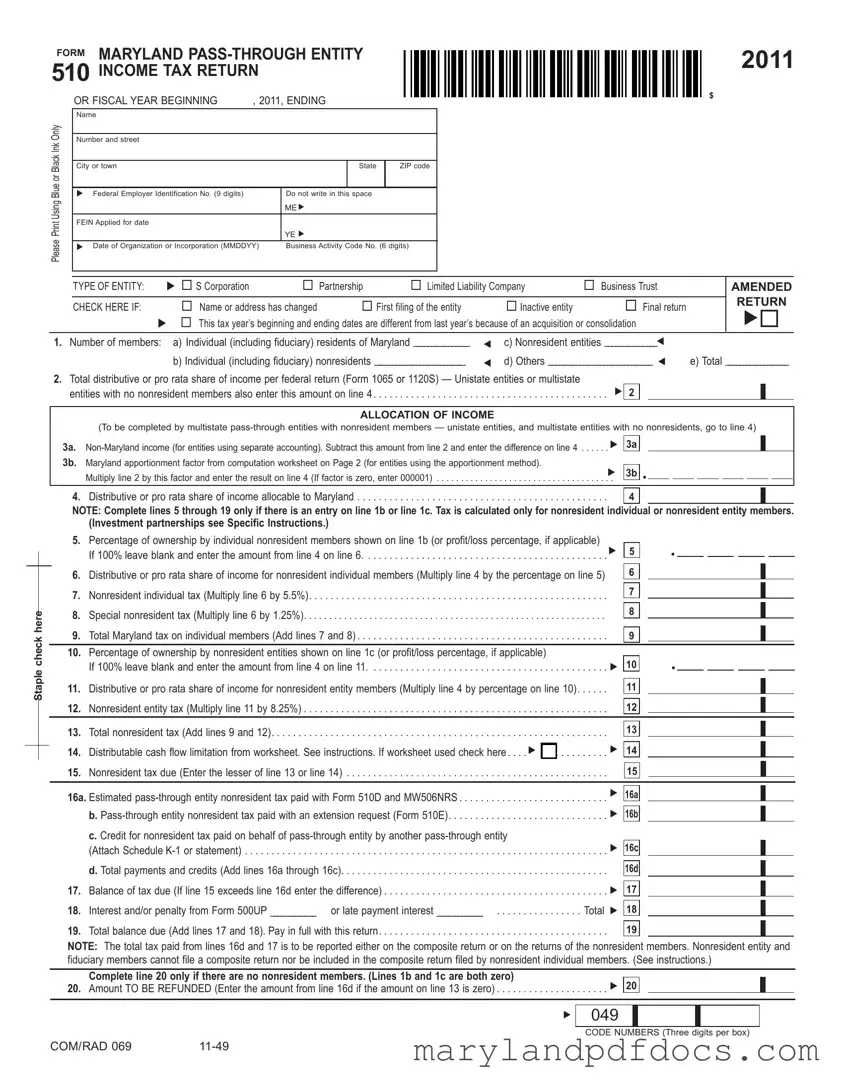

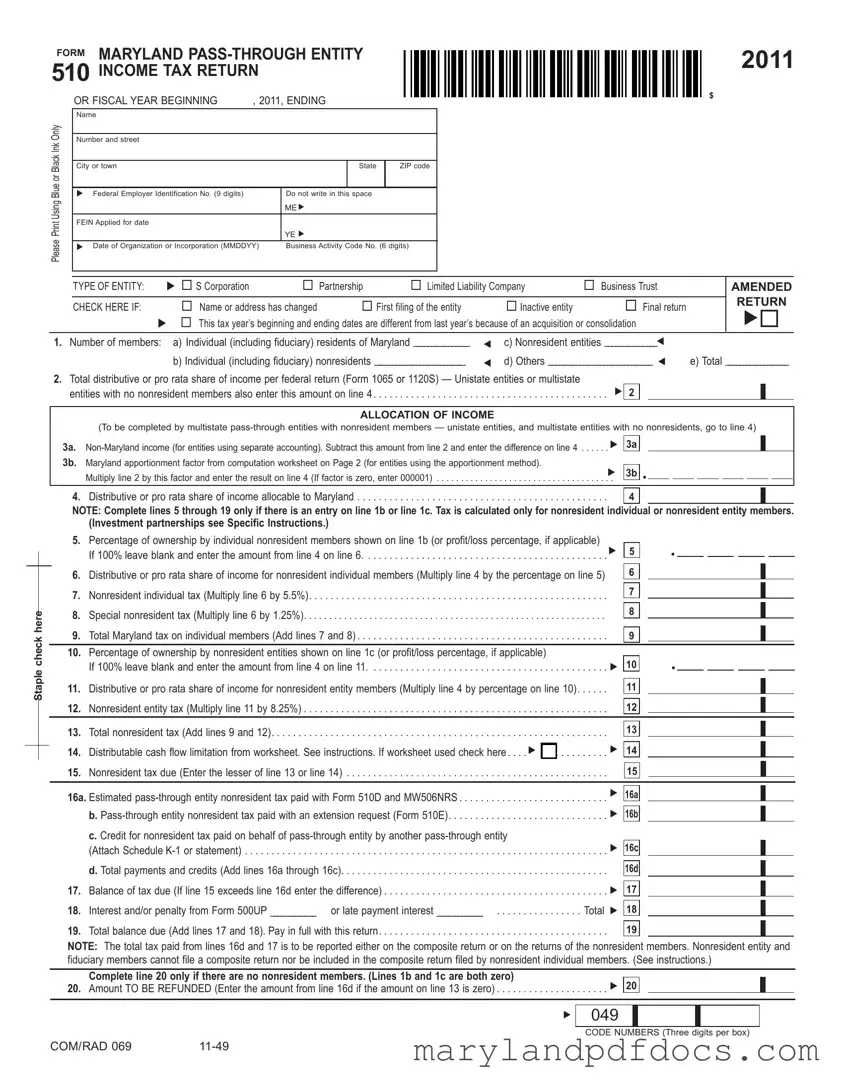

What is the Maryland 510 form?

The Maryland 510 form is the income tax return specifically designed for pass-through entities. These entities include S Corporations, Partnerships, Limited Liability Companies, and Business Trusts. The form allows these entities to report their income, deductions, and tax liabilities to the state of Maryland. It also facilitates the allocation of income to both resident and non-resident members.

Who needs to file the Maryland 510 form?

Any pass-through entity that conducts business in Maryland or has members who are Maryland residents must file the Maryland 510 form. This includes entities with non-resident members. If the entity is newly formed, inactive, or filing for the first time, it must also complete this form. Additionally, if there are any changes in the entity's name or address, an amended return may be required.

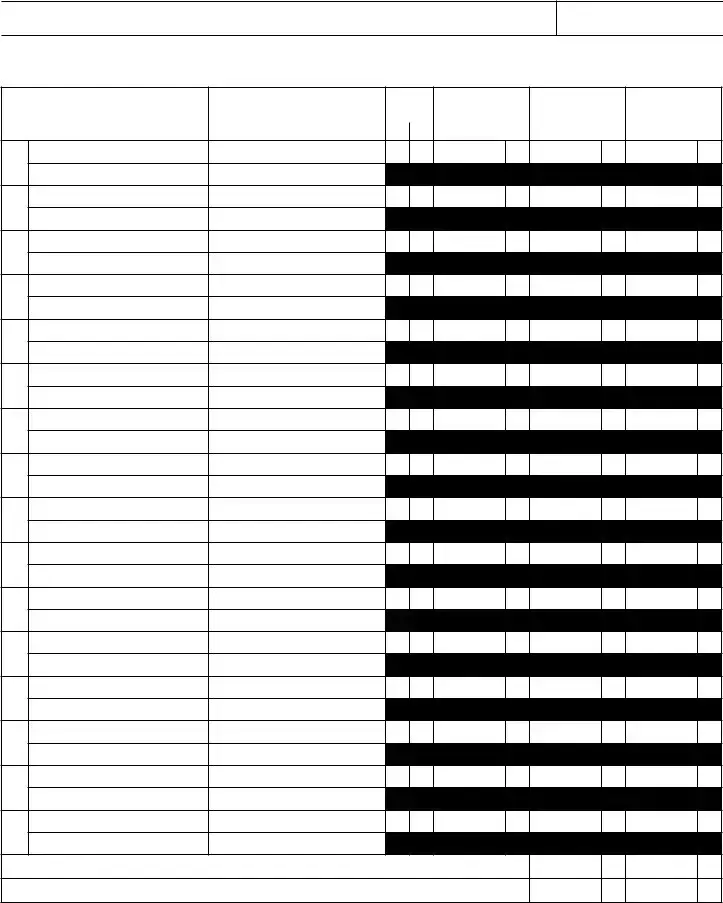

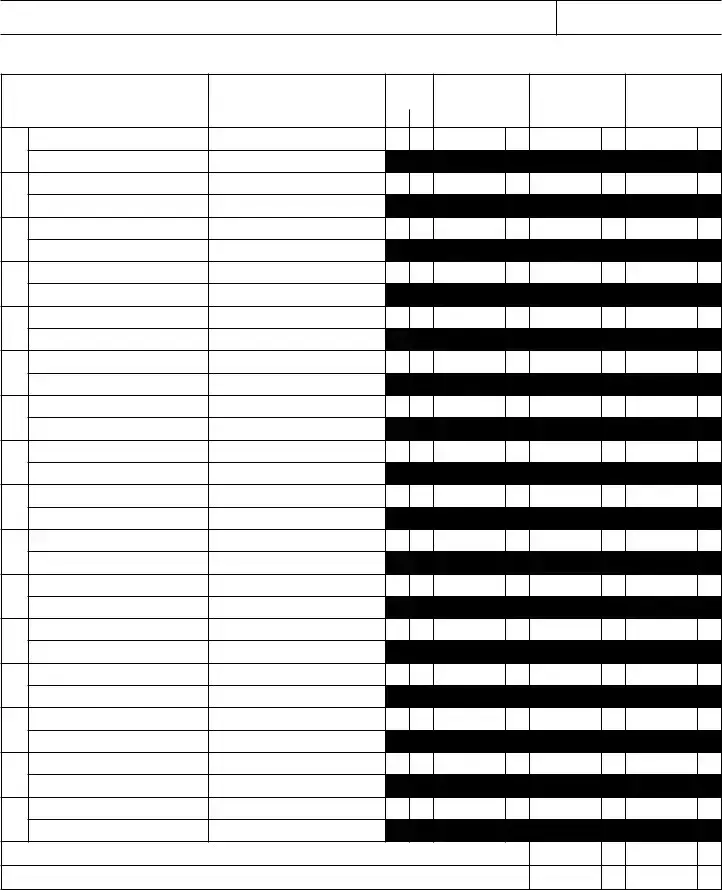

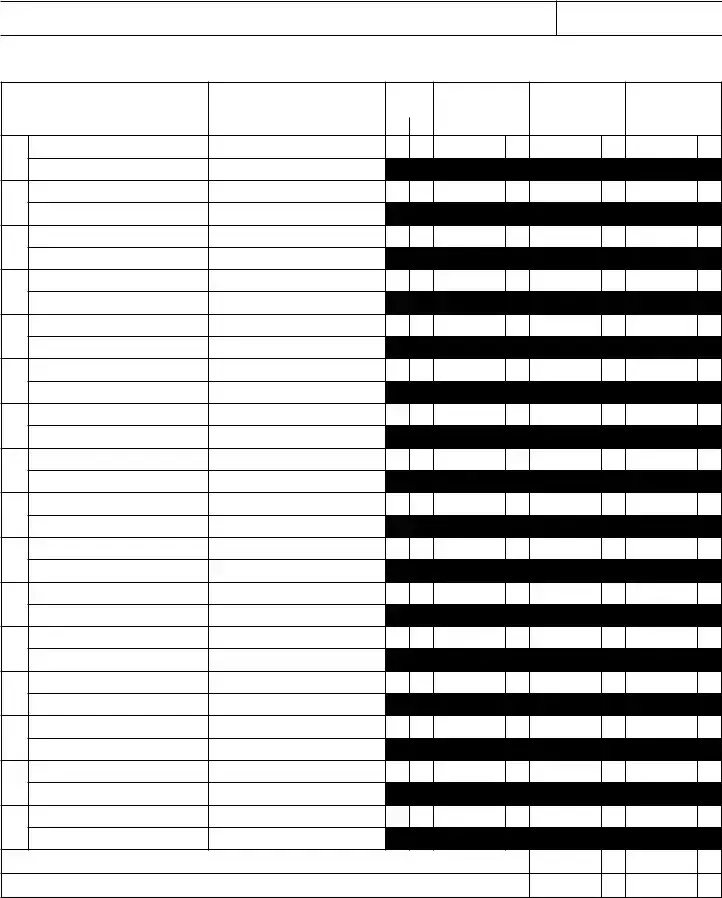

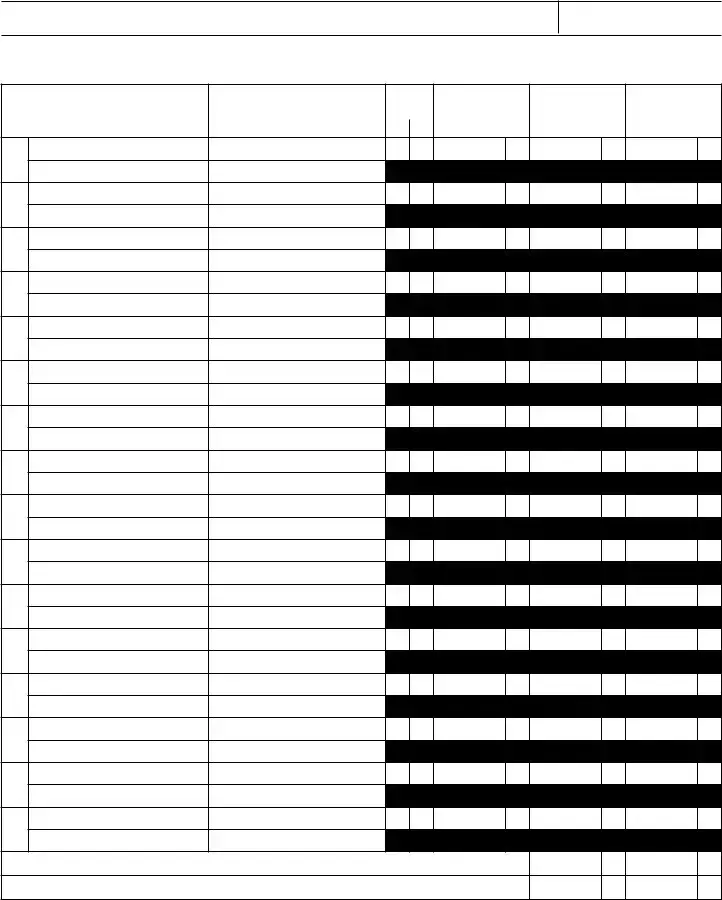

What information is required to complete the Maryland 510 form?

To complete the Maryland 510 form, you will need the entity's name, address, and Federal Employer Identification Number (FEIN). You will also need to provide details about the type of entity, the number of members, and the total distributive share of income. Additionally, if applicable, you must include information about non-resident members and any income allocation calculations. Accurate figures for income, deductions, and tax credits are essential for correct reporting.

How is tax calculated on the Maryland 510 form?

Tax is calculated based on the distributive share of income allocable to Maryland. For non-resident individual members, the tax rate is 5.5%, while for non-resident entities, it is 8.25%. The form includes specific lines to compute these taxes based on the ownership percentages and income reported. It is important to follow the instructions carefully to ensure accurate calculations.

What happens if the entity has no non-resident members?

If the entity has no non-resident members, lines 1b and 1c on the form will be zero. In this case, you will need to complete line 20, which indicates the amount to be refunded if applicable. The entity will not have to calculate taxes for non-resident members and can focus on the income and tax obligations of resident members only.

Where should the completed Maryland 510 form be sent?

The completed Maryland 510 form should be mailed to the Comptroller of Maryland, Revenue Administration Division, at the address provided on the form. Make sure to include the FEIN on the check if you are submitting a payment. It is important to ensure that the form is sent to the correct address to avoid delays in processing.

if you authorize your preparer to discuss this return with us.

if you authorize your preparer to discuss this return with us.