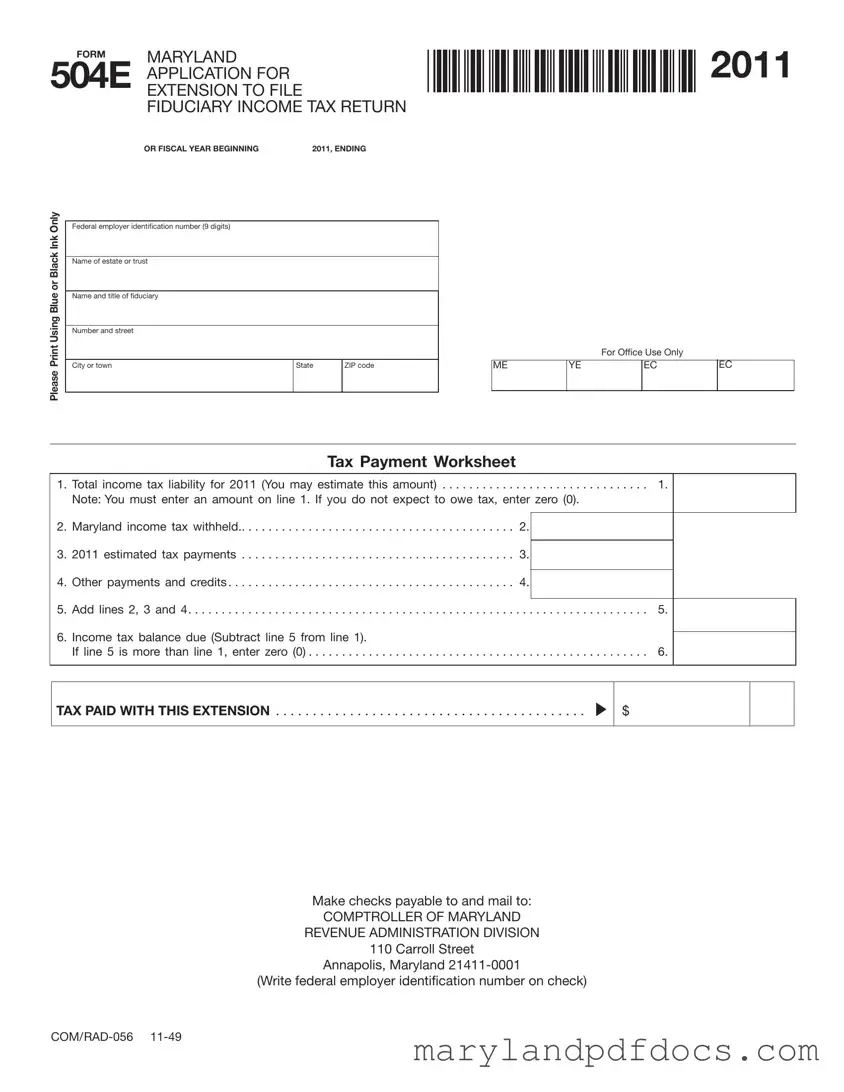

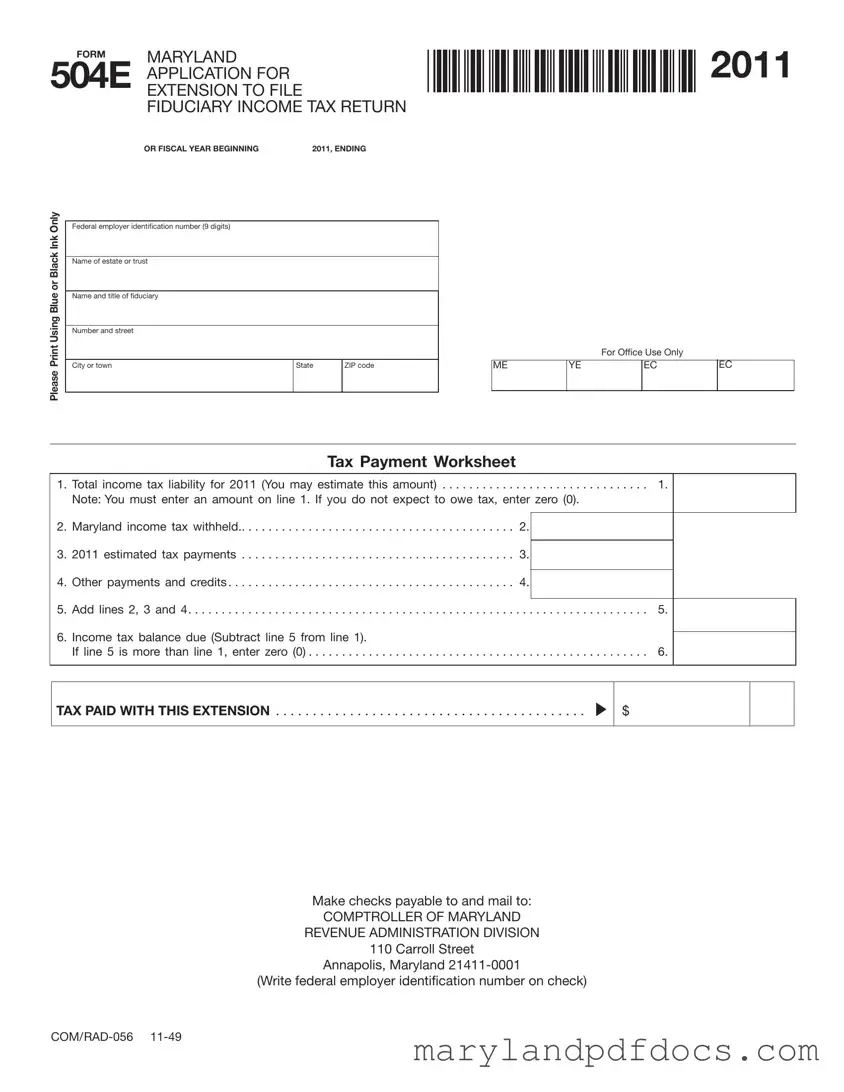

Fill Out Your Maryland 504E Template

The Maryland 504E form is an application that allows fiduciaries to request an automatic six-month extension to file their fiduciary income tax return. Completing this form correctly and submitting it by the due date is essential for securing the extension. To ensure compliance and avoid penalties, fiduciaries must also pay the estimated tax amount indicated on the form.

Ready to fill out the Maryland 504E form? Click the button below!

Launch Maryland 504E Editor

Fill Out Your Maryland 504E Template

Launch Maryland 504E Editor

Launch Maryland 504E Editor

or

Free Maryland 504E PDF

You’ve already started — finish it

Fill out Maryland 504E digitally in just minutes.