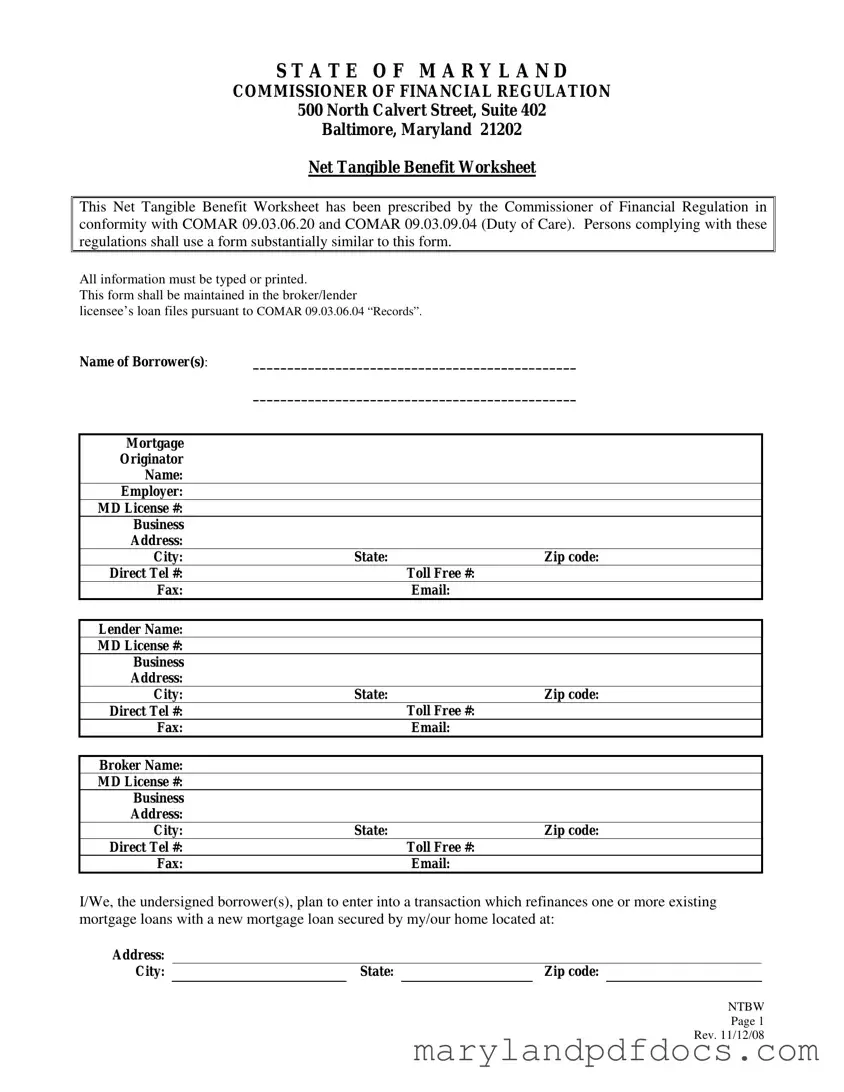

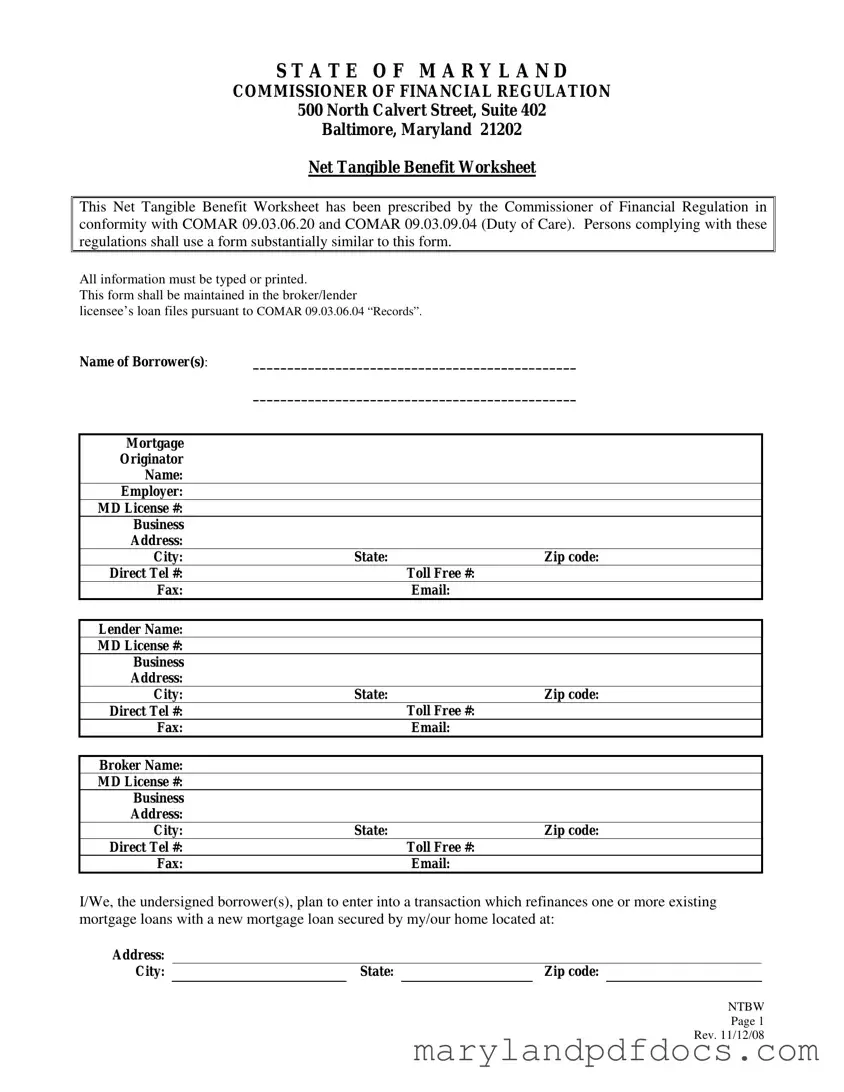

What is the Maryland Net Tangible Benefit Worksheet?

The Maryland Net Tangible Benefit Worksheet is a form required by the Commissioner of Financial Regulation. It helps borrowers assess the benefits of refinancing their mortgage loans. This worksheet ensures that borrowers understand the potential advantages and costs associated with taking out a new loan compared to their existing loans.

Who needs to use this worksheet?

Anyone considering refinancing their mortgage in Maryland should use this worksheet. It is particularly important for borrowers who want to ensure that they are making a financially sound decision. Mortgage originators and lenders are also responsible for providing this form to borrowers as part of the refinancing process.

What information is required on the worksheet?

The worksheet requires several pieces of information, including the names of the borrowers, the mortgage originator’s details, and the lender’s information. Additionally, borrowers must provide specifics about the property being refinanced and indicate which benefits apply to their situation.

What are some examples of benefits listed on the worksheet?

There are various benefits that borrowers can select on the worksheet. These include obtaining a lower interest rate, reducing monthly payments, switching from an adjustable rate to a fixed rate, and eliminating private mortgage insurance. Each borrower can choose the benefits that apply to their refinancing situation.

Why is it important to understand the costs associated with a new loan?

Understanding the costs associated with a new loan is crucial because it helps borrowers make informed decisions. Refinancing can come with fees, closing costs, and potentially higher interest rates. By evaluating these costs against the benefits, borrowers can determine if refinancing is truly advantageous for their financial circumstances.

How does this worksheet ensure compliance with regulations?

The worksheet is prescribed in accordance with specific Maryland regulations (COMAR). By using this form, lenders and borrowers can demonstrate that they have fulfilled their duty of care, ensuring that the refinancing process is transparent and that borrowers are fully informed about their options.

What should borrowers do after completing the worksheet?

After completing the worksheet, borrowers should review it carefully to ensure all information is accurate and that they fully understand the benefits and costs involved. Signing the worksheet indicates that they have read and comprehended its contents. It should then be kept in the lender's loan files as part of the official documentation.

Can borrowers add additional benefits not listed on the worksheet?

Yes, borrowers can specify additional benefits in the section provided on the worksheet. This allows for a more personalized assessment of their refinancing situation, ensuring that all relevant advantages are considered when making a decision.

What happens if a borrower does not believe there is a net tangible benefit?

If a borrower does not believe there is a net tangible benefit to refinancing, they should not proceed with the new loan. It is essential for borrowers to feel confident that refinancing will improve their financial situation. They may want to explore other options or consult with a financial advisor for guidance.