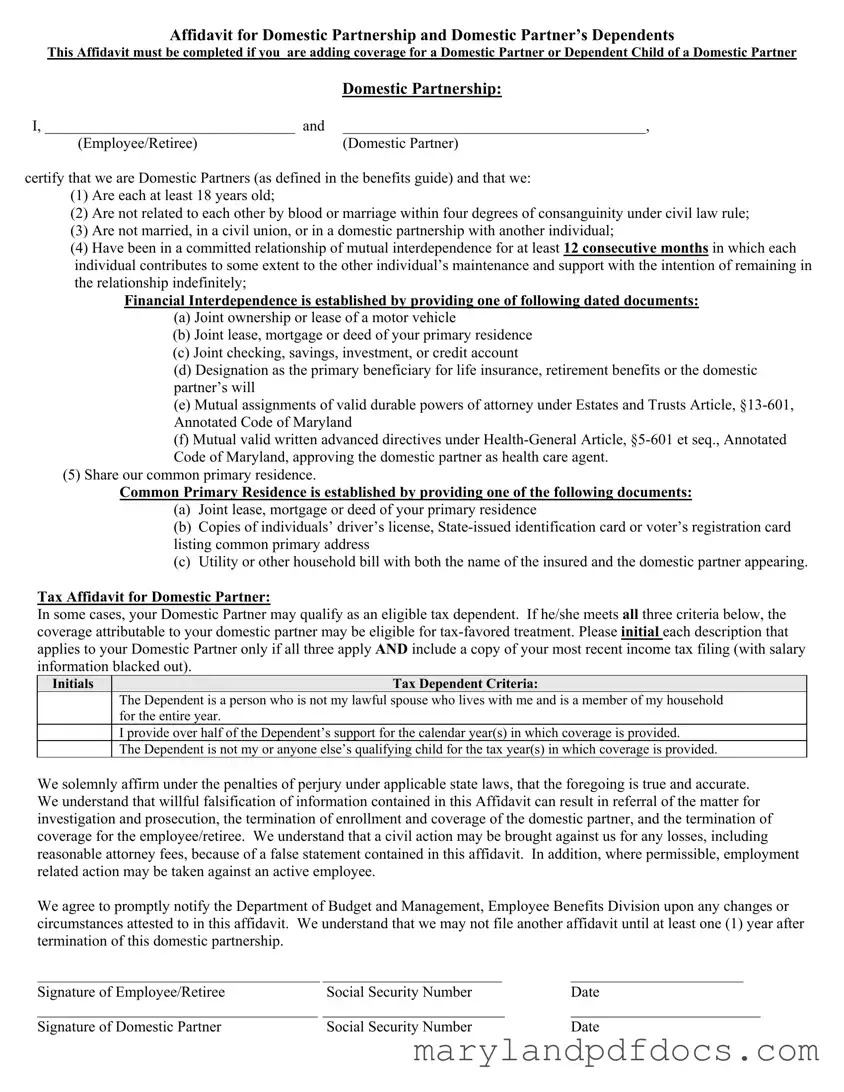

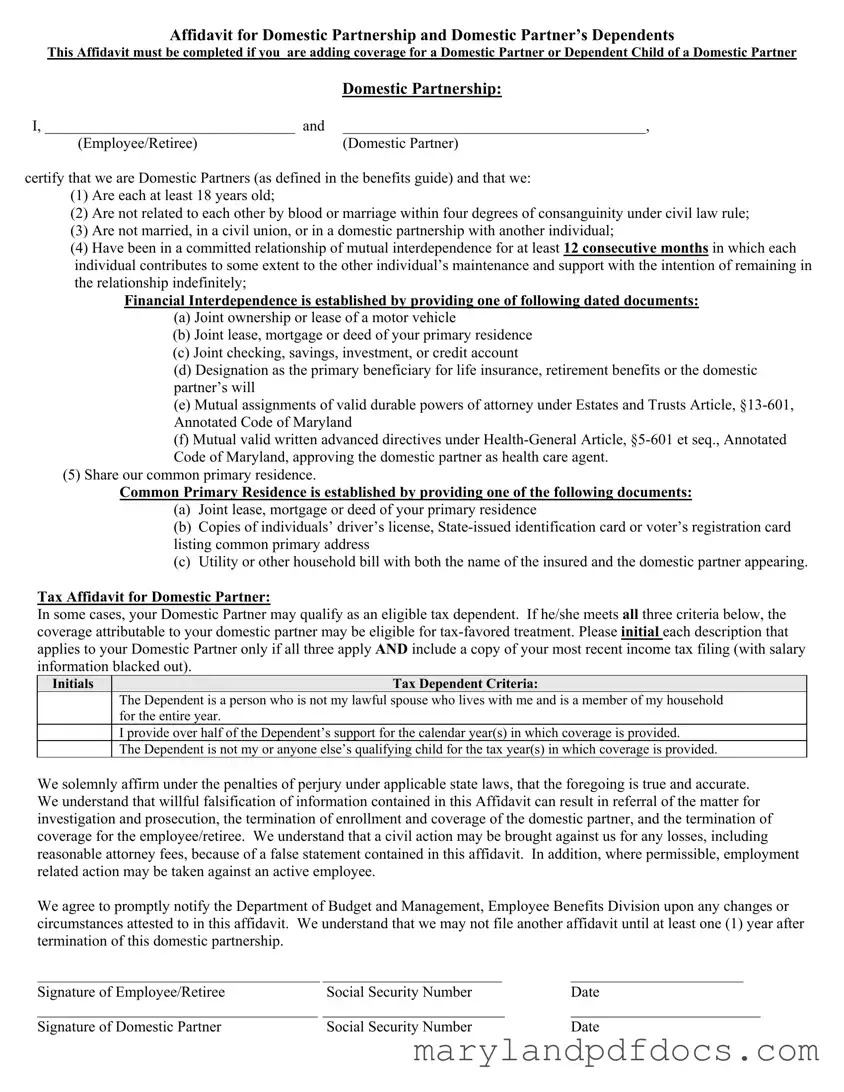

Affidavit for Domestic Partnership and Domestic Partner’s Dependents

This Affidavit must be completed if you are adding coverage for a Domestic Partner or Dependent Child of a Domestic Partner

|

Domestic Partnership: |

I, _________________________________ and |

________________________________________, |

(Employee/Retiree) |

(Domestic Partner) |

certify that we are Domestic Partners (as defined in the benefits guide) and that we:

(1)Are each at least 18 years old;

(2)Are not related to each other by blood or marriage within four degrees of consanguinity under civil law rule;

(3)Are not married, in a civil union, or in a domestic partnership with another individual;

(4)Have been in a committed relationship of mutual interdependence for at least 12 consecutive months in which each individual contributes to some extent to the other individual’s maintenance and support with the intention of remaining in the relationship indefinitely;

Financial Interdependence is established by providing one of following dated documents:

(a)Joint ownership or lease of a motor vehicle

(b)Joint lease, mortgage or deed of your primary residence

(c)Joint checking, savings, investment, or credit account

(d)Designation as the primary beneficiary for life insurance, retirement benefits or the domestic partner’s will

(e)Mutual assignments of valid durable powers of attorney under Estates and Trusts Article, §13-601, Annotated Code of Maryland

(f)Mutual valid written advanced directives under Health-General Article, §5-601 et seq., Annotated Code of Maryland, approving the domestic partner as health care agent.

(5)Share our common primary residence.

Common Primary Residence is established by providing one of the following documents:

(a)Joint lease, mortgage or deed of your primary residence

(b)Copies of individuals’ driver’s license, State-issued identification card or voter’s registration card listing common primary address

(c)Utility or other household bill with both the name of the insured and the domestic partner appearing.

Tax Affidavit for Domestic Partner:

In some cases, your Domestic Partner may qualify as an eligible tax dependent. If he/she meets all three criteria below, the coverage attributable to your domestic partner may be eligible for tax-favored treatment. Please initial each description that applies to your Domestic Partner only if all three apply AND include a copy of your most recent income tax filing (with salary information blacked out).

Initials |

Tax Dependent Criteria: |

|

The Dependent is a person who is not my lawful spouse who lives with me and is a member of my household |

|

for the entire year. |

|

I provide over half of the Dependent’s support for the calendar year(s) in which coverage is provided. |

|

The Dependent is not my or anyone else’s qualifying child for the tax year(s) in which coverage is provided. |

We solemnly affirm under the penalties of perjury under applicable state laws, that the foregoing is true and accurate. We understand that willful falsification of information contained in this Affidavit can result in referral of the matter for investigation and prosecution, the termination of enrollment and coverage of the domestic partner, and the termination of coverage for the employee/retiree. We understand that a civil action may be brought against us for any losses, including reasonable attorney fees, because of a false statement contained in this affidavit. In addition, where permissible, employment related action may be taken against an active employee.

We agree to promptly notify the Department of Budget and Management, Employee Benefits Division upon any changes or circumstances attested to in this affidavit. We understand that we may not file another affidavit until at least one (1) year after termination of this domestic partnership.

_________________________________________ __________________________ |

_________________________ |