Fill Out Your Maryland Sales And Use Tax Resale Certificate Template

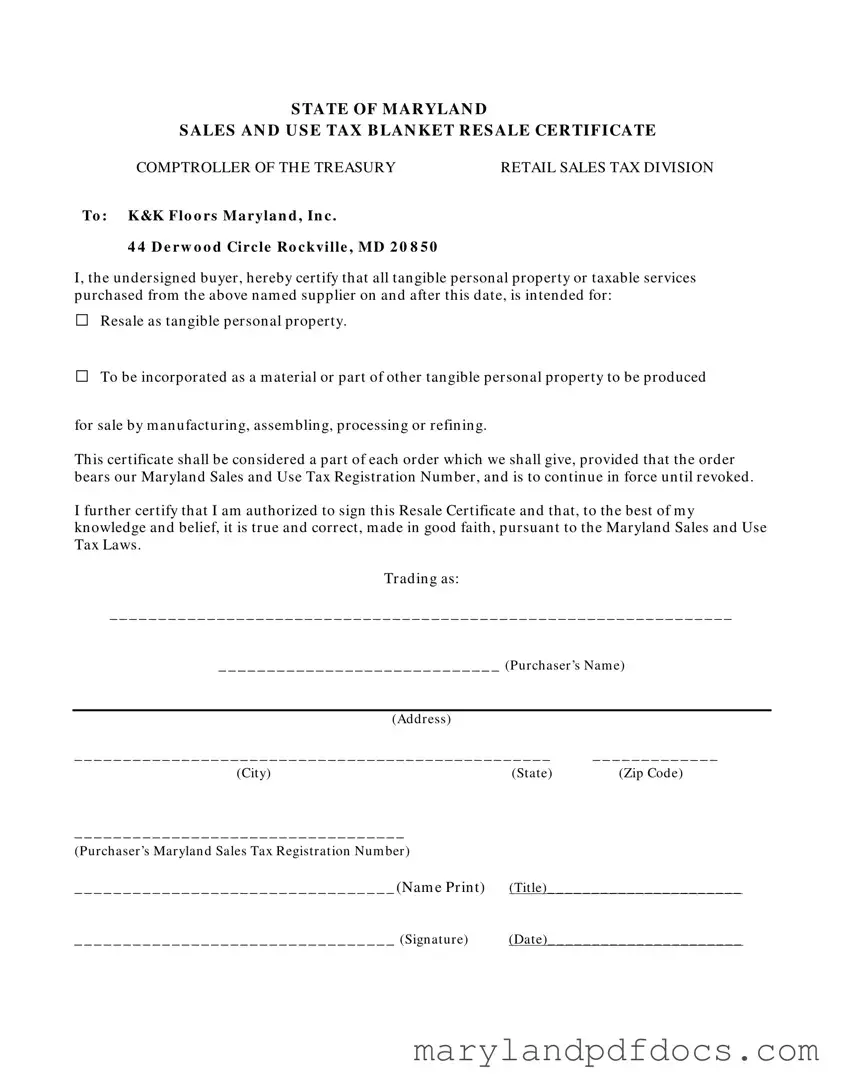

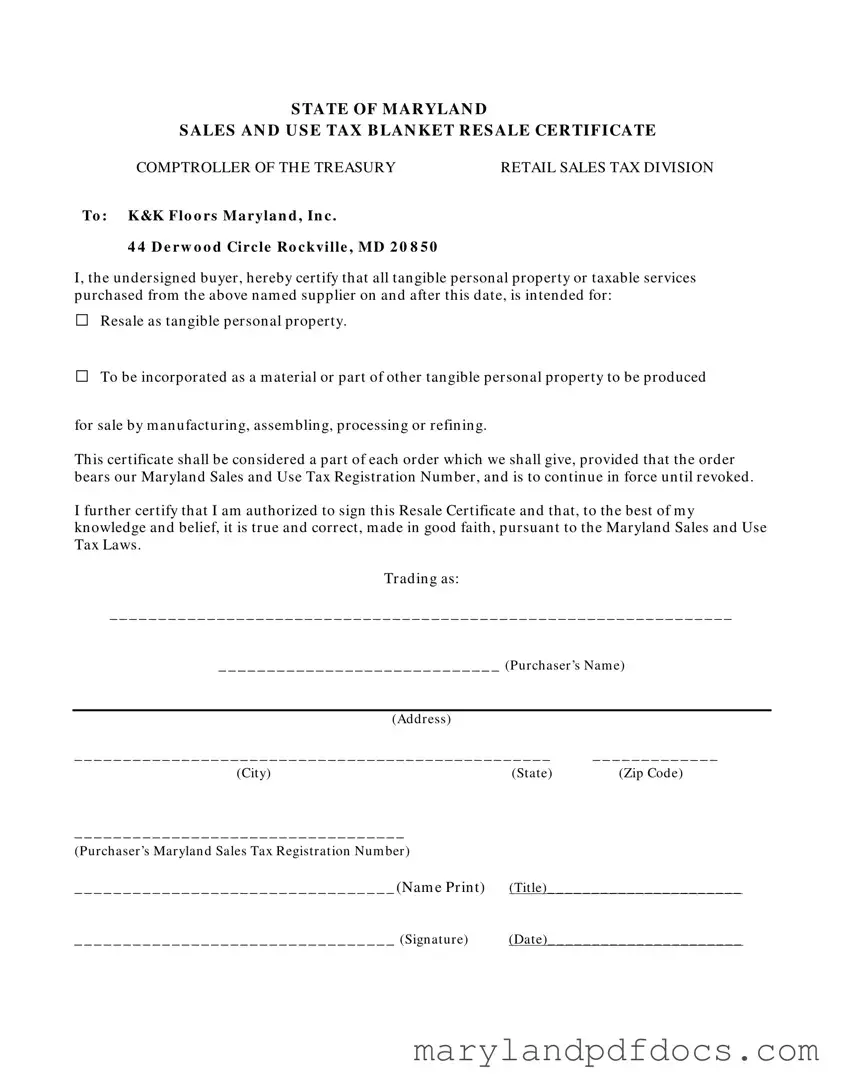

The Maryland Sales and Use Tax Resale Certificate form is a document used by buyers to certify that they intend to purchase tangible personal property or taxable services for resale. This certificate allows businesses to avoid paying sales tax on items they plan to resell. To ensure compliance with Maryland tax laws, it is important to fill out the form accurately and keep it on file for future transactions.

Ready to complete the form? Click the button below to get started.

Launch Maryland Sales And Use Tax Resale Certificate Editor

Fill Out Your Maryland Sales And Use Tax Resale Certificate Template

Launch Maryland Sales And Use Tax Resale Certificate Editor

Launch Maryland Sales And Use Tax Resale Certificate Editor

or

Free Maryland Sales And Use Tax Resale Certificate PDF

You’ve already started — finish it

Fill out Maryland Sales And Use Tax Resale Certificate digitally in just minutes.