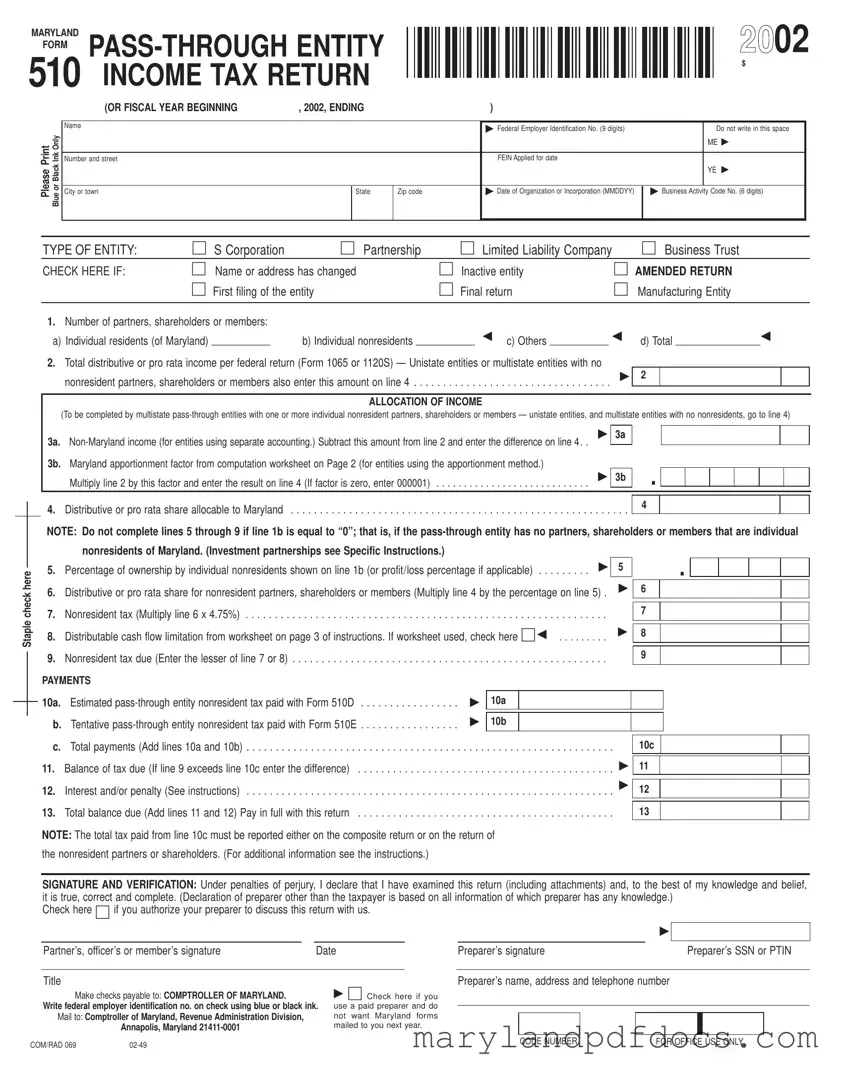

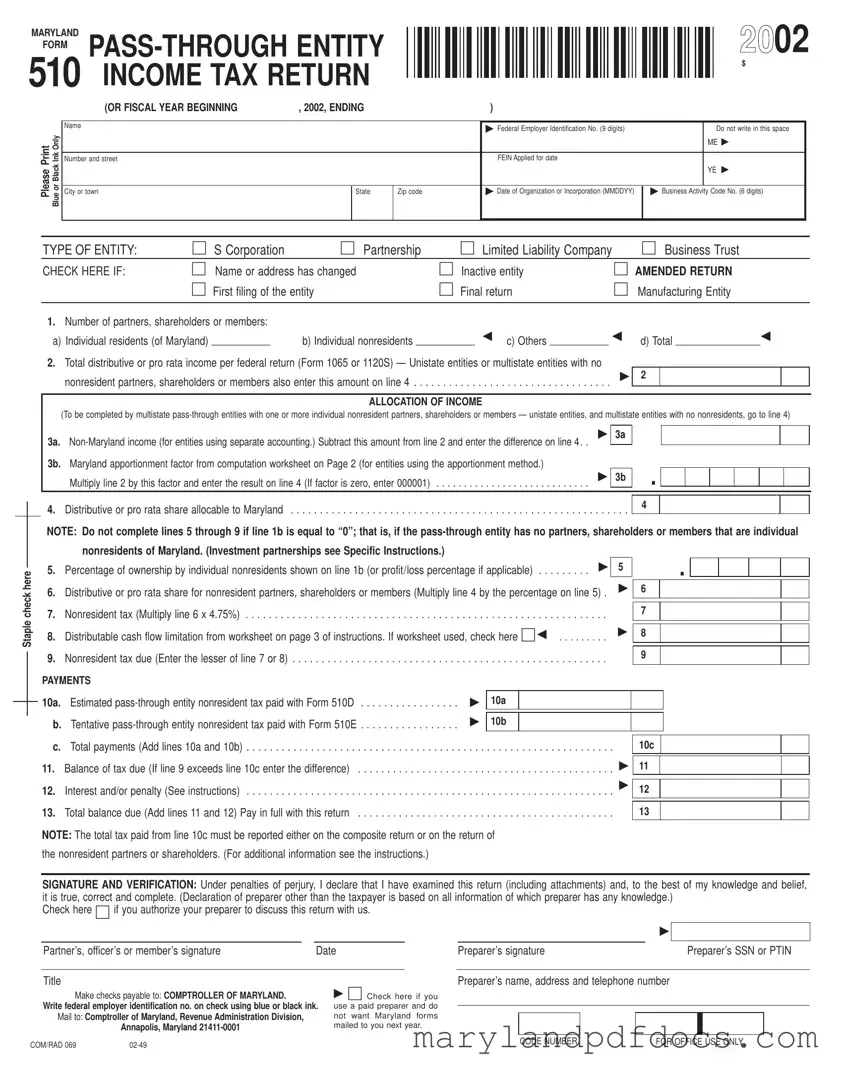

What is the Maryland Form 510?

The Maryland Form 510 is an income tax return specifically designed for pass-through entities, such as S corporations, partnerships, limited liability companies, and business trusts. This form is used to report income, deductions, and tax liabilities for these entities. It ensures that the income is appropriately allocated to partners, shareholders, or members, especially when they include nonresidents of Maryland.

Who needs to file the Maryland Form 510?

If your business operates as a pass-through entity and has partners, shareholders, or members, you will likely need to file the Maryland Form 510. This includes S corporations, partnerships, and limited liability companies. If your entity has any nonresident partners or shareholders, filing this form becomes even more crucial to ensure proper tax compliance.

When is the Maryland Form 510 due?

The due date for the Maryland Form 510 typically aligns with the federal tax return deadlines. For calendar year filers, this means the form is due on April 15. If your entity operates on a fiscal year basis, the form is due on the 15th day of the fourth month following the end of your fiscal year. Always check for any updates or changes in deadlines that may occur.

What information do I need to complete the Maryland Form 510?

To complete the Maryland Form 510, you will need several pieces of information, including the entity's name, Federal Employer Identification Number (FEIN), and business activity code. Additionally, you should gather details about your partners, shareholders, or members, including their residency status and distributive shares of income. If applicable, you will also need to calculate your Maryland apportionment factor, especially if your entity operates in multiple states.

How do I determine the distributive share for nonresident partners?

The distributive share for nonresident partners is calculated by multiplying the total income allocable to Maryland by the percentage of ownership held by the nonresident partners. This ensures that nonresidents only pay taxes on their share of income earned within Maryland. If you have questions about how to accurately make these calculations, consider seeking guidance from a tax professional.

What happens if I miss the filing deadline for Form 510?

If you miss the filing deadline for the Maryland Form 510, your entity may be subject to penalties and interest on any unpaid taxes. It's essential to file as soon as possible, even if you cannot pay the full amount owed. Consider reaching out to the Maryland Revenue Administration Division to discuss your situation and explore options for compliance.

Can I amend my Maryland Form 510 after filing?

Yes, you can amend your Maryland Form 510 if you discover errors or need to make changes after the initial filing. To do this, you will need to indicate that the return is amended and provide the corrected information. It’s important to submit any necessary documentation along with the amended return to ensure accurate processing.