MARYLAND STATE RETIREMENT AGENCY |

VSP |

|

120 EAST BALTIMORE STREET |

|

BALTIMORE, MARYLAND 21202-6700 |

|

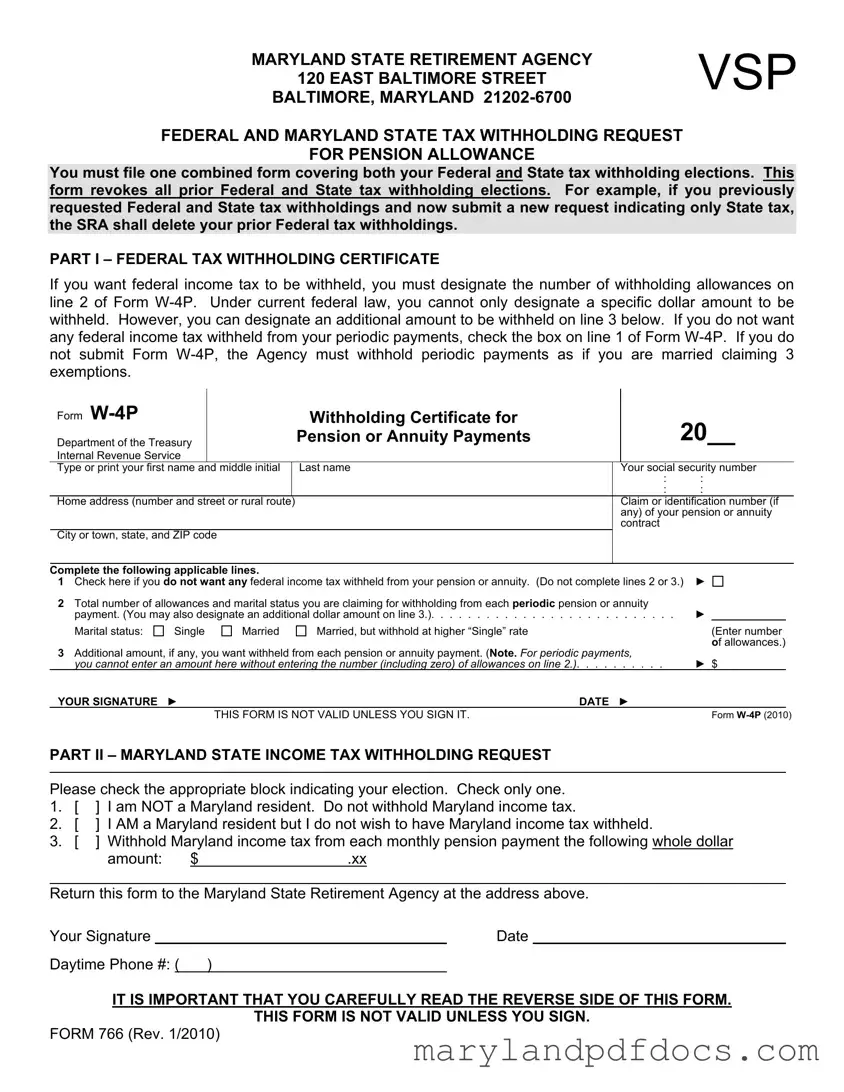

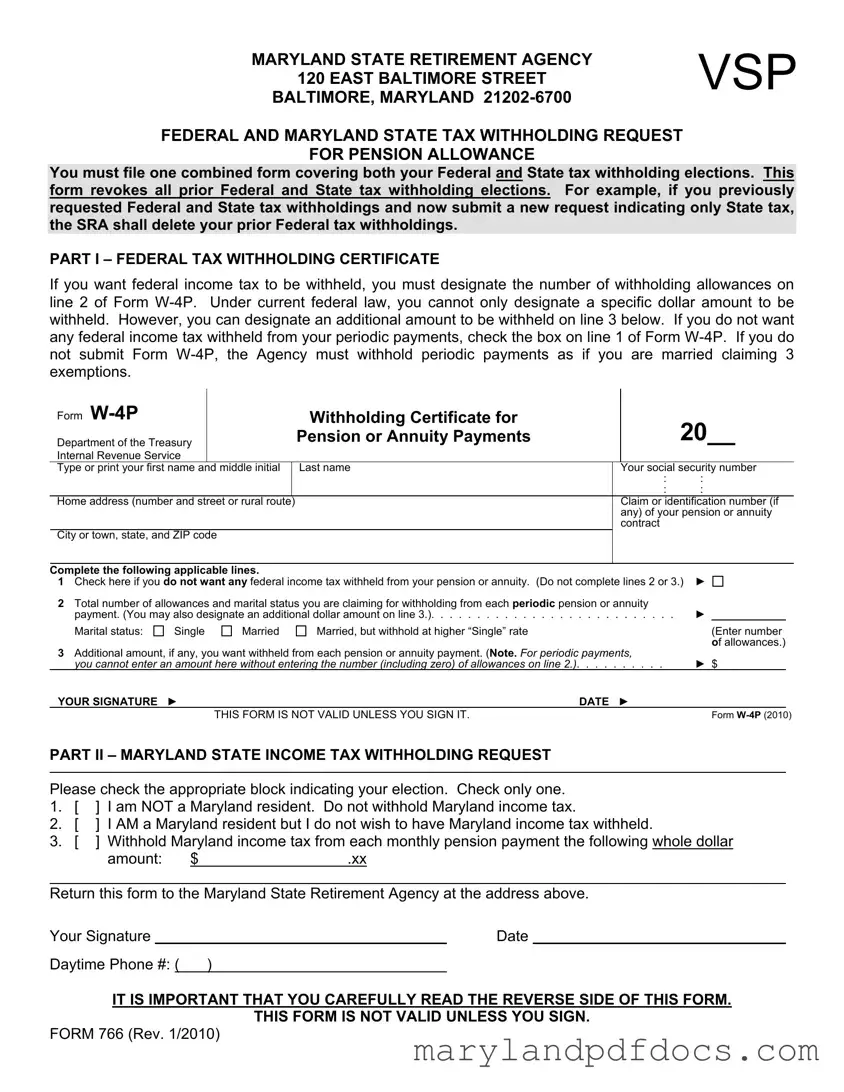

FEDERAL AND MARYLAND STATE TAX WITHHOLDING REQUEST

FOR PENSION ALLOWANCE

You must file one combined form covering both your Federal and State tax withholding elections. This form revokes all prior Federal and State tax withholding elections. For example, if you previously requested Federal and State tax withholdings and now submit a new request indicating only State tax, the SRA shall delete your prior Federal tax withholdings.

PART I – FEDERAL TAX WITHHOLDING CERTIFICATE

If you want federal income tax to be withheld, you must designate the number of withholding allowances on line 2 of Form W-4P. Under current federal law, you cannot only designate a specific dollar amount to be withheld. However, you can designate an additional amount to be withheld on line 3 below. If you do not want any federal income tax withheld from your periodic payments, check the box on line 1 of Form W-4P. If you do not submit Form W-4P, the Agency must withhold periodic payments as if you are married claiming 3 exemptions.

Form W-4P |

|

|

|

Withholding Certificate for |

|

20__ |

|

Department of the Treasury |

|

|

Pension or Annuity Payments |

|

|

|

|

|

|

|

|

|

|

Internal Revenue Service |

|

|

|

|

|

|

|

|

Type or print your first name and middle initial |

|

Last name |

|

Your social security number |

|

|

|

|

|

: |

: |

|

|

|

|

|

|

|

: |

: |

|

|

Home address (number and street or rural route) |

|

|

Claim or identification number (if |

|

|

|

|

|

|

any) of your pension or annuity |

|

|

|

|

|

|

contract |

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete the following applicable lines. |

|

|

|

► |

1 Check here if you do not want any federal income tax withheld from your pension or annuity. (Do not complete lines 2 or 3.) |

2 Total number of allowances and marital status you are claiming for withholding from each periodic pension or annuity |

► |

|

|

payment. (You may also designate an additional dollar amount on line 3.) |

Marital status: |

Single |

Married |

Married, but withhold at higher “Single” rate |

|

|

(Enter number |

|

|

|

|

|

|

|

|

of allowances.) |

3 Additional amount, if any, you want withheld from each pension or annuity payment. (Note. For periodic payments, |

► $ |

you cannot enter an amount here without entering the number (including zero) of allowances on line 2.). . . . |

. . . . . . |

YOUR SIGNATURE |

► |

|

|

DATE |

► |

|

|

|

|

|

THIS FORM IS NOT VALID UNLESS YOU SIGN IT. |

|

|

|

Form W-4P (2010) |

PART II – MARYLAND STATE INCOME TAX WITHHOLDING REQUEST

Please check the appropriate block indicating your election. Check only one.

1.[ ] I am NOT a Maryland resident. Do not withhold Maryland income tax.

2.[ ] I AM a Maryland resident but I do not wish to have Maryland income tax withheld.

3.[ ] Withhold Maryland income tax from each monthly pension payment the following whole dollar

Return this form to the Maryland State Retirement Agency at the address above.

Your Signature |

|

|

Date |

Daytime Phone #: ( |

) |

|

|

|

|

|

|

IT IS IMPORTANT THAT YOU CAREFULLY READ THE REVERSE SIDE OF THIS FORM.

THIS FORM IS NOT VALID UNLESS YOU SIGN.

FORM 766 (Rev. 1/2010)

2

Part I

FEDERAL INCOME TAX WITHHOLDING

The monthly retirement payments you receive from the Maryland State Retirement and Pension System may be subject to Federal income tax withholding. For further information, please refer to Internal Revenue Service Publication 575 regarding the taxability of pension and annuity income.

As a retiree, the following Federal income tax withholding alternatives are available to you:

1.You may elect not to have Federal income tax deducted from your monthly retirement payment, or

2.You may claim a certain number of exemptions and have the Maryland State Retirement and Pension System deduct the appropriate amount, if any, in accordance with the Federal income tax tables and you may designate an additional specific whole dollar amount to be withheld from your monthly retirement payment.

If you elect not to have Federal withholding apply to your monthly retirement payments, or if you do not have enough Federal income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the Internal Revenue Service estimated tax rules if your withholding and estimated tax payment are not sufficient. New retirees, especially, should see IRS Publication 505.

Part II

MARYLAND STATE INCOME TAX WITHHOLDING

The monthly retirement payments you receive from the Maryland State Retirement and Pension System may be subject to Maryland income tax withholding.

As a retiree and a Maryland resident, the following Maryland income tax withholding alternatives are available to you:

1.You may elect not to have Maryland income tax deducted from your monthly retirement payment, or

2.You may designate a specific whole dollar amount to be withheld from your monthly retirement payment.

If you elect not to have Maryland withholding apply to your monthly retirement payments, or if you do not have enough Maryland income tax withheld, you may be responsible for payment of estimated tax.

An election of any one of the alternatives will remain in effect until you revoke it. You may revoke or change your election at any time by filing a new Federal and Maryland State Tax Withholding Request.

The Maryland State Retirement Agency can not assist you in the preparation of tax returns. Please contact the Internal Revenue Service at 1-800-829-1040, the Comptroller’s Taxpayer Service Information Line at 410-260- 7980 (in Central Maryland) or 1-800-638-2937, or a tax consultant for any assistance.

To receive additional copies of the Federal and Maryland State Tax Withholding Request form, or for other information concerning your retirement benefits, call 410-625-5555, or toll free in Maryland 1-800-492-5909, or visit our website at www.sra.state.md.us.

SEE REVERSE SIDE FOR FEDERAL AND MARYLAND STATE TAX WITHHOLDING REQUEST

FORM 766 (Rev. 1/2010)