What is the purpose of the Maryland 510D form?

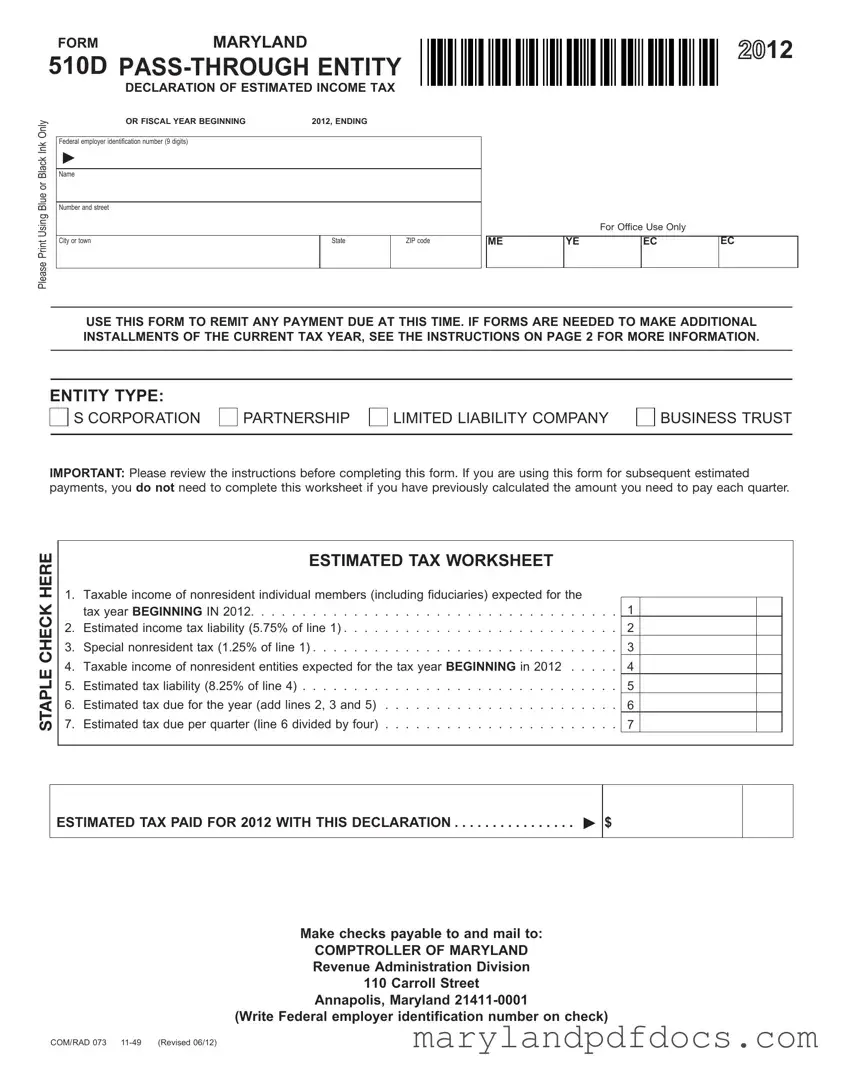

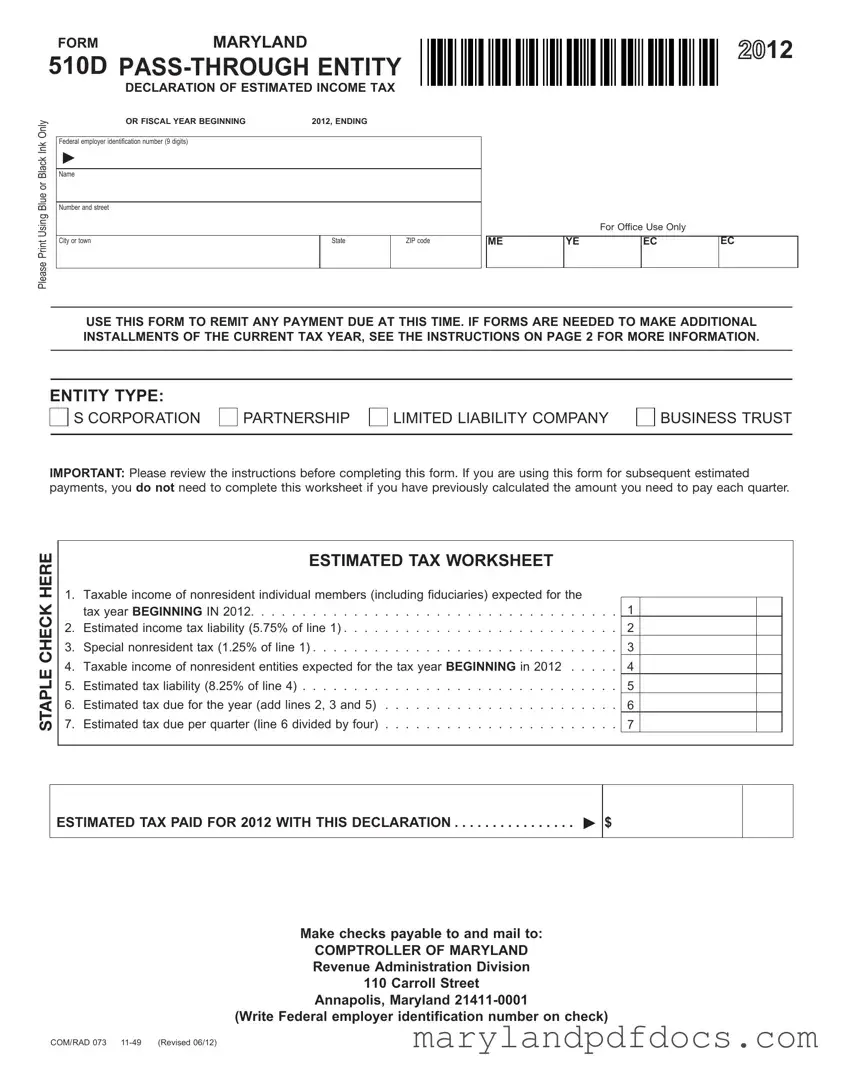

The Maryland 510D form is designed for pass-through entities (PTEs) to declare and remit estimated income tax. This form is particularly important for PTEs that have nonresident members, as it ensures that the appropriate taxes are paid on their behalf. By using this form, PTEs can calculate their estimated tax liabilities and make necessary payments to avoid penalties.

Who needs to file the Maryland 510D form?

Any pass-through entity, such as an S corporation, partnership, limited liability company, or business trust, with nonresident members is required to file the Maryland 510D form. If the PTE expects to owe more than $1,000 in taxes for the year, it must make quarterly estimated payments. This requirement helps ensure that nonresident members are properly taxed on their share of the entity's income.

How is the estimated tax calculated on the Maryland 510D form?

To calculate the estimated tax, the PTE first determines the taxable income of its nonresident members. For individual members, the tax rate is 5.75%, plus a special nonresident tax of 1.25%. For nonresident entities, the tax rate is 8.25%. The total estimated tax due for the year is the sum of these calculations, which is then divided by four to find the quarterly estimated tax payment.

When are the payments due for the Maryland 510D form?

Payments for the Maryland 510D form are due on specific dates. For S corporations, the payments must be made by the 15th day of the 4th, 6th, 9th, and 12th months following the start of the tax year. For partnerships, LLCs, and business trusts, the due dates are the 4th, 6th, 9th, and 13th months. It’s crucial to meet these deadlines to avoid interest and penalties.

What happens if the estimated tax needs to be amended?

If a PTE realizes that its estimated tax needs to be adjusted, it can recalculate the required amount using the estimated tax worksheet provided with the form. Any adjustments should be reflected in the next installment payment. It's important to ensure that the remaining installments are at least 25% of the amended estimated tax due for the year to stay compliant.

How should payments be submitted with the Maryland 510D form?

When submitting the Maryland 510D form, include a check or money order made payable to the Comptroller of Maryland. Be sure to write the federal employer identification number (FEIN) on the payment, along with the type of tax and the tax year dates. Payments should be mailed to the Comptroller of Maryland's Revenue Administration Division in Annapolis. Remember, cash should never be sent.

12

12