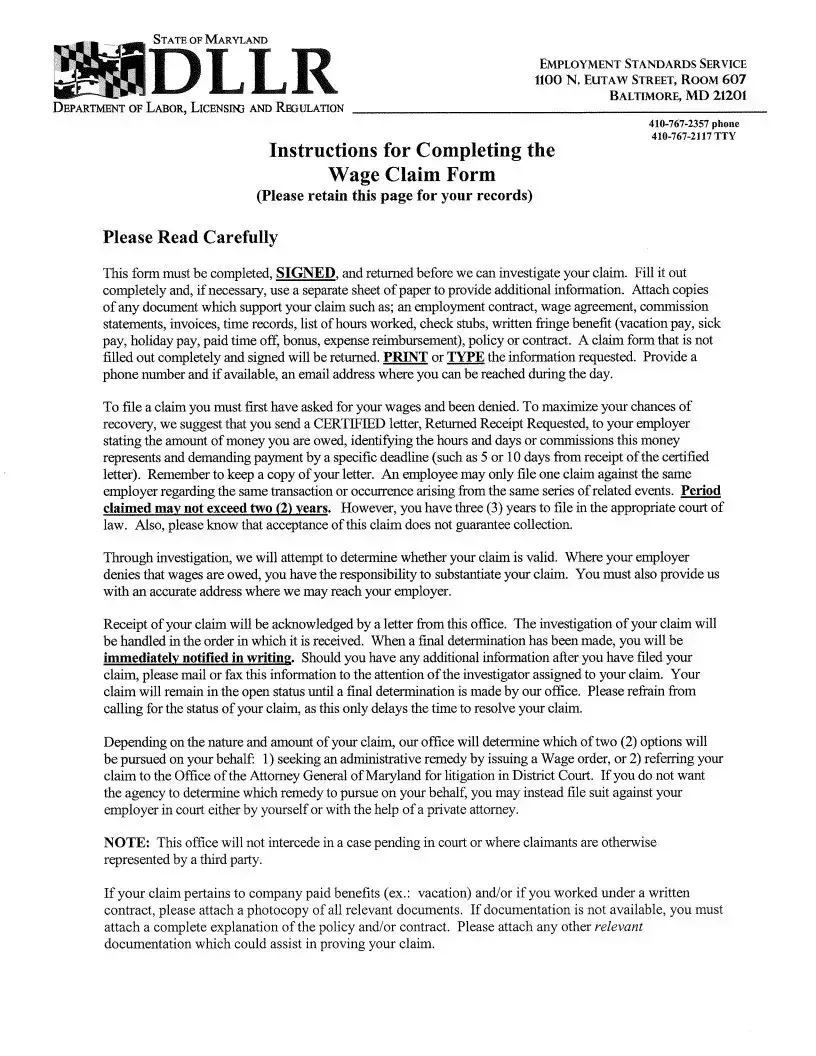

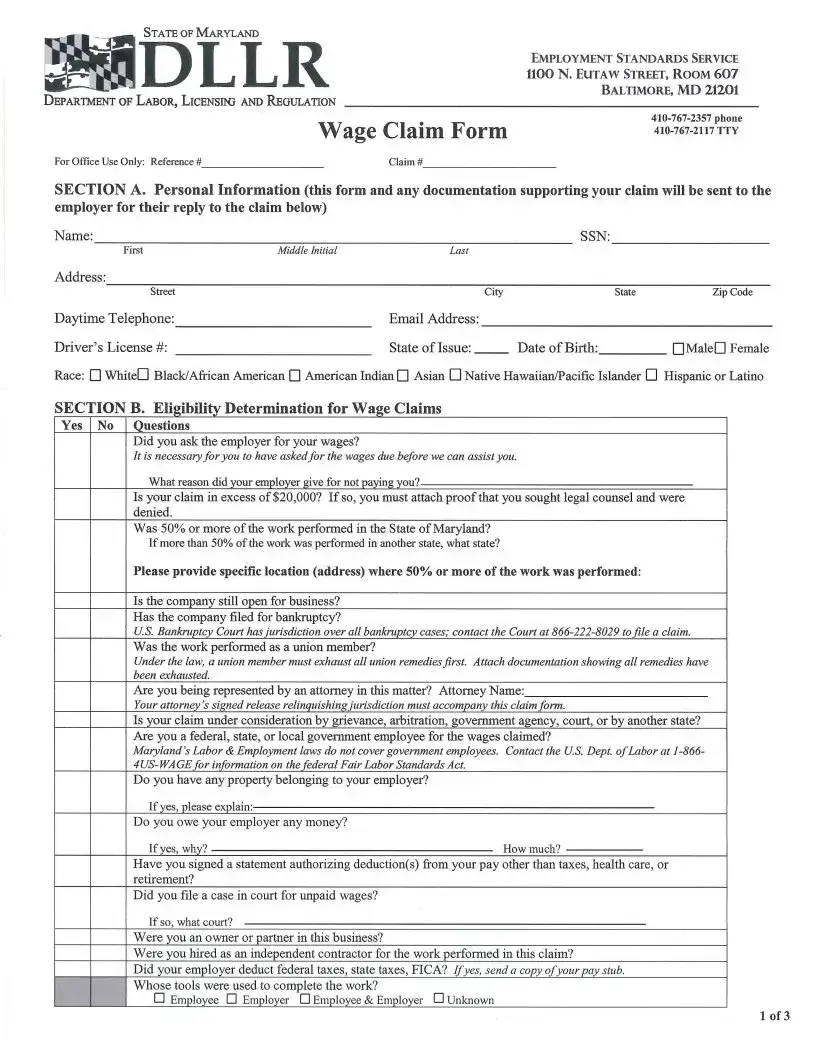

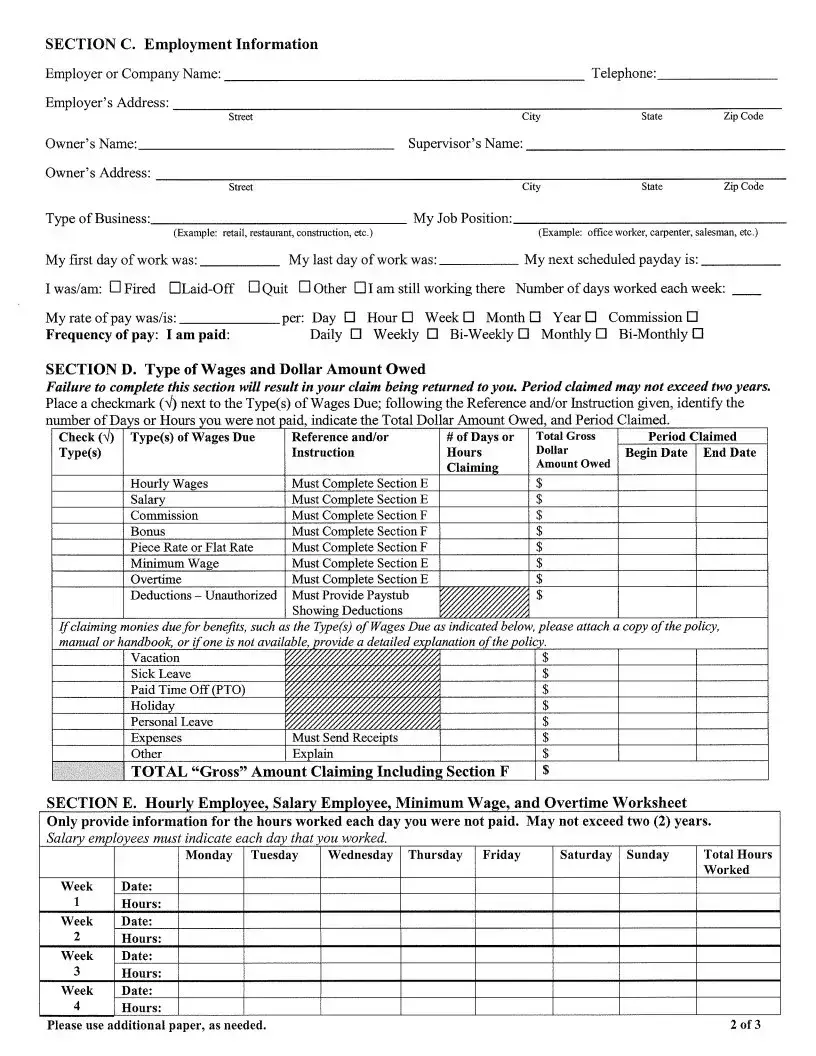

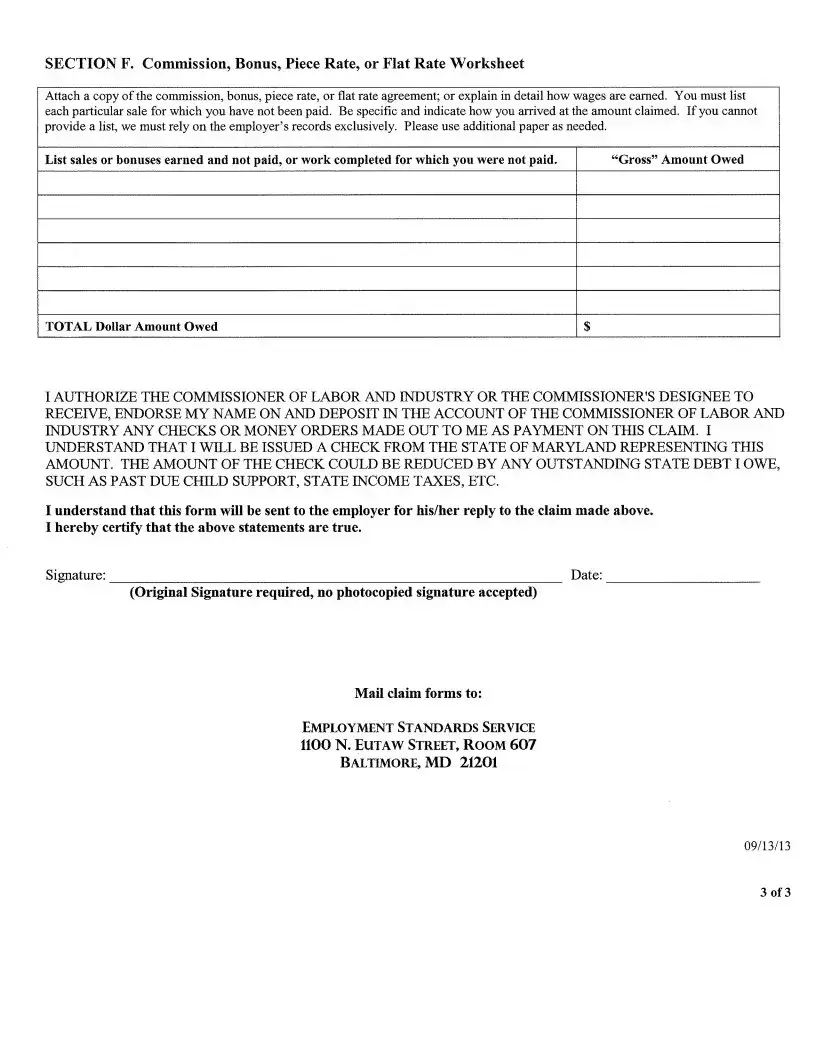

The Maryland Wage Claim form is a crucial document for employees seeking to recover unpaid wages from their employers. This form must be filled out completely and signed before the Maryland Department of Labor can investigate your claim. If you believe you are owed wages, it’s important to act promptly and accurately by completing the form and submitting it to the appropriate office.

Ready to take the first step in recovering your wages? Fill out the Maryland Wage Claim form by clicking the button below.

Launch Maryland Wage Claim Editor

Fill Out Your Maryland Wage Claim Template

Launch Maryland Wage Claim Editor

Launch Maryland Wage Claim Editor

or

Free Maryland Wage Claim PDF

You’ve already started — finish it

Fill out Maryland Wage Claim digitally in just minutes.