|

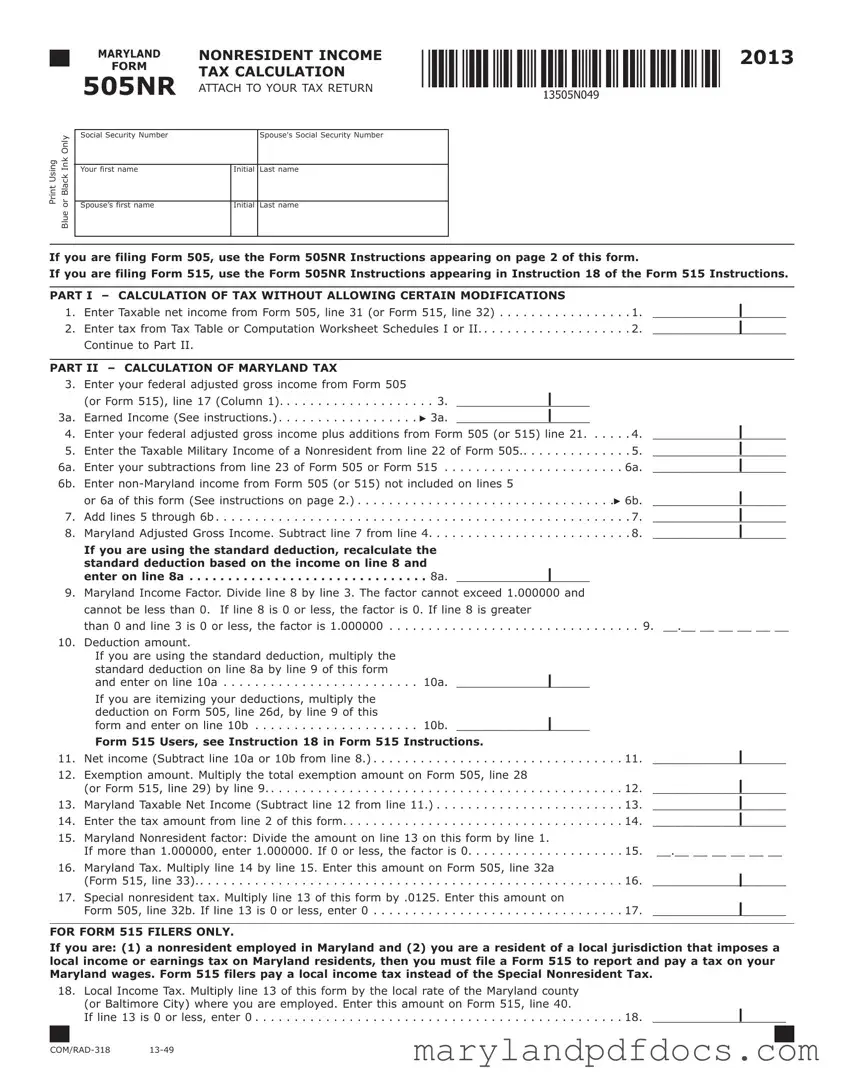

MARYLAND |

NONRESIDENT INCOME |

|

FORM |

TAX CALCULATION |

|

505NR |

|

INSTRUCTIONS |

|

2013 |

|

Using Form 505NR, Nonresident Income Tax Calculation, follow the line-by-line instructions below to figure your Maryland tax.

Line 1. Enter the taxable net income from Form 505, line 31.

Line 2. Find the income range in the tax table that applies to the amount on line 1 of Form 505NR. Find the Maryland tax corresponding to your income range. Enter the tax amount from the tax table. If your taxable income on line 1 is $50,000 or more, use the Maryland Tax Computation Worksheet schedules at the end of the tax table.

Line 3. Enter your federal adjusted gross income (FAGI) from Form 505, line 17 (column 1).

Line 3a. If you are claiming a federal earned income credit (EIC), enter the earned income you used to calculate your federal EIC.

Earned income includes wages, salaries, tips, professional fees and other compensation received for personal services you performed. It also includes any amount received as a scholarship that you must include in your federal AGI.

Line 4. Enter the amount from Form 505, line 21.

Line 5. Taxable Military Income of a nonresident, if applicable.

Line 6a. Enter the amount of your subtractions from line 23 of Form 505.

Line 6b. Enter any non-Maryland income (not including losses reported on lines 1 through 14 of column 3, or adjustments to income reported on line 16 of column 3) from Form 505 (or 515), that have not been included on lines 5 or 6a of this form.

Important Note: Make sure that you follow the instruction for line 6b above to arrive at the correct amount. The non-Maryland losses and adjustments should have been reported on line 18 of Form 505 (or 515) and included on the amounts reported on line 4 of this form.

Be sure to include the following items if not already included on line 5 or 6a.

•Maryland salaries and wages should be included if you are a resident of a reciprocal state.

•Income subject to tax as a resident when required to file both Forms 502 and 505 should be included.

•Line 17 of column 3 on Form 505 (or 515) should also include income for wages earned in Maryland by a nonresident rendering police, fire, rescue or emergency services in an area covered under a state of emergency declared by the Maryland Governor, if the wages are paid by a nonprofit organization not registered to do business in the state and not otherwise doing business in the state, or by a state, county or political subdivision of a state, other than the State of Maryland.

PAGE 2

Line 7. Add lines 5 through 6b.

Line 8. Subtract line 7 from line 4. This is your Maryland Adjusted Gross Income.

Line 8a. If you are using the standard deduction amount, recalculate the standard deduction (line 8) based on the Maryland adjusted gross income.

Line 9. Compute your Maryland income factor by dividing line 8 by line 3. Carry the factor to six decimal places. The factor cannot exceed 1.000000 and cannot be less than 0. If line 8 is 0 or less, the factor is 0. If line 8 is greater than 0 and line 3 is 0 or less, the factor is 1.000000.

Line 10a. If you are using the standard deduction, multiply the standard deduction on line 8a by the Maryland Income Factor (line 9) and enter on line 10a.

Line 10b. If you are itemizing your deductions, multiply the deduction on Form 505 line 26d by the Maryland Income Factor (line 9) and enter on line 10b.

Line 11. If you are using the standard deduction, subtract line 10a from line 8. If you are using itemized deductions, subtract line 10b from line 8.

Line 12. Multiply the total exemption amount |

on |

Form |

|

505, line 28 by the factor on line 9. |

|

|

Line 13. Subtract line 12 from line 11. This |

is |

your |

|

Maryland taxable net income. |

|

|

Line 14. |

Enter the tax from line 2 of this form. |

|

|

Line 15. |

Divide the amount on line 13 of this form by the |

|

amount on line 1. Carry this Maryland nonresident |

|

factor to six decimal places. If more than |

|

1.000000, enter 1.000000. If 0 or less, enter 0. |

Line 16. |

Multiply line 14 by line 15 to arrive at your |

|

Maryland tax. Enter this amount on line 16 and |

|

on Form 505, line 32a. |

|

|

Line 17. |

Multiply line 13 by .0125. Enter this amount on |

|

line 17 and on Form 505, line 32b. If line 13 is |

|

0 or less, enter 0. |

|

|

On Form 505, add lines 32a and 32b and enter the total on line 32c.

Note: If you are using Form 505NR with Form 505, follow the instructions above. If you are using Form 505NR with

Form 515, please follow Instruction 18 in the Form 515 instructions.