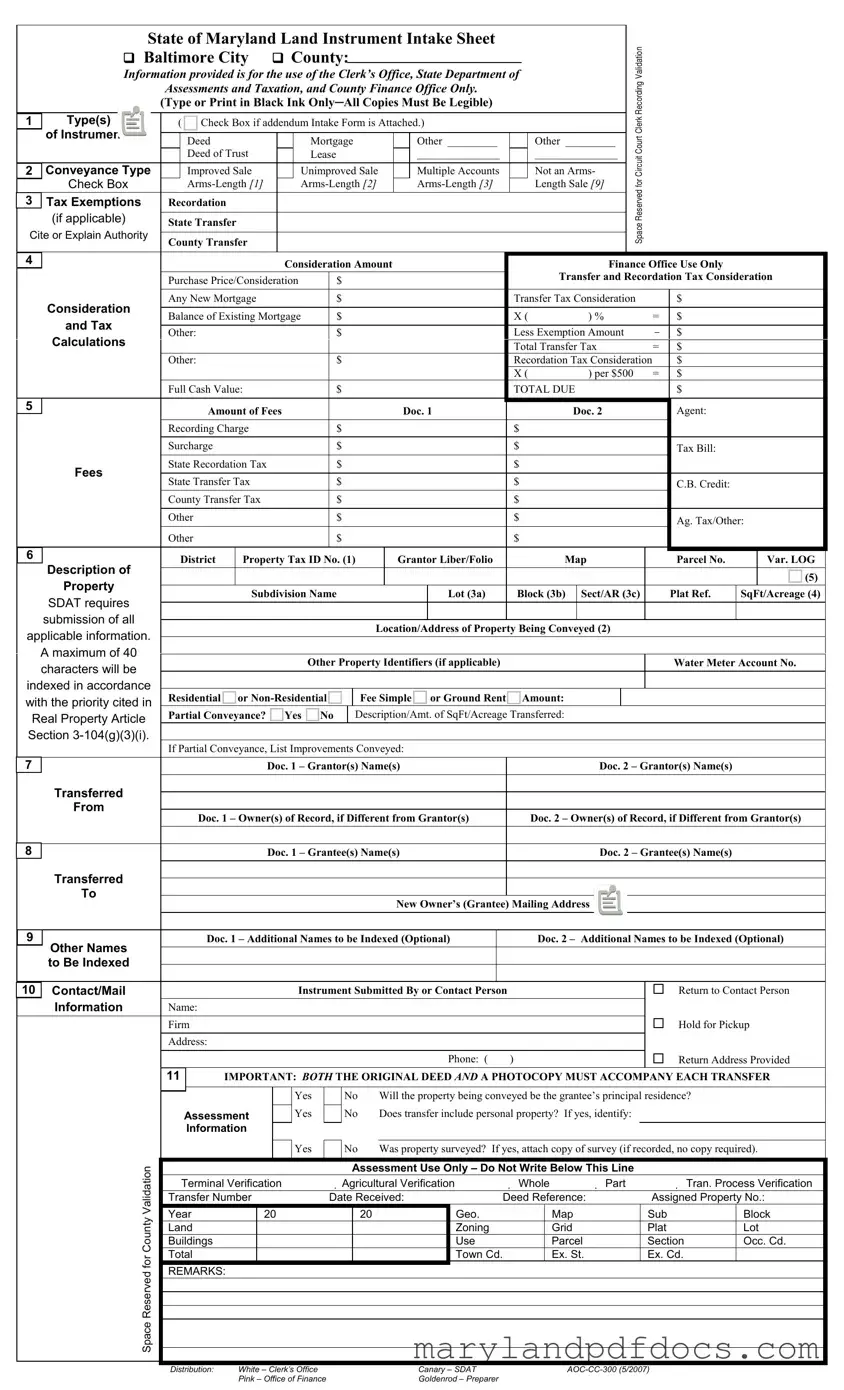

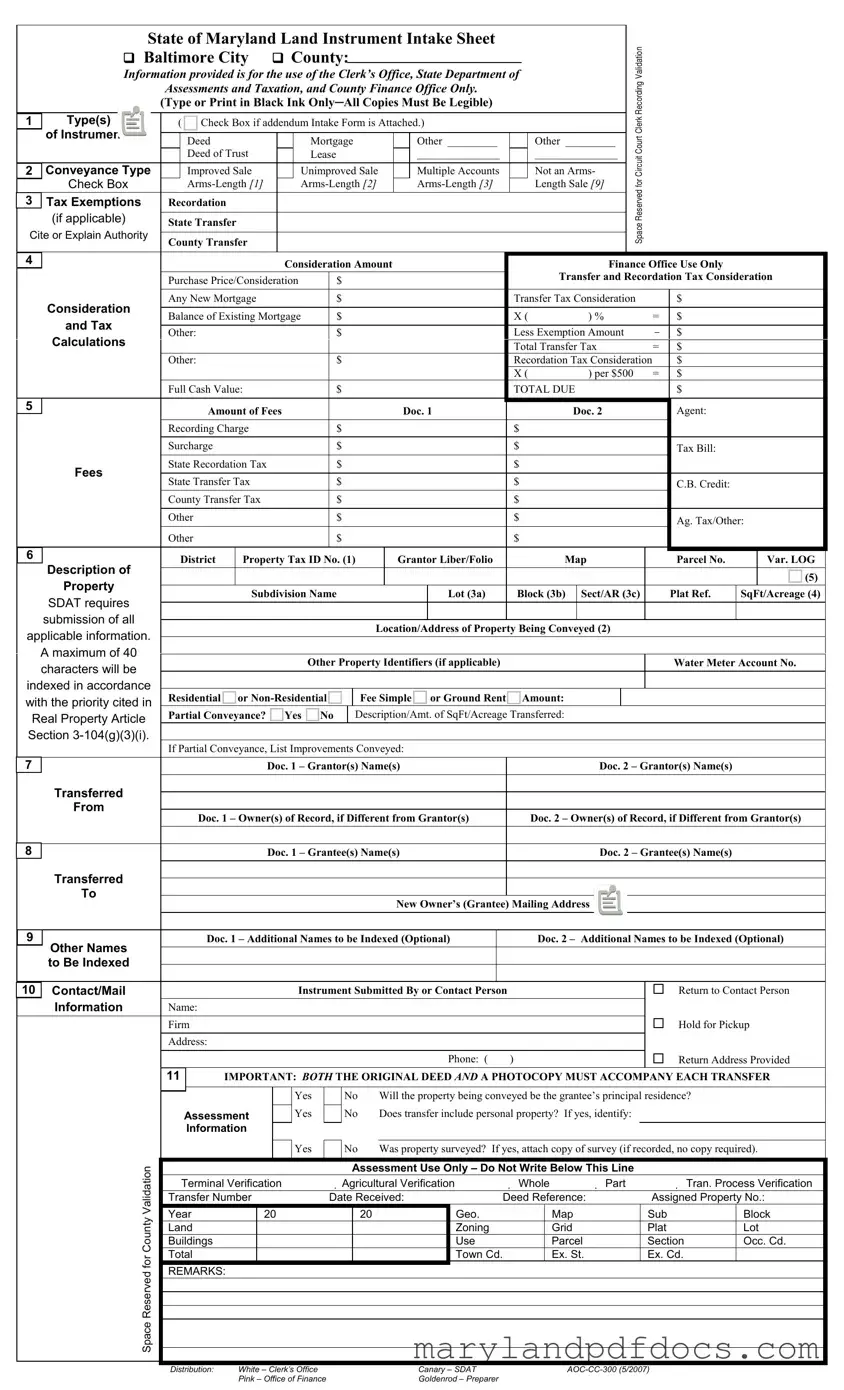

What is the purpose of the Maryland Sheet form?

The Maryland Sheet form is used for the recording of various land instruments in the state of Maryland. It collects essential information for the Clerk’s Office, the State Department of Assessments and Taxation, and the County Finance Office. This ensures that all necessary data is captured for property transactions.

What types of instruments can be recorded using this form?

This form can be used to record a variety of instruments, including deeds, mortgages, leases, and court orders. The form allows for multiple types of instruments to be indicated, ensuring flexibility for different transaction types.

How should the information be filled out on the form?

All information must be typed or printed in black ink. It is crucial that all copies are legible to avoid processing delays. If an addendum is needed, it should be clearly indicated on the form.

What is the significance of the consideration amount?

The consideration amount refers to the purchase price or value of the property being transferred. This figure is essential for calculating transfer and recordation taxes, which are based on the value of the transaction.

What are the tax implications associated with the form?

When completing the Maryland Sheet form, you will need to calculate both transfer tax and recordation tax based on the consideration amount. Specific formulas are provided on the form to assist in these calculations, ensuring compliance with state and county tax regulations.

Is it necessary to provide a description of the property?

Yes, a detailed description of the property is required. This includes the property tax ID number, subdivision name, and other identifiers. Accurate property information helps avoid confusion and ensures proper indexing.

What information is needed about the grantor and grantee?

The form requires the names of both the grantor(s) and grantee(s). If the owners of record differ from the grantors, that information must also be provided. This ensures that all parties involved in the transaction are correctly identified.

Are there any special instructions for submitting the form?

Both the original deed and a photocopy must accompany each transfer submission. Additionally, any necessary attachments, such as surveys, should be included if applicable. Ensure that the form is complete to avoid processing delays.

How can I ensure my submission is processed efficiently?

To ensure efficient processing, double-check that all sections of the form are filled out accurately. Make sure all required documents are included and legible. Providing clear contact information will also help facilitate communication if any issues arise.

What should I do if I have more questions about the Maryland Sheet form?

If you have further questions, consider reaching out to the Clerk’s Office or the State Department of Assessments and Taxation. They can provide additional guidance and clarify any uncertainties you may have regarding the form or the submission process.