|

|

|

|

|

|

|

|

|

Page 3 |

|

PART IV PROGRAM SERVICE REVENUE AND OTHER REVENUE (STATE NATURE) |

|

Program |

|

Other |

|

|

|

|

|

|

|

service revenue |

|

revenue |

|

(a) Fees from government agencies |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . |

|

|

|

|

|

(b) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . |

|

|

|

|

|

(c) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . |

|

|

|

|

|

(d) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . |

|

|

|

|

|

(e) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . |

|

|

|

|

|

(f) Total program service revenue (enter here and on line 2) |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . |

|

|

|

|

|

(g) Total other revenue (enter here and on line 11) |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . |

|

|

|

|

|

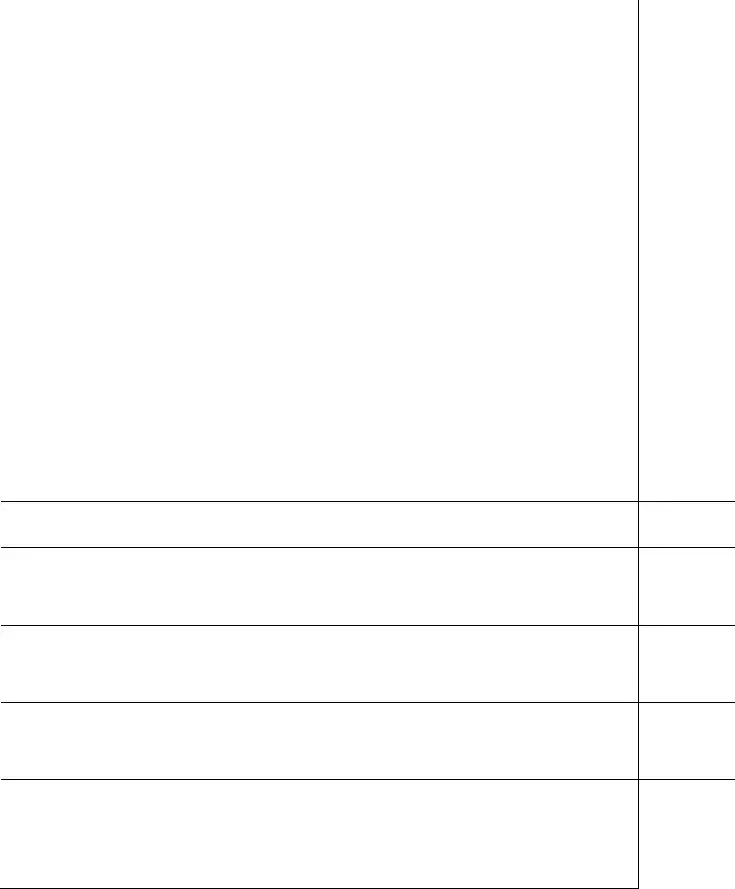

PART V BALANCE SHEETS |

If line 12, Part 1, and line 59 are $25,000 or less, you should complete only lines 59, 66, and 74 and, if you do not |

|

Use fund accounting, line 73. If line 12 or line 59 is more than $25,000, complete the entire balance sheet. |

|

|

|

|

Note: Columns (C) and (D) are optional. Columns (A) and (B) must be |

(A) Beginning of |

|

|

End of year |

|

|

|

completed to the extent applicable. Where required, attach schedules should be |

(B) Total |

|

(C) Unrestricted/ |

|

(D) Restricted/ |

|

year |

|

|

|

for end-of-year amounts only. |

|

|

|

Expendable |

|

Nonexpendable |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

45 |

Cash — non-interest bearing |

|

|

|

|

|

|

|

46 |

Savings and temporary cash investments |

|

|

|

|

|

|

|

47 |

Accounts receivable _______ |

|

|

|

|

|

|

|

|

|

minus allowance for doubtful accounts ____________ |

|

|

|

|

|

|

|

48 |

Pledges receivable ________ |

|

|

|

|

|

|

|

|

|

minus allowance for doubtful accounts ____________ |

|

|

|

|

|

|

|

49 |

Grants receivable |

|

|

|

|

|

|

|

50 |

Receivable due from officers, directors, trustees and key |

|

|

|

|

|

|

|

|

employees (attach schedule) |

. . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

51 |

Other notes and loans receivable ____________ |

|

|

|

|

|

|

|

|

minus allowance for doubtful accounts ____________ |

|

|

|

|

|

|

|

52 |

Inventories for sale or use |

. . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

53 |

Prepaid expenses and deferred charges |

|

|

|

|

|

|

|

54 |

Investments — securities (attach schedule) |

|

|

|

|

|

|

|

55 |

Investments — land, buildings and equipment: basis ____ |

|

|

|

|

|

|

|

|

minus allowance for doubtful accounts ____________ |

|

|

|

|

|

|

|

56 |

Investments — other (attach schedule) |

|

|

|

|

|

|

|

57 |

Land, buildings and equipment: basis _________ |

|

|

|

|

|

|

|

|

minus accumulated depreciation ______ (attach schedule) |

|

|

|

|

|

|

|

58 |

Other assets _____________ |

|

|

|

|

|

|

|

|

59 |

Total assets (add lines 45 through 58) |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

60 |

Accounts payable and accrued expenses |

|

|

|

|

|

|

|

61 |

Grants payable |

|

|

|

|

|

|

|

62 |

Support and revenue designated for future periods |

|

|

|

|

|

|

|

|

(attach schedule) |

|

|

|

|

|

|

|

63 |

Loans from officers, directors, trustees, and key employees |

|

|

|

|

|

|

|

|

(attach schedule) |

. . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

64 |

Mortgages and other notes payable (attach schedule) |

|

|

|

|

|

|

|

65 |

Other liabilities ___________ |

|

|

|

|

|

|

|

|

66 |

Total liabilities (add lines 60 through 65) |

|

|

|

|

|

|

|

|

Fund Balances or Net Worth |

|

|

|

|

|

|

|

Organizations that use fund accounting, check here |

|

|

|

|

|

|

|

and complete lines 67 through 70 and lines 74 and 75. |

|

|

|

|

|

|

|

67 a. Current unrestricted fund |

|

|

|

|

|

|

|

|

b. Current restricted fund |

. . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

68 |

Land, buildings and equipment fund |

|

|

|

|

|

|

|

69 |

Endowment fund |

. . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

70 |

Other funds (Describe _________ ) |

|

|

|

|

|

|

|

Organizations that do not use fund accounting, check here |

|

|

|

|

|

|

|

and complete lines 71 through 75. |

|

|

|

|

|

|

|

|

71 |

Capital stock or trust principal |

|

|

|

|

|

|

|

72 |

Paid-in or capital surplus |

|

|

|

|

|

|

|

73 |

Retained earnings or accumulated income |

|

|

|

|

|

|

|

74 |

Total fund balances or new worth |

|

|

|

|

|

|

|

75 |

Total liabilities and fund balances/net worth |

|

|

|

|

|

|