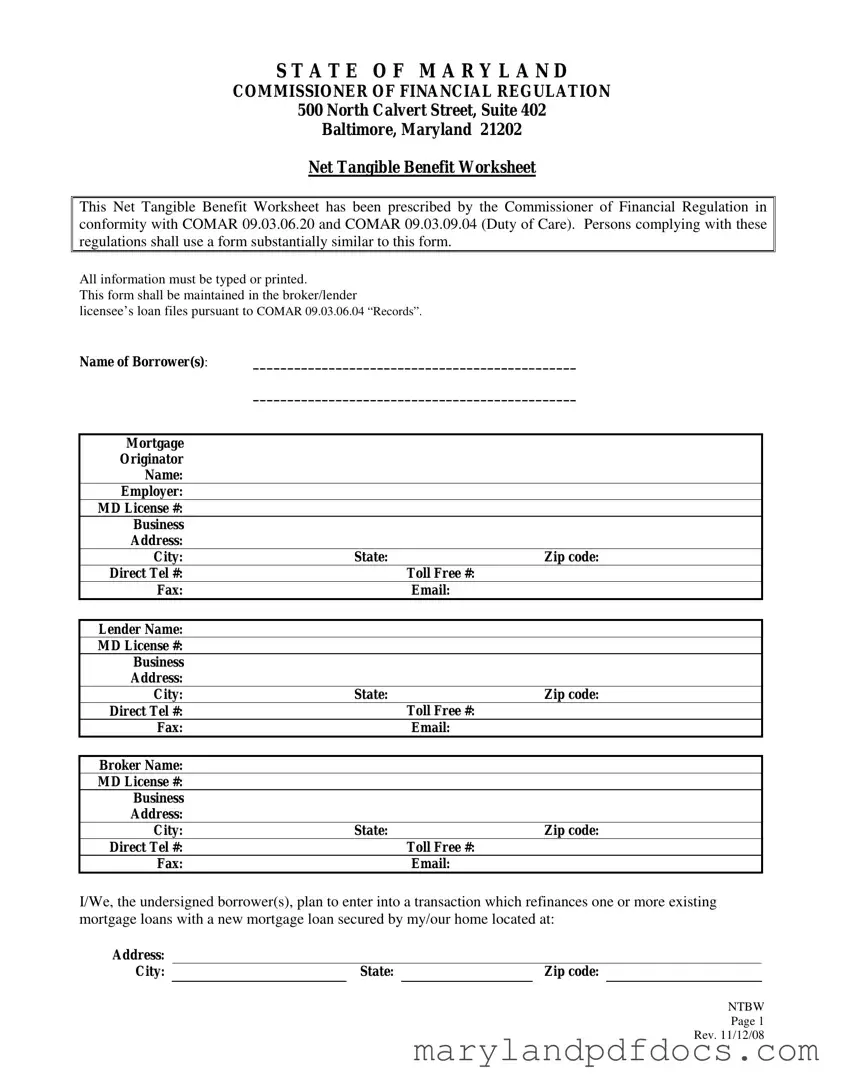

What is the Maryland Net Tangible Benefit Worksheet?

The Maryland Net Tangible Benefit Worksheet is a form required by the Commissioner of Financial Regulation. It is designed for borrowers who are refinancing existing mortgage loans. The form helps ensure that borrowers understand the costs and benefits associated with the new loan compared to their current loan. Compliance with specific regulations is necessary when using this form.

Who must use the Net Tangible Benefit Worksheet?

This form must be used by lenders and brokers who are facilitating mortgage refinancing in Maryland. It is intended to protect borrowers by ensuring that they receive a net tangible benefit from refinancing their loans. The form should be maintained in the loan files of the broker or lender as required by state regulations.

What information is required on the worksheet?

The worksheet requires various details, including the names of the borrowers, the mortgage originator, and the lender. It also requires the addresses and contact information for all parties involved. Additionally, borrowers must indicate the specific benefits they expect to gain from refinancing.

What does "net tangible benefit" mean?

A net tangible benefit refers to the advantages that a borrower receives from refinancing a mortgage. This can include a lower interest rate, reduced monthly payments, or the elimination of certain loan features. The worksheet prompts borrowers to consider how the new loan will benefit them compared to their existing loan.

How does the worksheet help borrowers?

The worksheet assists borrowers in evaluating the potential advantages of refinancing. By outlining the costs and benefits, it encourages borrowers to make informed decisions about whether to proceed with a new loan. It serves as a tool for transparency in the refinancing process.

What should borrowers consider before signing the worksheet?

Before signing, borrowers should carefully review the terms of both their existing loan and the new loan. They should assess the costs associated with the new loan and consider their personal financial situation. Understanding the potential benefits and drawbacks is crucial for making an informed choice.

Can borrowers customize the worksheet?

While the worksheet must conform to specific regulations, borrowers can specify additional benefits that may apply to their situation. This allows for some customization based on individual circumstances. However, the core structure and requirements of the form must be maintained.

Is the Net Tangible Benefit Worksheet legally binding?

The worksheet is not a legally binding contract. Instead, it serves as a disclosure tool to inform borrowers about the refinancing process. By signing the worksheet, borrowers acknowledge that they have read and understood the information provided, but it does not obligate them to proceed with the loan.

How long should lenders keep the worksheet on file?

Lenders are required to maintain the worksheet in their loan files as part of compliance with Maryland regulations. The specific duration for retaining these records may vary, but it is generally advisable to keep them for several years in case of audits or inquiries.

Where can borrowers obtain the Net Tangible Benefit Worksheet?

Borrowers can typically obtain the Net Tangible Benefit Worksheet from their lender or mortgage broker. Additionally, it may be available on the Maryland Commissioner of Financial Regulation's website or through other official state resources.