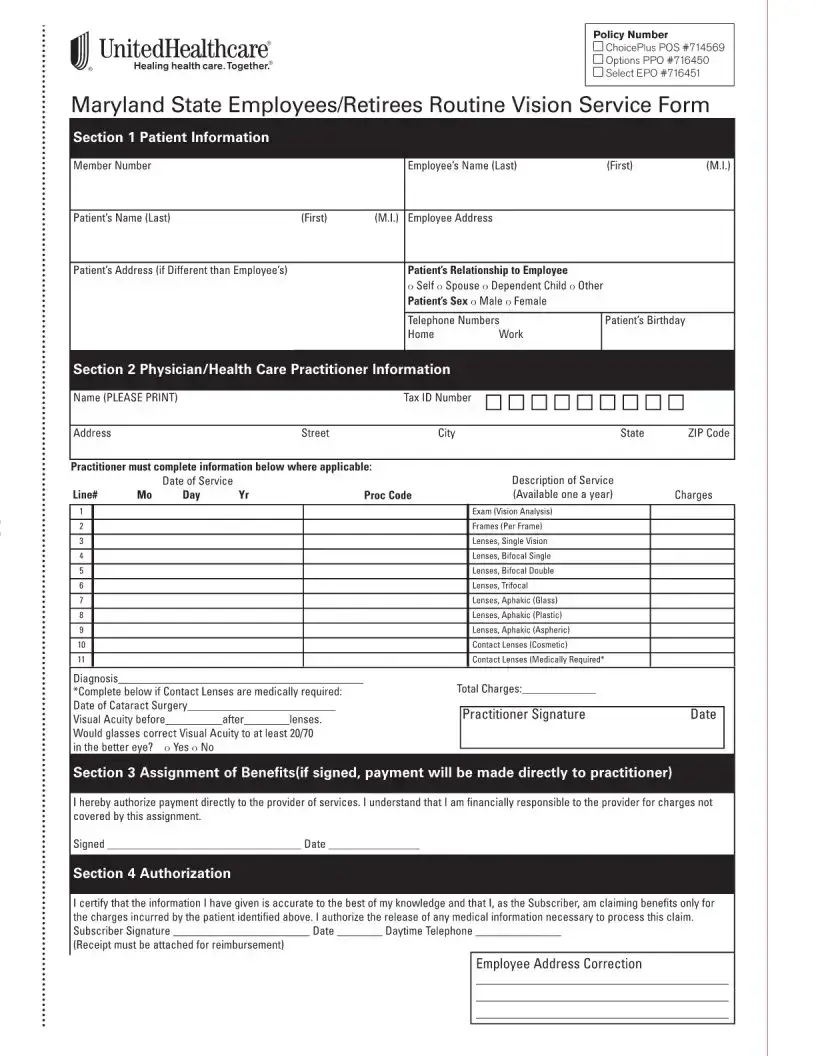

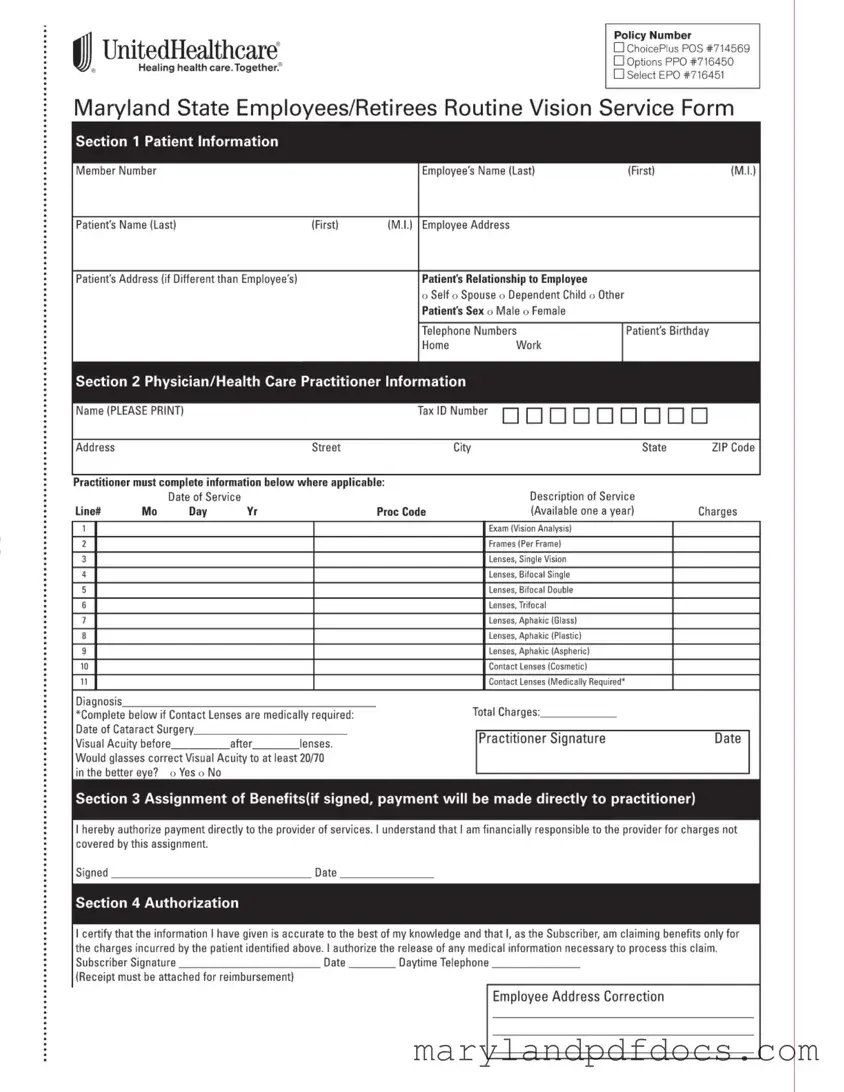

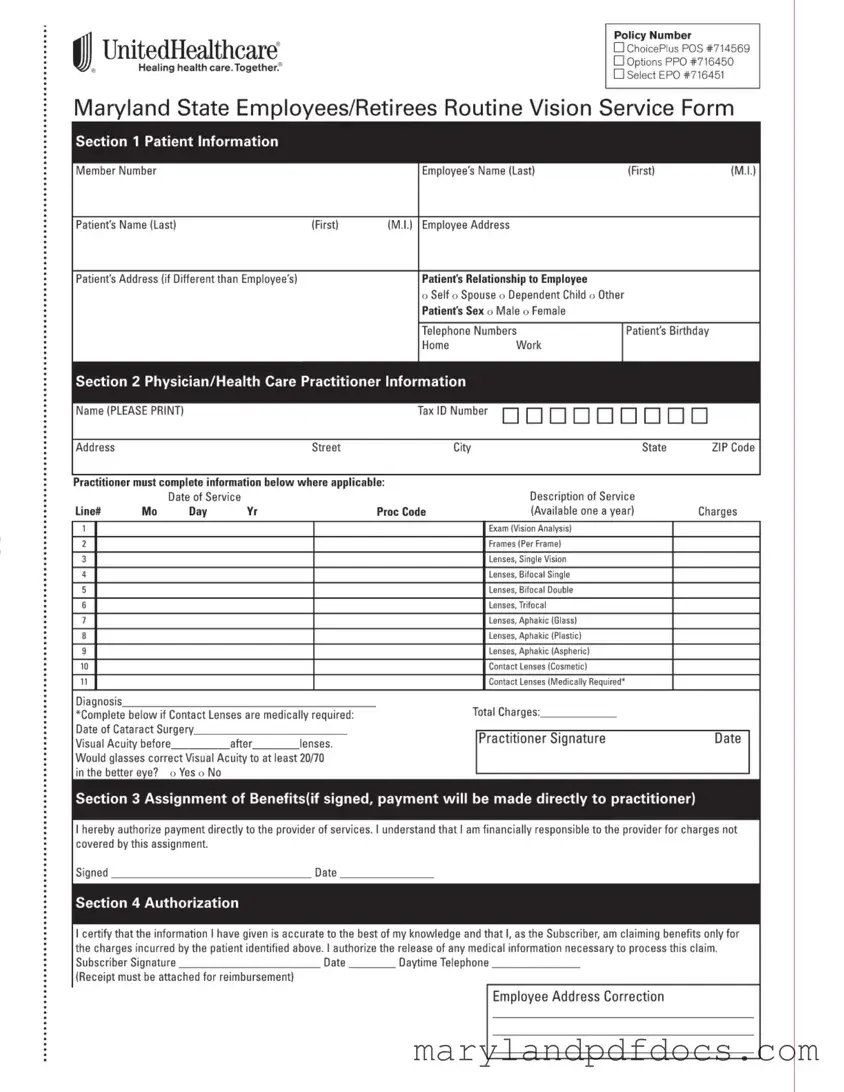

Fill Out Your Maryland Employees Vision Template

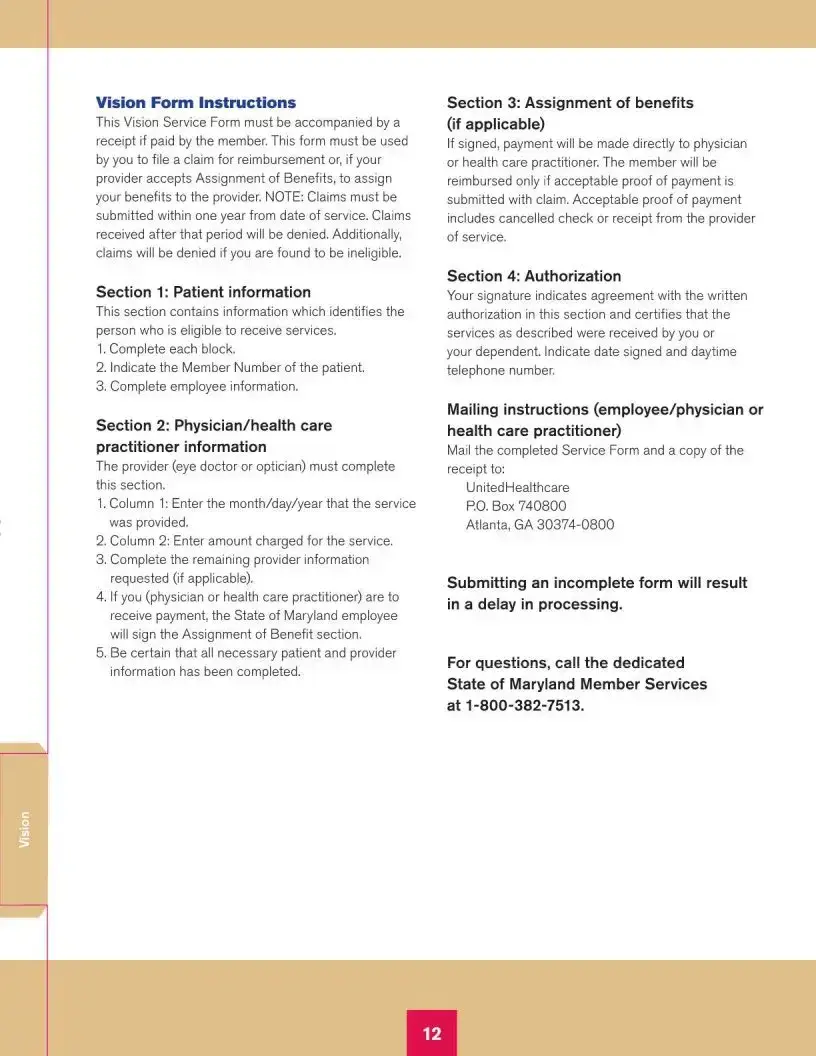

The Maryland Employees Vision Form is a document used by state employees and retirees to claim reimbursement for vision services. This form facilitates the assignment of benefits to healthcare providers, ensuring that eligible individuals receive the necessary eye care without upfront costs. To get started on your claim, fill out the form by clicking the button below.

Launch Maryland Employees Vision Editor

Fill Out Your Maryland Employees Vision Template

Launch Maryland Employees Vision Editor

Launch Maryland Employees Vision Editor

or

Free Maryland Employees Vision PDF

You’ve already started — finish it

Fill out Maryland Employees Vision digitally in just minutes.