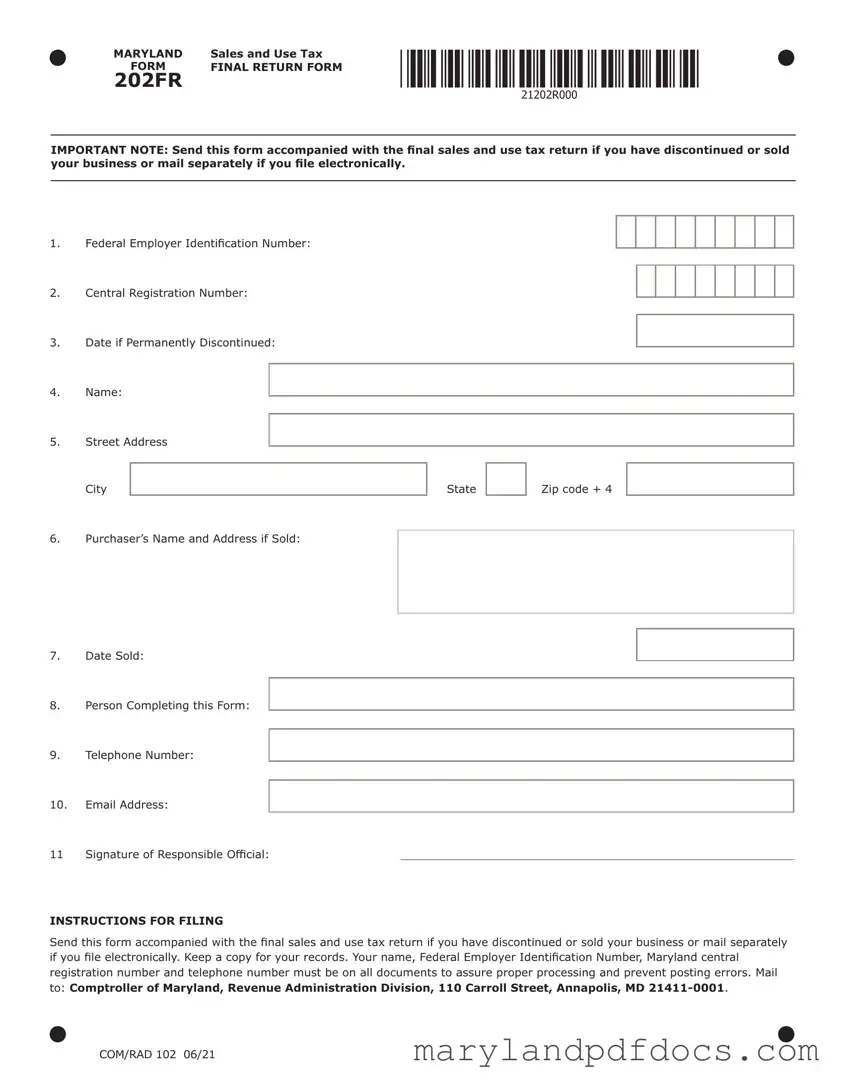

What is the Maryland Sales and Use Tax Form 202?

The Maryland Sales and Use Tax Form 202 is a final return form that businesses must file when they have discontinued operations or sold their business. This form serves to inform the state about the business's closure or transfer of ownership and ensures that any outstanding sales and use tax obligations are settled.

Who needs to file Form 202?

If you have permanently discontinued your business or sold it, you are required to file Form 202. This applies to all businesses registered in Maryland that have been collecting sales and use tax. Filing this form helps to formally close your account with the Maryland Comptroller’s office.

What information do I need to provide on Form 202?

When completing Form 202, you will need to provide several pieces of information. This includes your Federal Employer Identification Number, Central Registration Number, the date your business was permanently discontinued, your name and address, the purchaser’s name and address if applicable, the date of the sale, and your contact information. Additionally, the form must be signed by a responsible official.

How should I submit Form 202?

You should submit Form 202 along with your final sales and use tax return if you are discontinuing your business. If you file electronically, you can mail Form 202 separately. It is important to keep a copy for your records. Ensure that your name, Federal Employer Identification Number, Maryland Central Registration Number, and telephone number are included on all documents to avoid processing errors.

Where do I send Form 202?

Mail Form 202 to the Comptroller of Maryland, Revenue Administration Division, at 110 Carroll Street, Annapolis, MD 21411-0001. Make sure to send it to the correct address to ensure timely processing.

What happens if I do not file Form 202?

Failing to file Form 202 can lead to potential issues with the state, including the possibility of ongoing tax liabilities. Not filing may also complicate your ability to close your business officially, which could result in penalties or fees. It is best to complete this form to avoid any complications.

Can I file Form 202 electronically?

While you can file your final sales and use tax return electronically, Form 202 must be mailed separately if you choose that method. Ensure that you follow the instructions carefully to avoid any delays in processing.

Is there a deadline for filing Form 202?

There is no specific deadline mentioned for filing Form 202, but it is advisable to submit it as soon as you have discontinued your business or sold it. Timely filing can help prevent any complications with your tax obligations and ensure that your account is closed properly.

What should I do if I have questions about Form 202?

If you have questions regarding the completion or submission of Form 202, it is best to contact the Comptroller of Maryland’s office directly. They can provide you with the most accurate and detailed information to assist you with your specific situation.