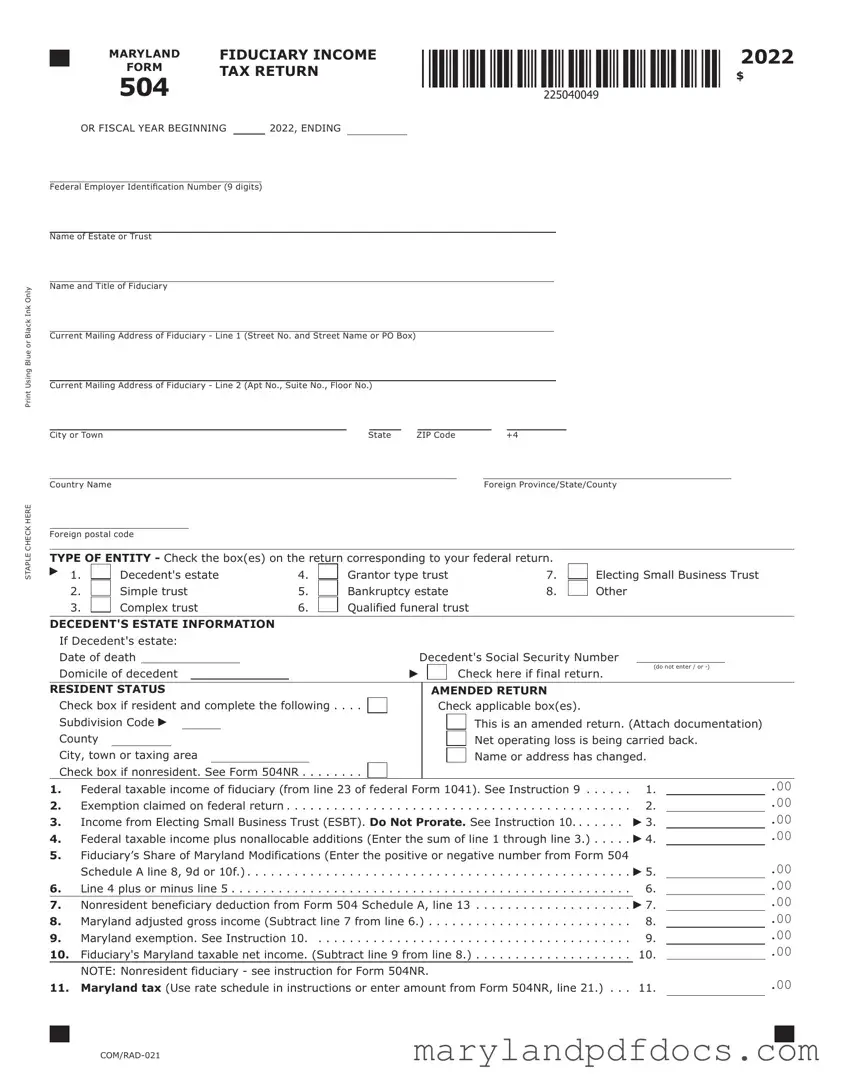

What is the Maryland 504 form?

The Maryland 504 form is a fiduciary income tax return used by estates and trusts in Maryland. It is essential for reporting the income earned by the estate or trust during a specific tax year. This form helps determine the taxable income and the tax liability for the fiduciary responsible for managing the estate or trust assets. It is important for ensuring compliance with state tax regulations.

Who needs to file the Maryland 504 form?

Fiduciaries of decedent estates, simple trusts, complex trusts, grantor-type trusts, bankruptcy estates, and qualified funeral trusts are required to file the Maryland 504 form. If the estate or trust has generated income during the tax year, the fiduciary must report this income using the form. Additionally, if the estate or trust is closing, a final return must be filed.

What information is required to complete the Maryland 504 form?

To complete the Maryland 504 form, you will need the federal employer identification number, the name and address of the estate or trust, and details about the fiduciary. For decedent estates, the date of death and the decedent's Social Security number are also necessary. Furthermore, you will need to provide information on income, deductions, and any modifications specific to Maryland tax regulations.

How do I determine if I need to file an amended Maryland 504 form?

If you discover errors or omissions after submitting the original Maryland 504 form, you should file an amended return. Indicate that it is an amended return by checking the appropriate box on the form. Ensure you include an explanation of the changes you are making and attach any required documentation, such as a copy of the amended federal Form 1041 if applicable.

What are Maryland modifications, and how do they affect the return?

Maryland modifications refer to specific adjustments that affect the taxable income of the estate or trust. These modifications may include additions, such as interest on state and local obligations, and subtractions, such as income from U.S. obligations. Understanding these modifications is crucial, as they directly impact the calculation of Maryland adjusted gross income and, ultimately, the tax owed.

What is the nonresident beneficiary deduction?

The nonresident beneficiary deduction applies when any beneficiaries of the estate or trust are not residents of Maryland. This deduction allows for the exclusion of income from intangible personal property accumulated for nonresident beneficiaries. To claim this deduction, you must complete the relevant section of the Maryland 504 form and attach Form 504 Schedule K-1 for each nonresident beneficiary.

How is the tax calculated on the Maryland 504 form?

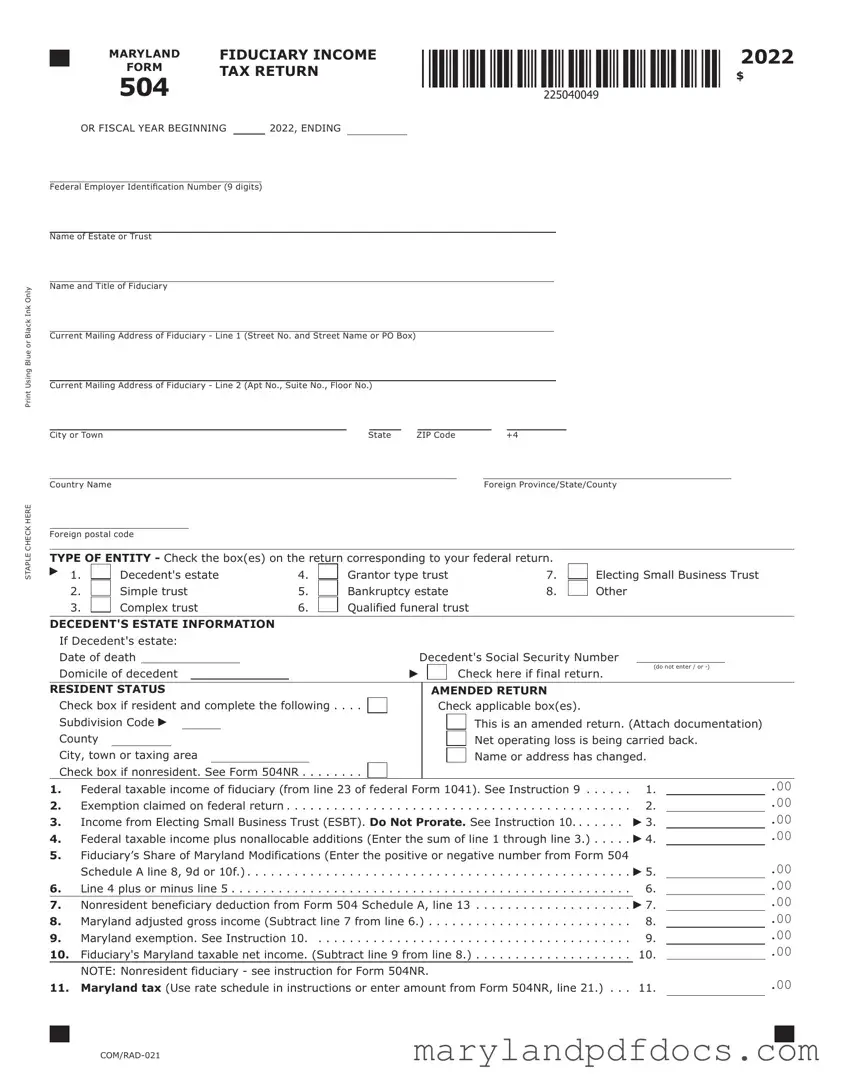

The tax calculation on the Maryland 504 form involves determining the Maryland taxable net income of the fiduciary. This is done by subtracting any claimed exemptions from the Maryland adjusted gross income. The resulting figure is then used to calculate the Maryland tax owed based on the applicable tax rate schedule. Local or special nonresident taxes may also apply, depending on the circumstances.

What should I do if I have an overpayment or balance due?

If your calculations show an overpayment, you can choose to have the amount refunded or applied to your estimated tax for the following year. Conversely, if you have a balance due, it is essential to pay this amount by the due date to avoid penalties and interest. The form provides clear lines for indicating overpayments and balances due, making it straightforward to manage your tax obligations.

15.

15. 28.

28. 29.

29.