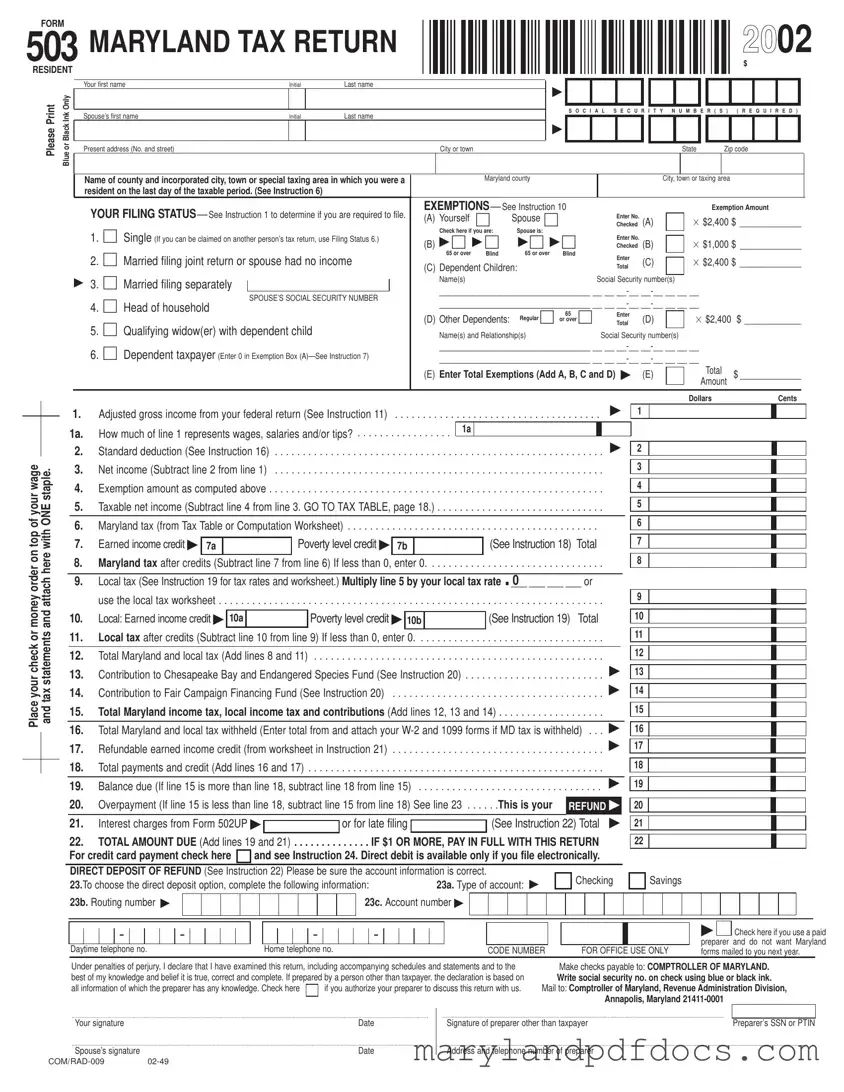

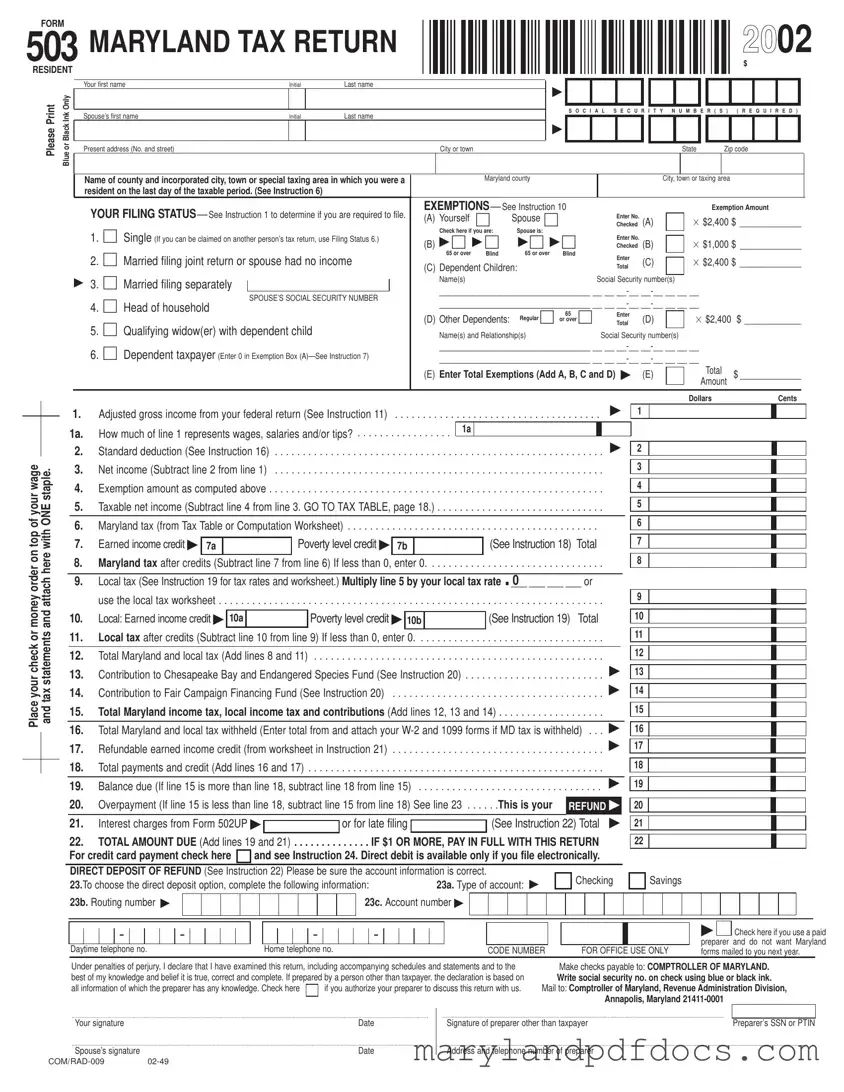

What is the Maryland 503 form?

The Maryland 503 form is a tax return specifically designed for residents of Maryland. It is a simplified version of the standard tax return, allowing eligible individuals to report their income and calculate their state tax liability. This form is typically used by those who do not have complex tax situations, such as additional income or deductions.

Who can use the Maryland 503 form?

You can use the Maryland 503 form if you meet specific criteria. Generally, it is intended for individuals who can answer "NO" to several questions regarding additional income, itemized deductions, or tax credits. If you do not have complex tax situations, this form may be suitable for you.

What information do I need to complete the Maryland 503 form?

To complete the Maryland 503 form, you will need personal information such as your name, address, and Social Security number. Additionally, you should have your federal tax return on hand, as you will need to report your adjusted gross income and calculate your exemptions and deductions based on that information.

What is the filing status section on the Maryland 503 form?

The filing status section allows you to indicate your marital status and how you will file your taxes. Options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Your filing status can affect your tax rate and the amount of exemptions you can claim.

How do I calculate exemptions on the Maryland 503 form?

Exemptions are calculated based on the number of dependents you have and your personal situation. For yourself and your spouse, you can claim a specific exemption amount. Additional exemptions may apply if you or your spouse are over 65 or blind. You will total these amounts to determine your total exemptions.

What should I do if I owe taxes after completing the Maryland 503 form?

If you find that you owe taxes after completing the form, you will need to pay the balance due. The form provides a section for you to calculate the total amount due. Make sure to pay by the due date to avoid any penalties or interest charges.

Can I e-file the Maryland 503 form?

Yes, you can e-file the Maryland 503 form. E-filing is often faster and more convenient. If you choose to e-file, ensure that you have all necessary information ready, including your bank account details if you want to set up direct deposit for any refund.

What if I made a mistake on my Maryland 503 form?

If you realize that you made a mistake after submitting your Maryland 503 form, you can file an amended return. This process allows you to correct errors and ensure that your tax records are accurate. Follow the specific instructions for amending your return as outlined by the Maryland Comptroller's office.

Where do I mail my completed Maryland 503 form?

Your completed Maryland 503 form should be mailed to the Comptroller of Maryland, Revenue Administration Division, in Annapolis. Ensure you check the address on the form for any updates or changes. If you're e-filing, follow the instructions provided by your e-filing service.

20

20