Fill Out Your Maryland 746 Template

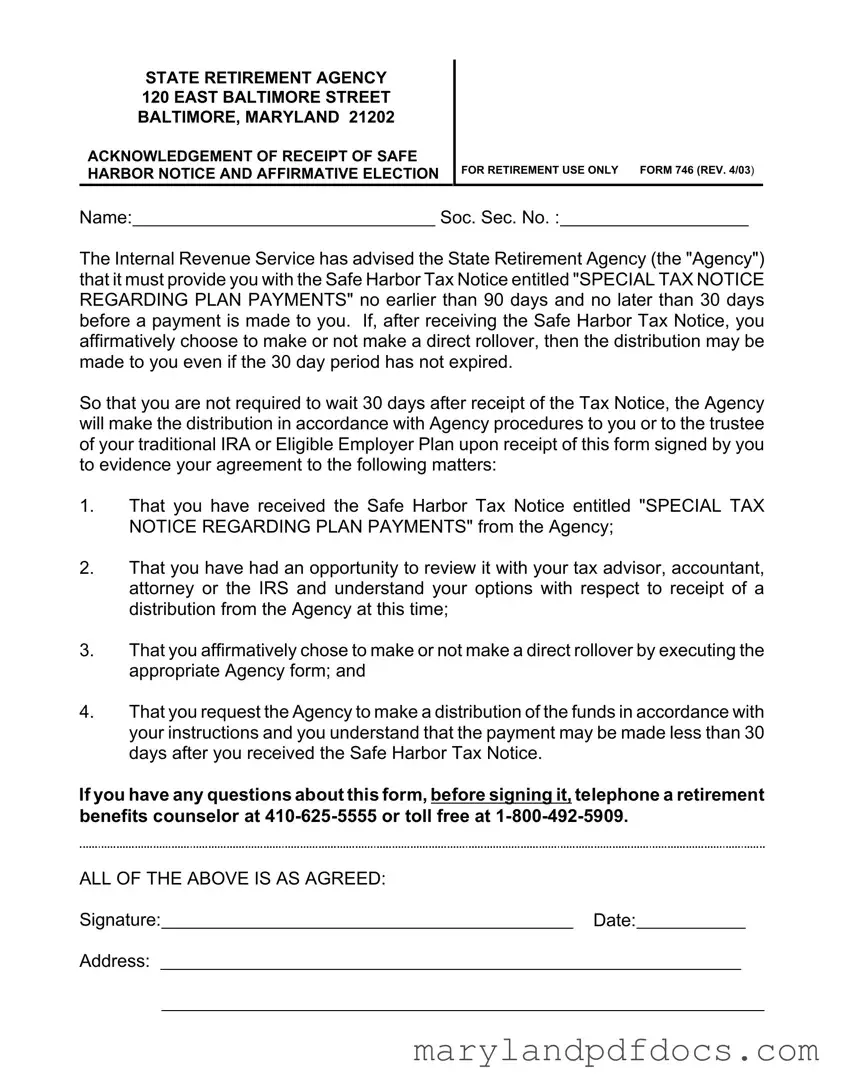

The Maryland 746 form is an important document that acknowledges your receipt of the Safe Harbor Tax Notice and allows you to make an affirmative election regarding your retirement distribution. This form ensures that you understand your options for receiving payments from the State Retirement Agency and confirms that you have had the opportunity to discuss these options with a tax professional. To proceed with your retirement distribution, please fill out the form by clicking the button below.

Launch Maryland 746 Editor

Fill Out Your Maryland 746 Template

Launch Maryland 746 Editor

Launch Maryland 746 Editor

or

Free Maryland 746 PDF

You’ve already started — finish it

Fill out Maryland 746 digitally in just minutes.