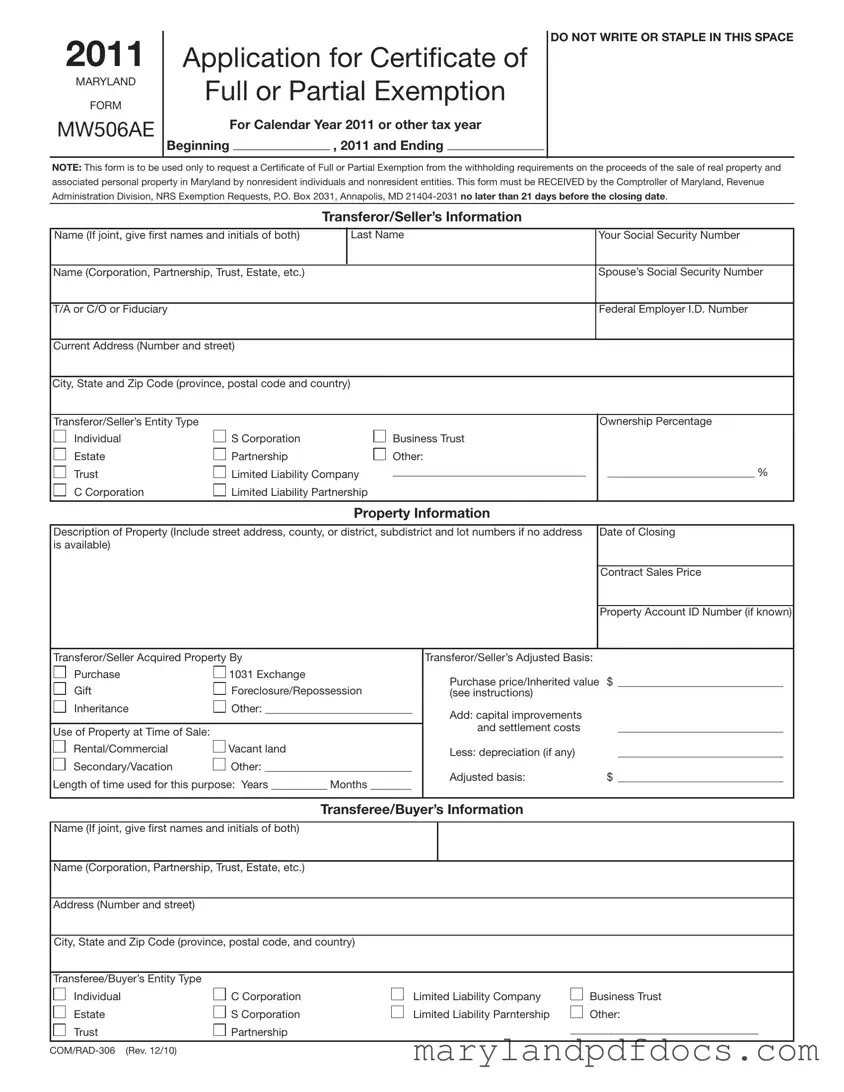

GENERAL INSTRUCTIONS

Purpose of Form

Use Form MW506AE to apply for a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and associated personal property in Maryland by nonresident individuals and nonresident entities. A nonresident entity is defined to mean an entity that: (1) is not formed under the laws of Maryland; and (2) is not qualified by or registered with the Department of Assessments and Taxation to do business in Maryland.

Who May File an Application

An individual, fiduciary, C corporation, S corporation, limited liability company, or partnership transferor/seller may file Form MW506AE. Unless the transferors/ sellers are a husband and wife filing a joint Maryland income tax return, a separate Form MW506AE is required for each transferor/seller.

IMPORTANT: The completed Form MW506AE must be received by the Comptroller of Maryland no later than 21 days before the closing date of the sale or transfer to ensure timely receipt of a Certificate of Full or Partial Exemption.

The Comptroller’s decision to issue or deny a Certificate of Full or Partial Exemption and the determination of the amount of tax to be withheld if a partial exemption is granted are final and not subject to appeal.

SPECIFIC INSTRUCTIONS

Enter the tax year of the transferor/ seller if other than a calendar year.

Transferor/Seller’s Information

Enter the name, address and identification number (Social Security number or federal employer identification number) of the transferor/ seller applying for the exemption.

If the transferor/seller was issued

an individual taxpayer identification number (ITIN) by the IRS, enter the ITIN.

Check the box indicating the transferor/seller’s entity type.

Enter the transferor/seller’s ownership percentage of the property.

Property Information

Enter the description of the property, including the street address(es) for the property as listed with the State Department of Assessments and Taxation (SDAT), including county. If the property does not have a street address, provide the full property account ID numbers used by SDAT to identify the property.

Enter the date of closing for the sale or transfer of the property.

Enter the contract sales price of the property being sold or transferred.

Enter the property account ID number, if known. If the property is made up of more than one parcel and has more than one property tax account number, include all applicable property account ID numbers.

Check the box that describes the transferor/seller’s acquisition of the property. Check the box that describes the transferor/seller’s use of the property at the time of the current sale, and enter the length of time

the property has been used for this purpose.

Complete the transferor/seller’s adjusted basis section by entering the purchase price when the transferor/ seller acquired the property, adding the cost of capital improvements (including acquisition costs such as commissions and state transfer taxes), and subtracting depreciation, if applicable. If inherited property, use the Date of Death value of the property.

Transferee/Buyer’s Information

Enter the name and address.

Check the box indicating the transferee/buyer’s entity type.

Attach schedule if there are multiple transferees/buyers.

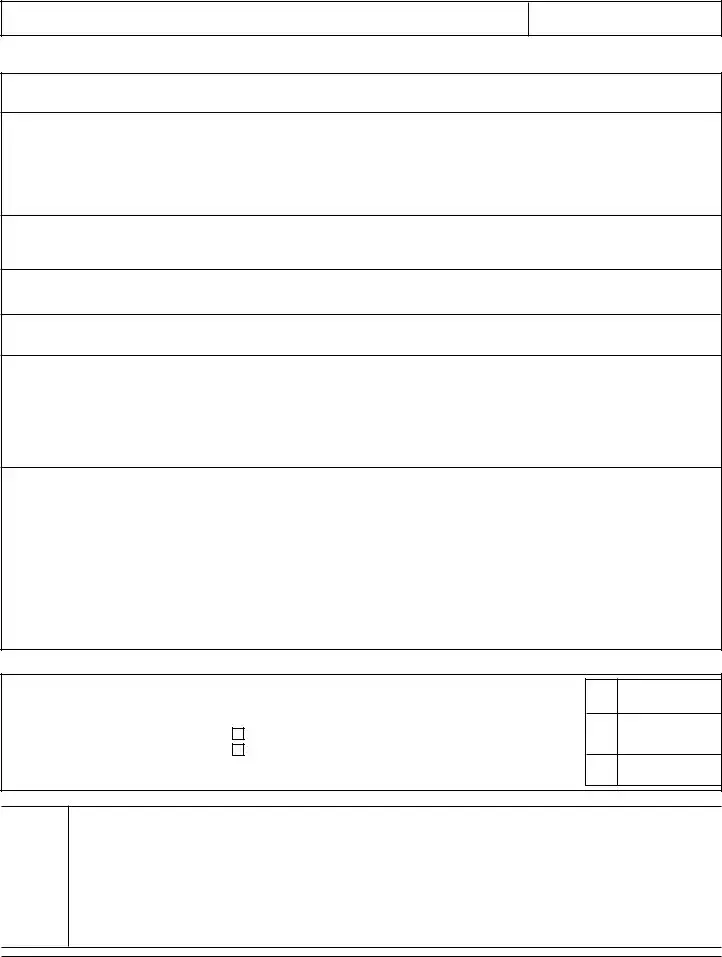

Reason for Full or Partial Exemption from Withholding

Check the box in the “Reason for Exemption” column that indicates the reason you are requesting a full or partial exemption from the income tax withholding requirements.

Specific Line Instructions for Reason for Full or Partial Exemption

Line 1. Transfer is of your principal residence as defined in §121 of the Internal Revenue Code, which means it has been your principal residence for two of the last five years.

Required Documentation: Copy of contract of sale or copy of estimated HUD-1 settlement sheet; copy of HUD-1 settlement sheet from purchase of property, if claiming settlement expenses as part of adjusted basis; and receipts and invoices for any capital improvements you are claiming.

Line 2. Transfer is a tax-free exchange for purposes of §1031 of the Internal Revenue Code.

Required documentation: Letter signed by the qualified intermediary, or by the person authorized to sign on behalf of a business entity acting as the qualified intermediary, which states the name(s) of the transferor(s), the property description, that the individual or business will be acting as the qualified intermediary for

the transferor(s) as part of a §1031 exchange of the property, whether there will be any boot, and if so, the amount of boot. The amount of any boot must be stated on the application as the taxable amount.