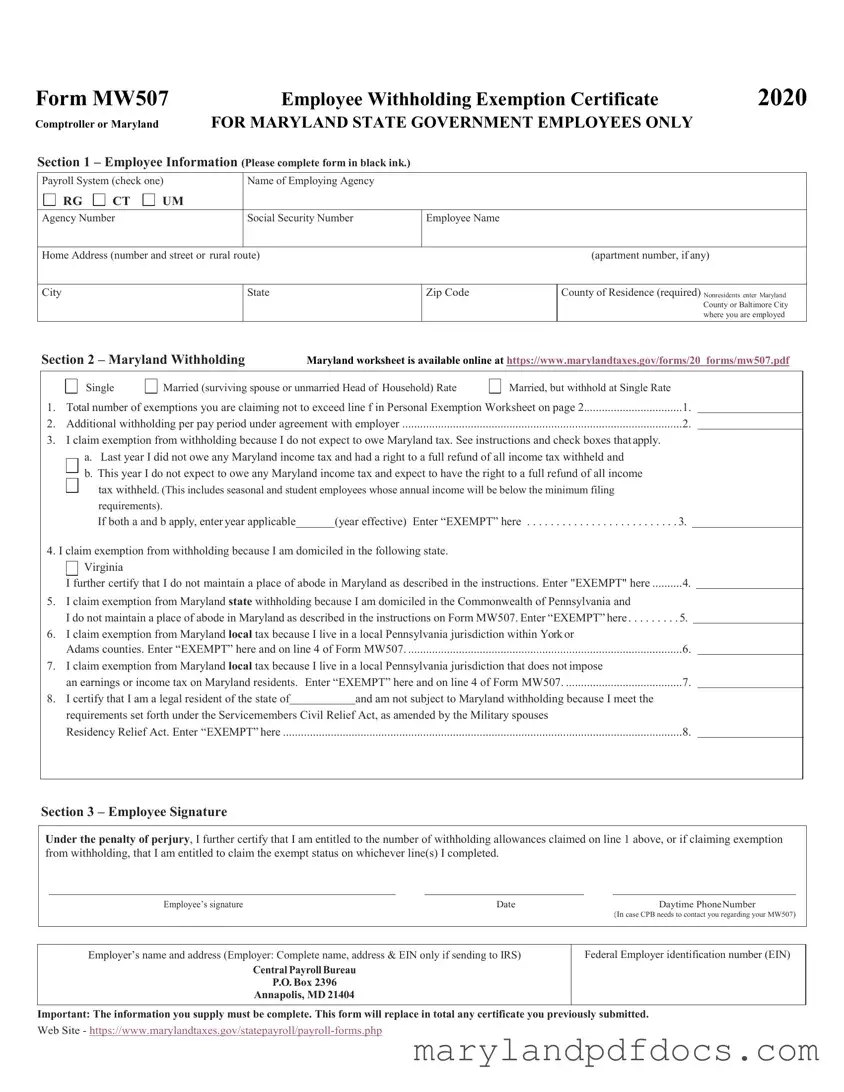

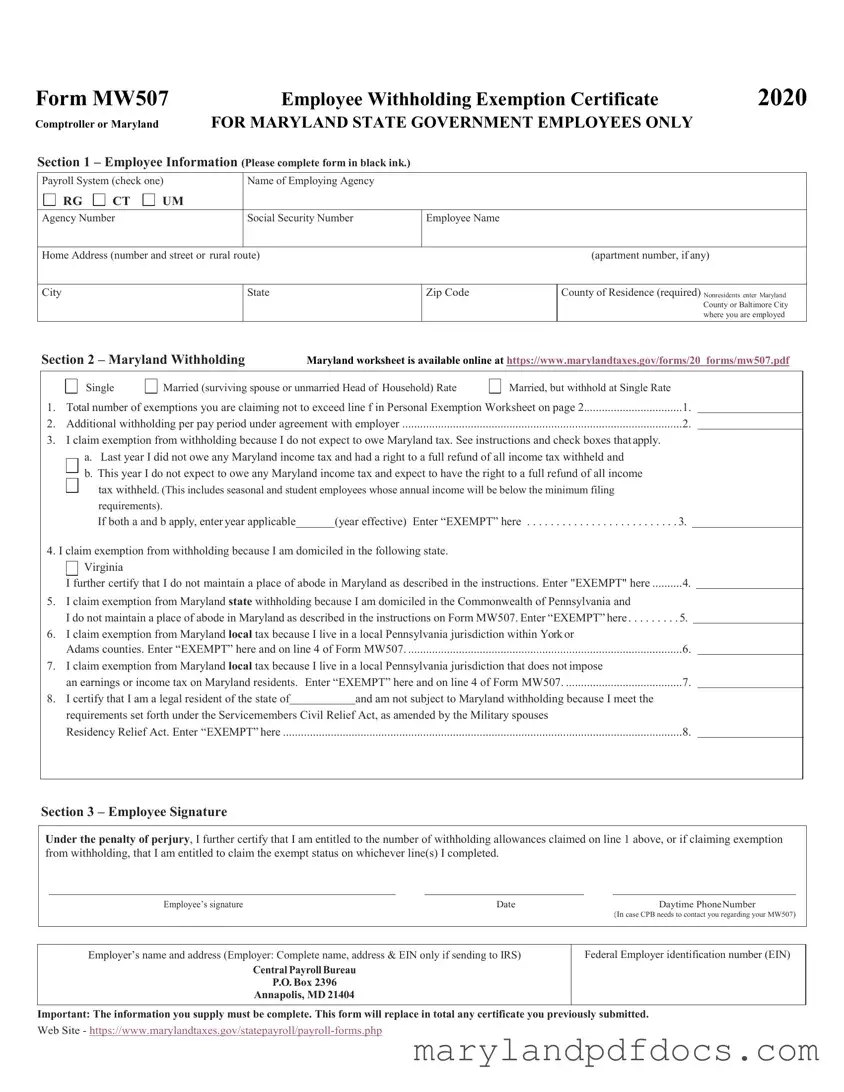

What is the Maryland W4 form?

The Maryland W4 form, officially known as the MW507 Employee Withholding Exemption Certificate, is used by employees in Maryland to determine how much state income tax should be withheld from their paychecks. It allows employees to claim exemptions based on their personal circumstances, such as marital status and number of exemptions.

Who needs to fill out the Maryland W4 form?

If you are a new employee in Maryland or if your tax situation has changed, you will need to complete the MW507 form. This includes changes in marital status, number of dependents, or if you are claiming exemption from withholding.

How do I complete the Maryland W4 form?

To complete the MW507 form, you will need to provide your personal information, including your name, address, and Social Security number. You will also indicate your marital status and the number of exemptions you are claiming. Be sure to read the instructions carefully to ensure you fill it out correctly.

What if I qualify for exemption from withholding?

If you qualify for exemption from Maryland state withholding, you can indicate this on the form. You must meet specific criteria, such as not owing any Maryland income tax last year and not expecting to owe this year. Make sure to check the appropriate boxes and provide any required details.

Can I change my withholding status later?

Yes, you can change your withholding status at any time by submitting a new MW507 form to your employer. If your financial situation changes, such as a change in marital status or number of dependents, it’s a good idea to update your withholding to reflect those changes.

Where can I find the Maryland W4 form?

You can access the MW507 form online at the Maryland Comptroller's website. The form is available in PDF format for easy printing. You can also find instructions and additional resources related to withholding on the same site.

What happens if I don’t submit the Maryland W4 form?

If you do not submit the MW507 form, your employer will typically withhold taxes at the highest rate, which may lead to over-withholding. This means you might receive a larger tax refund when you file your tax return, but it can also impact your take-home pay throughout the year.

Do I need to submit the Maryland W4 form to the IRS?

No, the MW507 form is specific to Maryland state withholding and should be submitted to your employer, not the IRS. However, your employer may need to provide certain information to the IRS regarding your withholding.

What should I do if I have questions about the form?

If you have questions about completing the MW507 form or your withholding, you can reach out to your employer’s payroll department for assistance. Additionally, the Maryland Comptroller’s website offers resources and contact information for further inquiries.