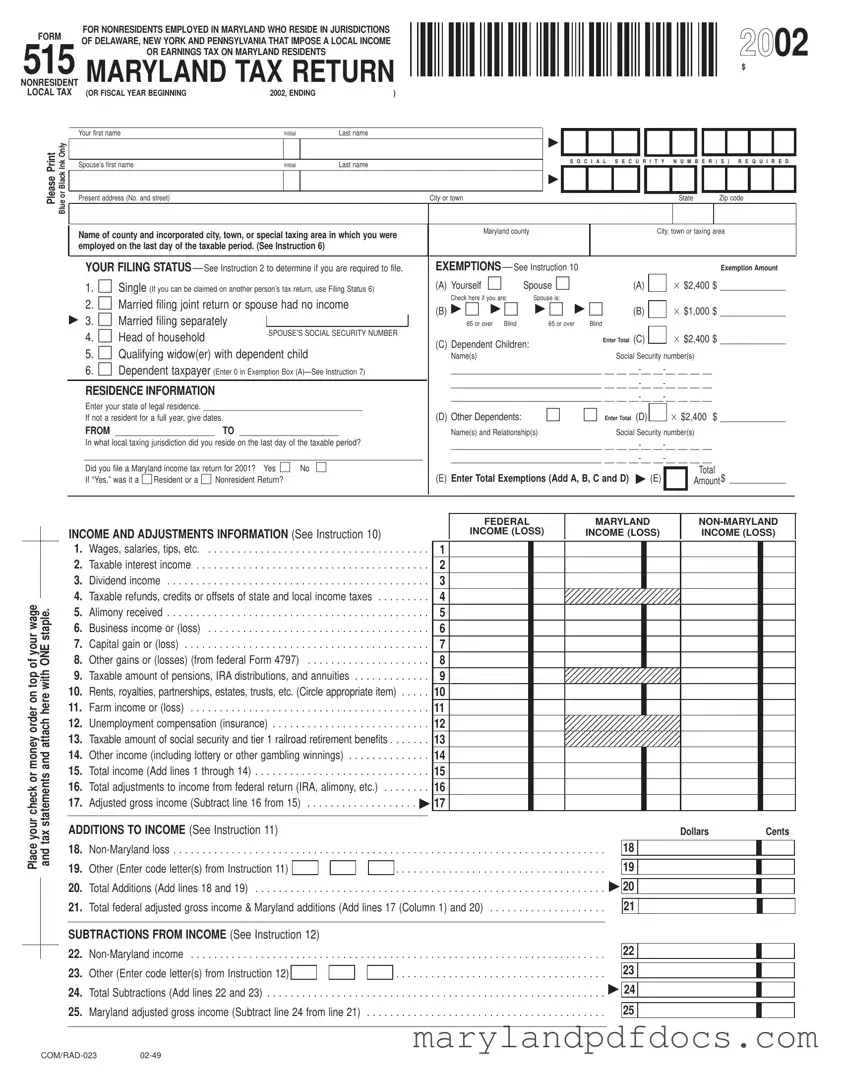

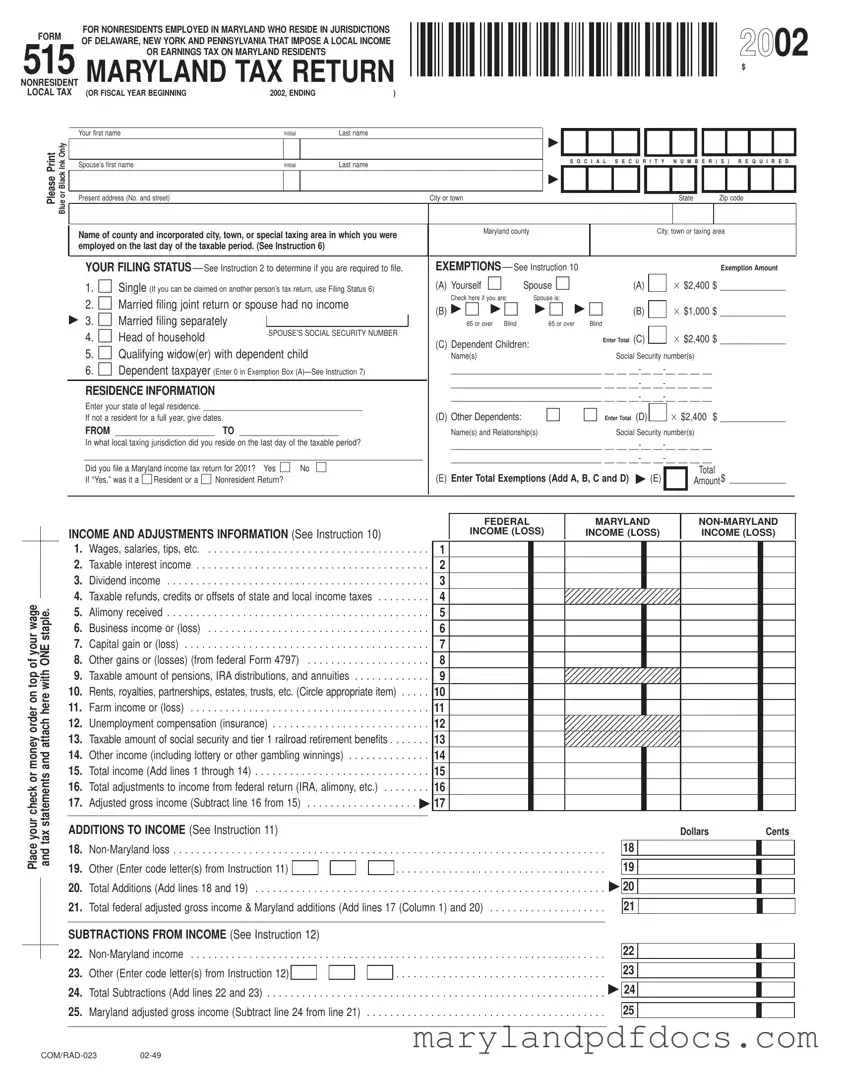

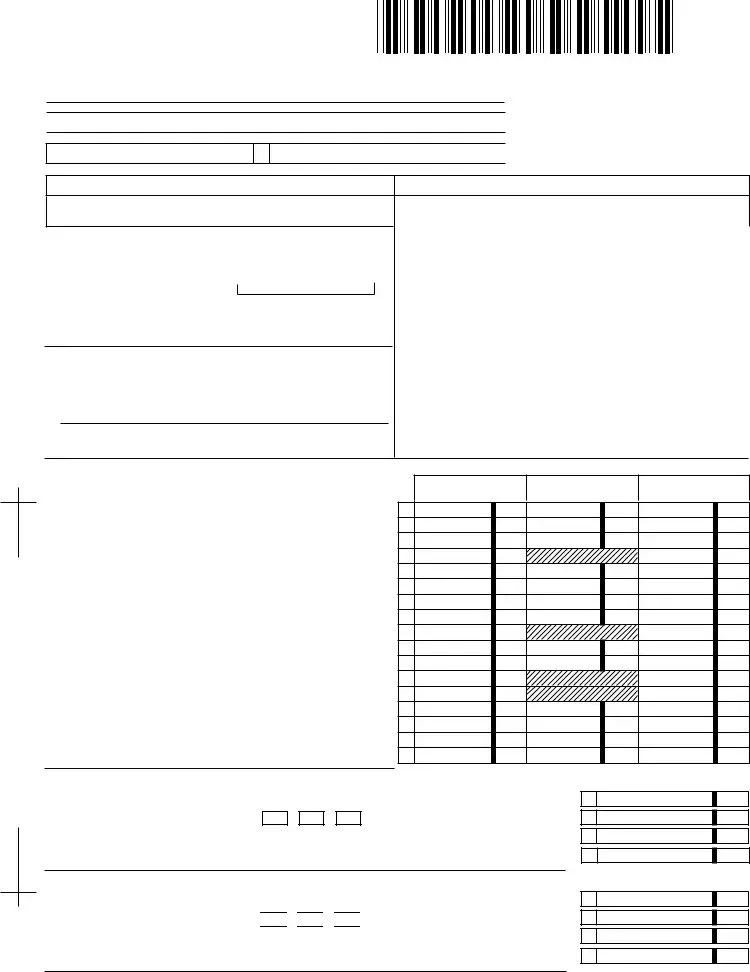

1. Who needs to file the Maryland 515 form?

You need to file the Maryland 515 form if you are a nonresident employed in Maryland and you live in Delaware, New York, or Pennsylvania. Specifically, this applies if you earn salary, wages, or other compensation for services performed in Maryland and your home jurisdiction imposes a local income tax on Maryland residents. Additionally, you must be required to file a federal return.

2. What is considered nonresident status?

A nonresident is anyone who does not have a permanent home in Maryland. If you did not maintain a place to live in Maryland for more than six months during the tax year, you qualify as a nonresident. If you establish or abandon legal residence in Maryland during the year, your tax status may change for that portion of the year.

3. What income is taxable under the Maryland 515 form?

If you are required to file Form 515, you are subject to local income tax on your federal adjusted gross income derived from salary, wages, or other compensation for services performed in Maryland. This includes wages earned in Baltimore City or if you live in jurisdictions like New York City or Wilmington, Delaware.

4. How do I determine if I must file a Maryland return?

To determine if you must file, add up all your federal gross income (excluding exempt income). If your total income meets or exceeds the minimum filing levels outlined in the form, you must file. For those aged 65 and over, different thresholds apply. If Maryland tax was withheld from your pay, you must file to claim a refund, even if you do not meet the income threshold.

5. What if Maryland tax was withheld from my income?

If Maryland tax was withheld from your earnings, you must file Form 515 to receive a refund. Complete the necessary sections on the form, including your filing status and residence information. Attach any W-2 or 1099 forms that show the Maryland tax withheld. Remember, you must file within three years of the original due date to get a refund.

6. What should I include as exemptions on the form?

You can claim the same number of exemptions as on your federal return, but the exemption amounts differ. You can also claim additional exemptions for being age 65 or over or for blindness. Make sure to check the appropriate boxes on the form to accurately report your exemptions.

7. When is the Maryland 515 form due?

The Maryland 515 form is due by April 15 of the year following the tax year. For example, if you are filing for the tax year 2002, your return must be submitted by April 15, 2003. Ensure that you complete the form accurately and submit it on time to avoid penalties.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .