What is the purpose of the Maryland New Hire form?

The Maryland New Hire form is used to report newly hired or rehired employees to the Maryland New Hire Registry. This registry helps in the enforcement of child support orders and assists in the prevention of fraud related to public assistance programs. Employers are required to submit this information to ensure compliance with state laws.

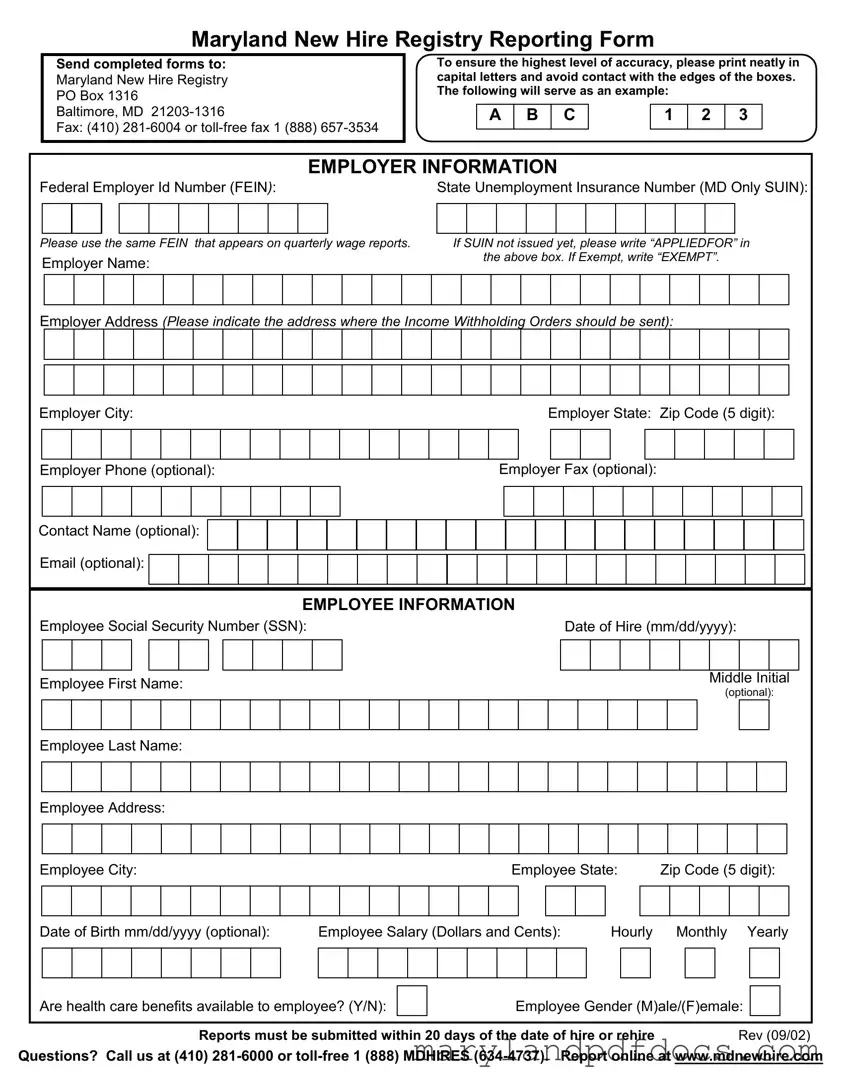

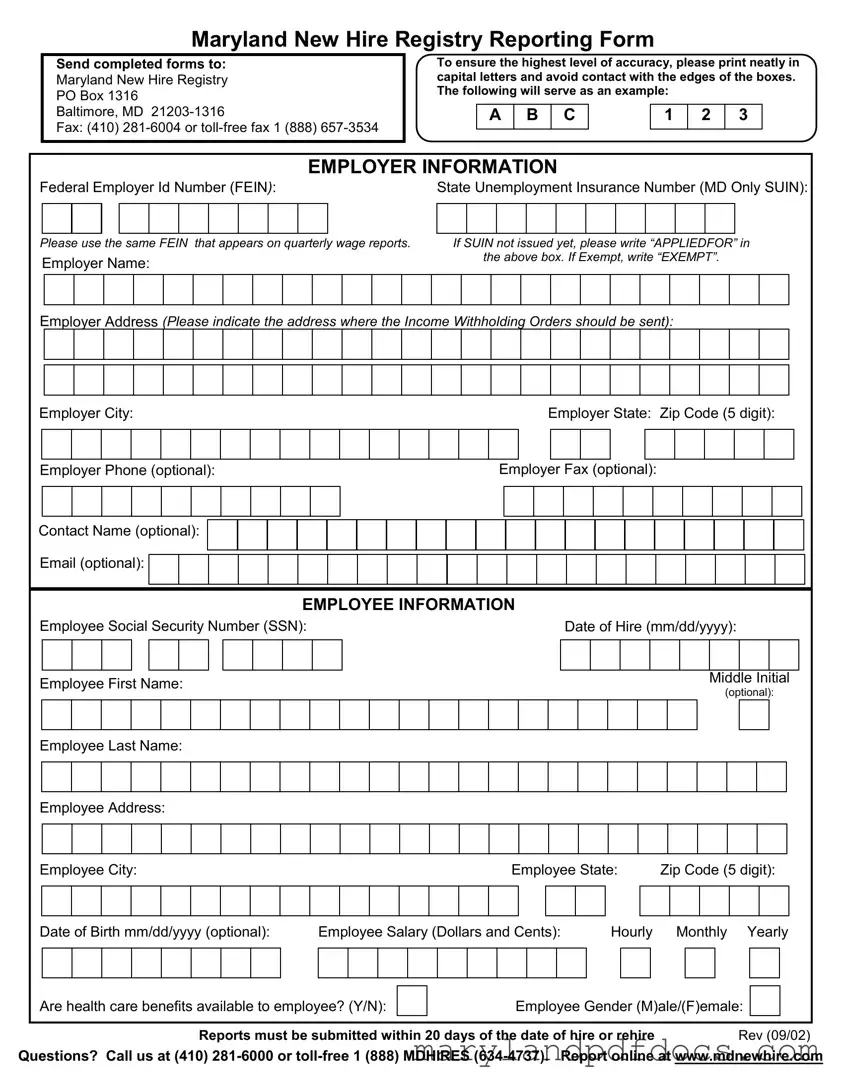

How do I submit the Maryland New Hire form?

You can submit the completed Maryland New Hire form by mailing it to the Maryland New Hire Registry at PO Box 1316, Baltimore, MD 21203-1316. Alternatively, you can fax the form to (410) 281-6004 or use the toll-free fax number 1 (888) 657-3534. Make sure to keep a copy for your records.

What information is required on the form?

The form requires detailed information about both the employer and the employee. Employers must provide their Federal Employer Identification Number (FEIN), State Unemployment Insurance Number (if applicable), and contact details. Employee information includes their Social Security Number, date of hire, name, address, salary, and gender. It is important to fill out the form accurately to avoid delays.

When must the Maryland New Hire form be submitted?

The completed form must be submitted within 20 days of the employee's hire or rehire date. Timely reporting is crucial for compliance with state regulations and to support the efficient processing of child support and other benefits.

What should I do if I do not have a State Unemployment Insurance Number?

If you do not yet have a State Unemployment Insurance Number, you should write “APPLIED FOR” in the designated box on the form. This indicates that you are in the process of obtaining the number. If your business is exempt from needing a SUIN, you should write “EXEMPT” in the same box.

Can I submit the form online?

Yes, the Maryland New Hire Registry allows for online reporting. You can visit their website at www.mdnewhire.com to complete the reporting process electronically. This option may save time and ensure quicker processing of your submission.

What if I have questions while filling out the form?

If you have any questions or need assistance while completing the Maryland New Hire form, you can call the Maryland New Hire Registry at (410) 281-6000 or toll-free at 1 (888) MDHIRES (634-4737). They can provide guidance and clarification on any aspects of the form.

What happens if I fail to submit the form on time?

Failing to submit the Maryland New Hire form within the required 20 days can lead to penalties for the employer. It is essential to adhere to this timeline to avoid potential fines and ensure compliance with state laws. Regularly reviewing your hiring practices can help maintain timely submissions.