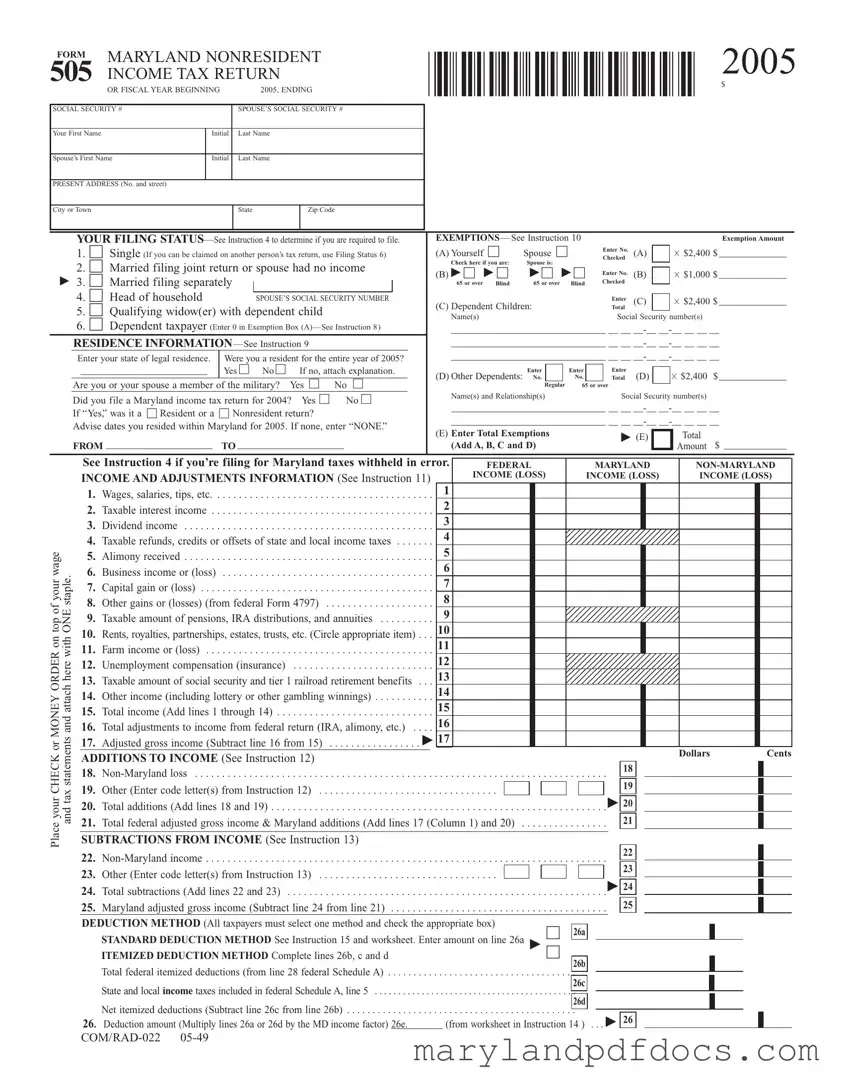

What is the Maryland 505 form?

The Maryland 505 form is a tax return specifically designed for nonresidents who earn income in Maryland. This form allows individuals to report their income, calculate taxes owed, and claim any exemptions or credits available to them. It is essential for ensuring compliance with Maryland tax laws for those who do not reside in the state but have taxable income sourced from it.

Who needs to file the Maryland 505 form?

Nonresidents who have earned income in Maryland must file the Maryland 505 form. This includes individuals who worked in Maryland, received income from Maryland-based businesses, or had other sources of income connected to the state. It’s important to determine your filing status and whether you meet the income thresholds requiring you to file.

What information do I need to complete the Maryland 505 form?

To complete the Maryland 505 form, you will need personal information such as your Social Security number, your spouse’s Social Security number (if applicable), and your current address. Additionally, gather details about your income, including wages, interest, dividends, and any other taxable income. You’ll also need to know about any exemptions you may qualify for and any Maryland taxes withheld from your income.

How do I determine my filing status on the Maryland 505 form?

Your filing status is determined based on your marital status and whether you can be claimed as a dependent on someone else's tax return. The form provides options for various statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Carefully review the instructions provided to ensure you select the correct status.

What are exemptions, and how do I claim them on the Maryland 505 form?

Exemptions reduce your taxable income and can lower your overall tax liability. On the Maryland 505 form, you can claim exemptions for yourself, your spouse, and any dependents. Each exemption has a specific dollar amount, which is indicated on the form. Be sure to check the instructions to understand how to calculate and enter your exemptions correctly.

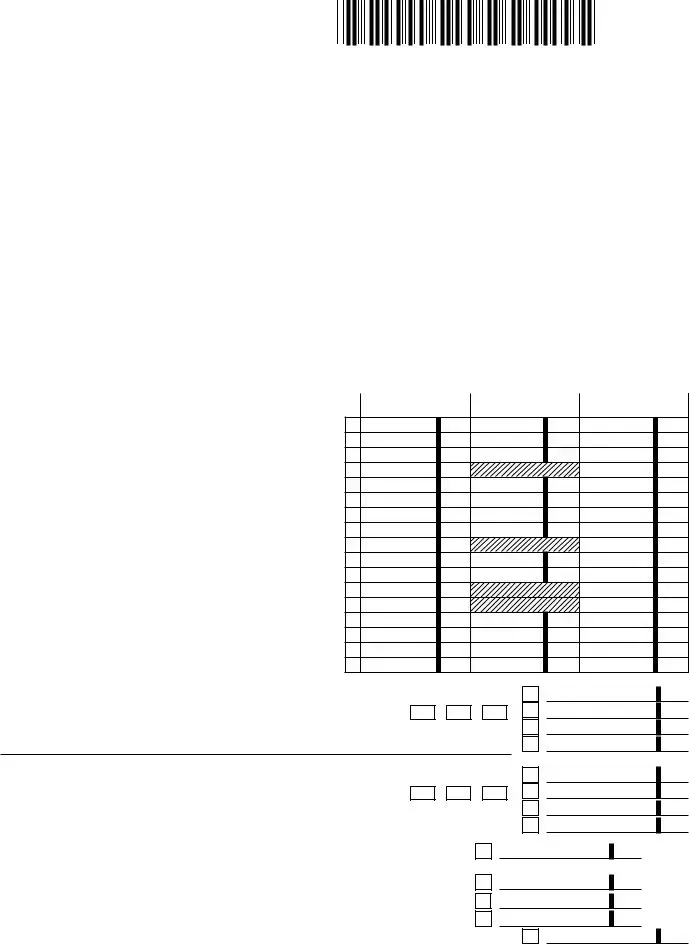

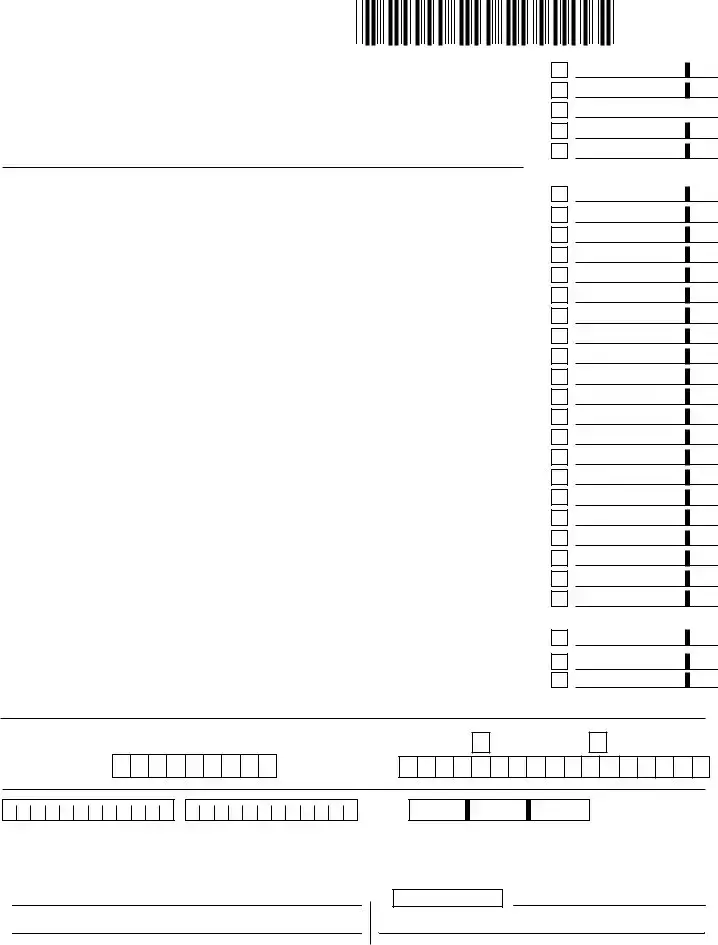

What should I do if I owe taxes or expect a refund?

If you owe taxes, the Maryland 505 form will guide you on how to calculate the amount due. You can make a payment online or send a check with your completed form. If you expect a refund, you can choose to have it directly deposited into your bank account by providing your account information on the form. Make sure to double-check all details to avoid delays in receiving your refund.

Where do I send my completed Maryland 505 form?

Your completed Maryland 505 form should be mailed to the Comptroller of Maryland, Revenue Administration Division, in Annapolis. The exact address is provided on the form. Ensure that you send it well before the tax deadline to avoid any penalties or interest for late filing.