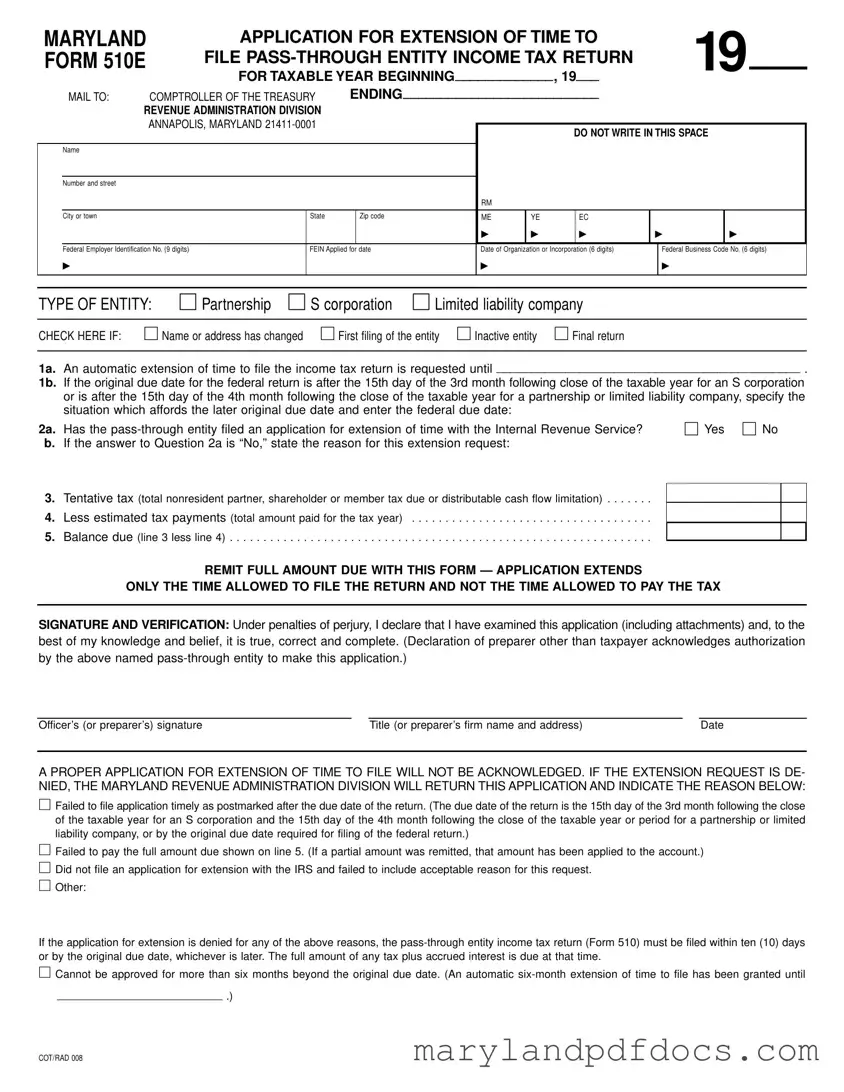

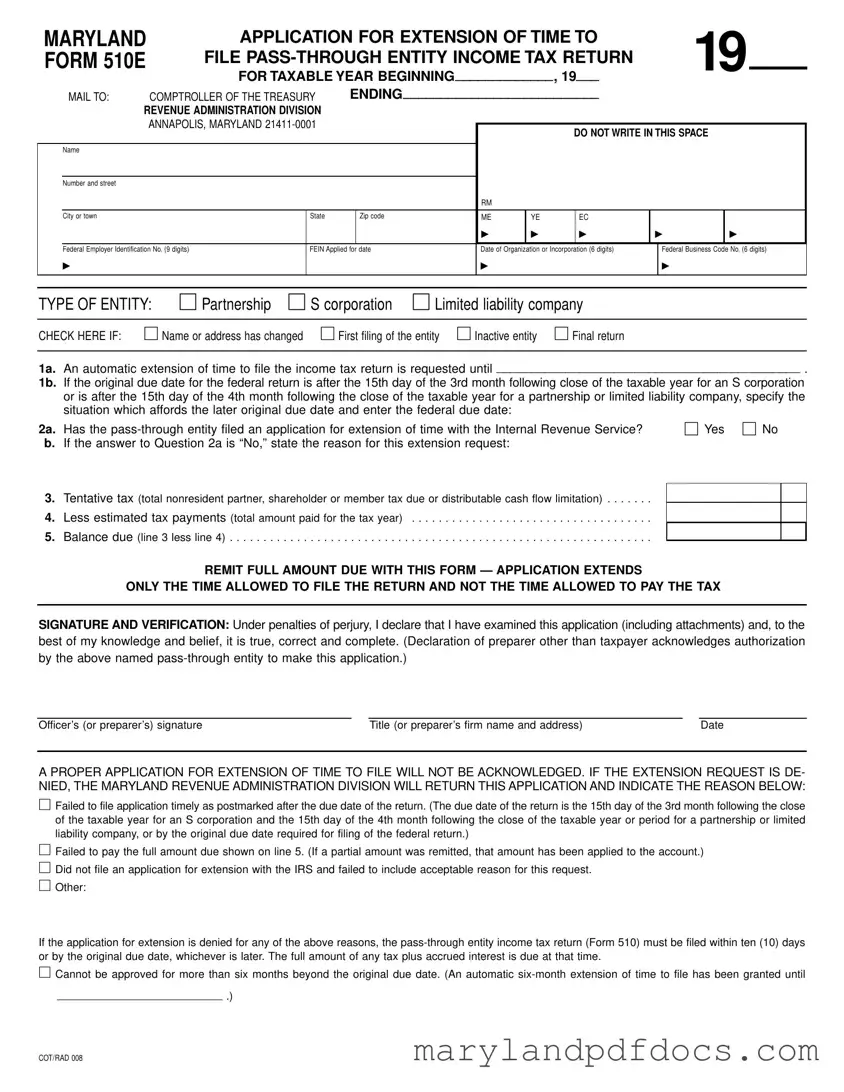

What is the Maryland 510E form?

The Maryland 510E form is an application used by pass-through entities, such as partnerships, S corporations, and limited liability companies, to request an extension of time to file their income tax return. This form allows entities to extend their filing deadline, but it does not extend the time to pay any taxes owed.

Who needs to file the Maryland 510E form?

If you are operating a pass-through entity in Maryland and require additional time to prepare your income tax return, you will need to file the Maryland 510E form. This includes partnerships, S corporations, and limited liability companies that may not be able to meet the original filing deadline.

When is the Maryland 510E form due?

The due date for filing the Maryland 510E form depends on the type of entity. For S corporations, the form must be submitted by the 15th day of the 3rd month following the close of the taxable year. For partnerships and limited liability companies, the due date is the 15th day of the 4th month following the close of the taxable year.

What happens if my extension request is denied?

If the Maryland Revenue Administration Division denies your extension request, you will be notified. In such cases, you must file the pass-through entity income tax return (Form 510) within ten days of the denial or by the original due date, whichever is later. Be aware that any unpaid taxes will incur interest and penalties.

Do I need to pay taxes when I file the Maryland 510E form?

Yes, when submitting the Maryland 510E form, you must remit the full amount of any taxes due. The extension only grants additional time to file your return, not to pay any taxes owed. Failure to pay the required amount may result in penalties and interest.

Can I get an additional extension beyond six months?

Generally, the Maryland 510E form allows for a maximum extension of six months. However, partnerships and limited liability companies may request an additional three-month extension for reasonable cause by submitting another Form 510E. This request must be justified with an acceptable reason.

What information do I need to provide on the Maryland 510E form?

You will need to provide several pieces of information, including the name and address of the pass-through entity, the Federal Employer Identification Number (FEIN), and the taxable year dates. Additionally, you must indicate the type of entity, any changes to the name or address, and the tentative tax amount expected for the year. Proper completion of the form is essential for the extension request to be acknowledged.