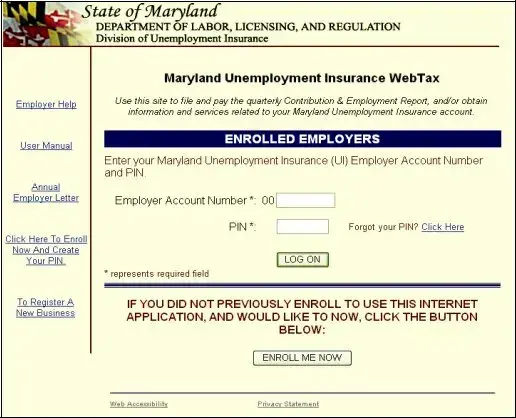

Fill Out Your Maryland Quarterly Contribution Report Template

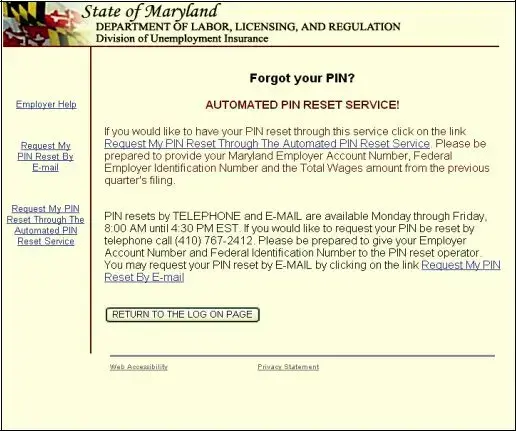

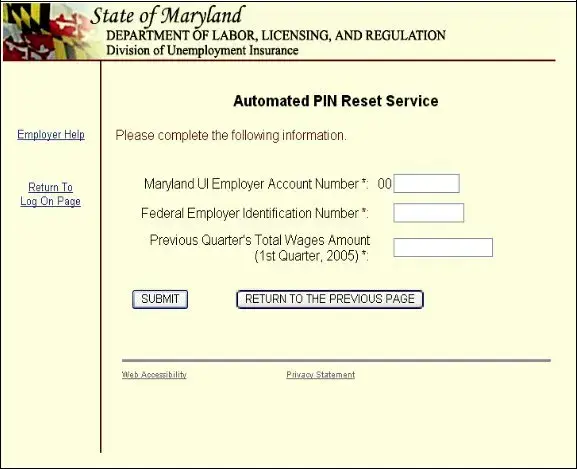

The Maryland Quarterly Contribution Report is a vital document that employers in Maryland must complete to report their unemployment insurance contributions and employee wages. This report ensures that businesses comply with state regulations and helps maintain the integrity of the unemployment insurance system. Understanding how to accurately fill out this form is essential for all employers, so let's explore the necessary steps and resources available to assist you in this process.

Ready to get started? Click the button below to fill out the form.

Launch Maryland Quarterly Contribution Report Editor

Fill Out Your Maryland Quarterly Contribution Report Template

Launch Maryland Quarterly Contribution Report Editor

Launch Maryland Quarterly Contribution Report Editor

or

Free Maryland Quarterly Contribution Report PDF

You’ve already started — finish it

Fill out Maryland Quarterly Contribution Report digitally in just minutes.