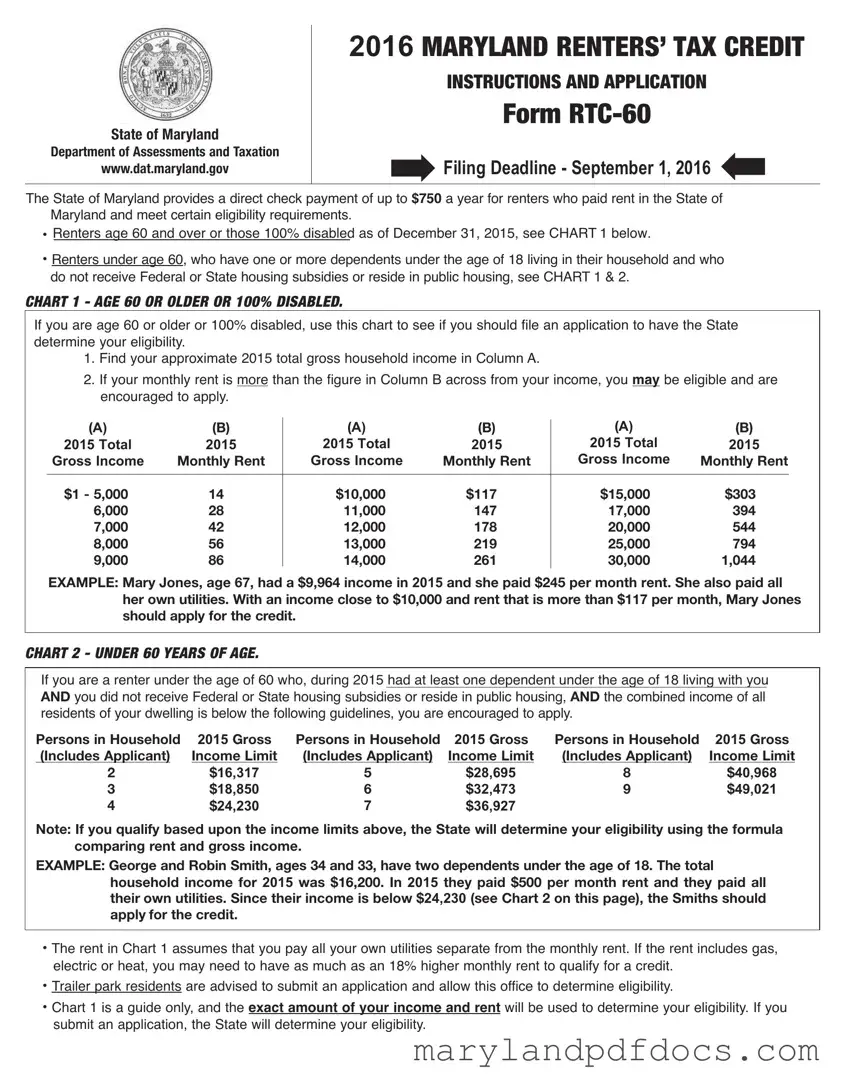

The State of Maryland provides a direct check payment of up to $750 a year for renters who paid rent in the State of Maryland and meet certain eligibility requirements.

•Renters age 60 and over or those 100% disabled as of December 31, 2015, see CHART 1 below.

•Renters under age 60, who have one or more dependents under the age of 18 living in their household and who do not receive Federal or State housing subsidies or reside in public housing, see CHART 1 & 2.

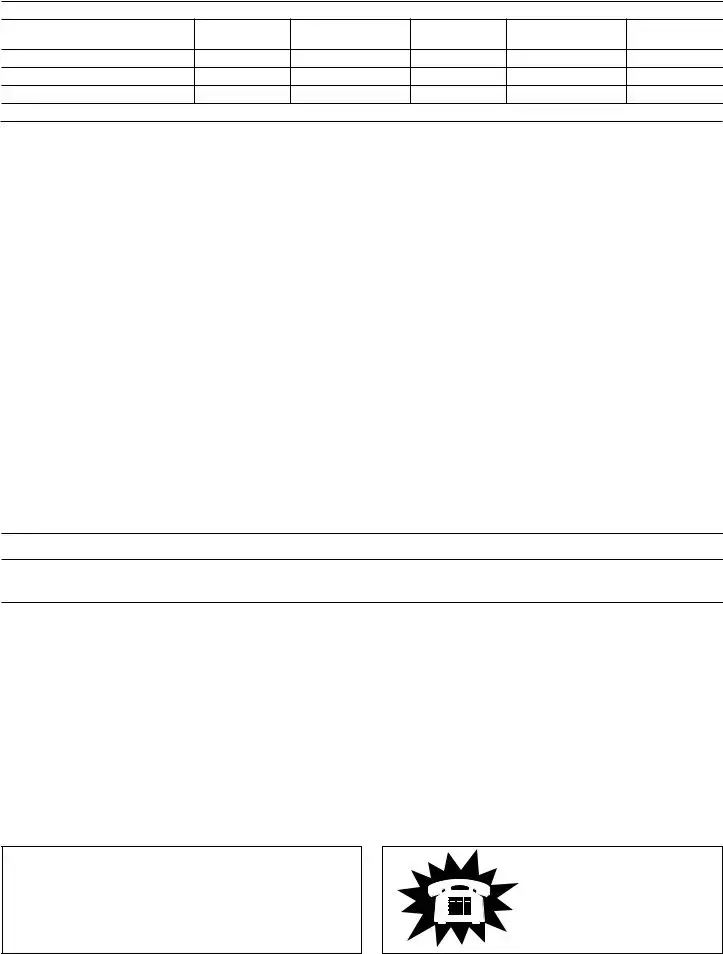

CHART 1 - AGE 60 OR OLDER OR 100% DISABLED.

If you are age 60 or older or 100% disabled, use this chart to see if you should file an application to have the State determine your eligibility.

1.Find your approximate 2015 total gross household income in Column A.

2.If your monthly rent is more than the figure in Column B across from your income, you may be eligible and are encouraged to apply.

(A) |

(B) |

(A) |

(B) |

|

(A) |

(B) |

|

2015 Total |

2015 |

2015 Total |

2015 |

|

2015 Total |

2015 |

Gross Income |

Monthly Rent |

Gross Income |

Monthly Rent |

|

Gross Income |

Monthly Rent |

|

|

|

|

|

|

|

$1 - 5,000 |

14 |

$10,000 |

$117 |

|

$15,000 |

$303 |

6,000 |

28 |

11,000 |

147 |

|

17,000 |

394 |

7,000 |

42 |

12,000 |

178 |

|

20,000 |

544 |

8,000 |

56 |

13,000 |

219 |

|

25,000 |

794 |

9,000 |

86 |

14,000 |

261 |

|

30,000 |

1,044 |

|

|

|

|

|

|

|

EXAMPLE: Mary Jones, age 67, had a $9,964 income in 2015 and she paid $245 per month rent. She also paid all her own utilities. With an income close to $10,000 and rent that is more than $117 per month, Mary Jones should apply for the credit.

CHART 2 - UNDER 60 YEARS OF AGE.

If you are a renter under the age of 60 who, during 2015 had at least one dependent under the age of 18 living with you AND you did not receive Federal or State housing subsidies or reside in public housing, AND the combined income of all residents of your dwelling is below the following guidelines, you are encouraged to apply.

Persons in Household |

2015 Gross |

Persons in Household |

2015 Gross |

Persons in Household |

2015 Gross |

(Includes Applicant) |

Income Limit |

(Includes Applicant) |

Income Limit |

(Includes Applicant) |

Income Limit |

2 |

$16,317 |

5 |

$28,695 |

8 |

$40,968 |

3 |

$18,850 |

6 |

$32,473 |

9 |

$49,021 |

4 |

$24,230 |

7 |

$36,927 |

|

|

Note: If you qualify based upon the income limits above, the State will determine your eligibility using the formula comparing rent and gross income.

EXAMPLE: George and Robin Smith, ages 34 and 33, have two dependents under the age of 18. The total

household income for 2015 was $16,200. In 2015 they paid $500 per month rent and they paid all their own utilities. Since their income is below $24,230 (see Chart 2 on this page), the Smiths should apply for the credit.

•The rent in Chart 1 assumes that you pay all your own utilities separate from the monthly rent. If the rent includes gas, electric or heat, you may need to have as much as an 18% higher monthly rent to qualify for a credit.

•Trailer park residents are advised to submit an application and allow this office to determine eligibility.

•Chart 1 is a guide only, and the exact amount of your income and rent will be used to determine your eligibility. If you submit an application, the State will determine your eligibility.