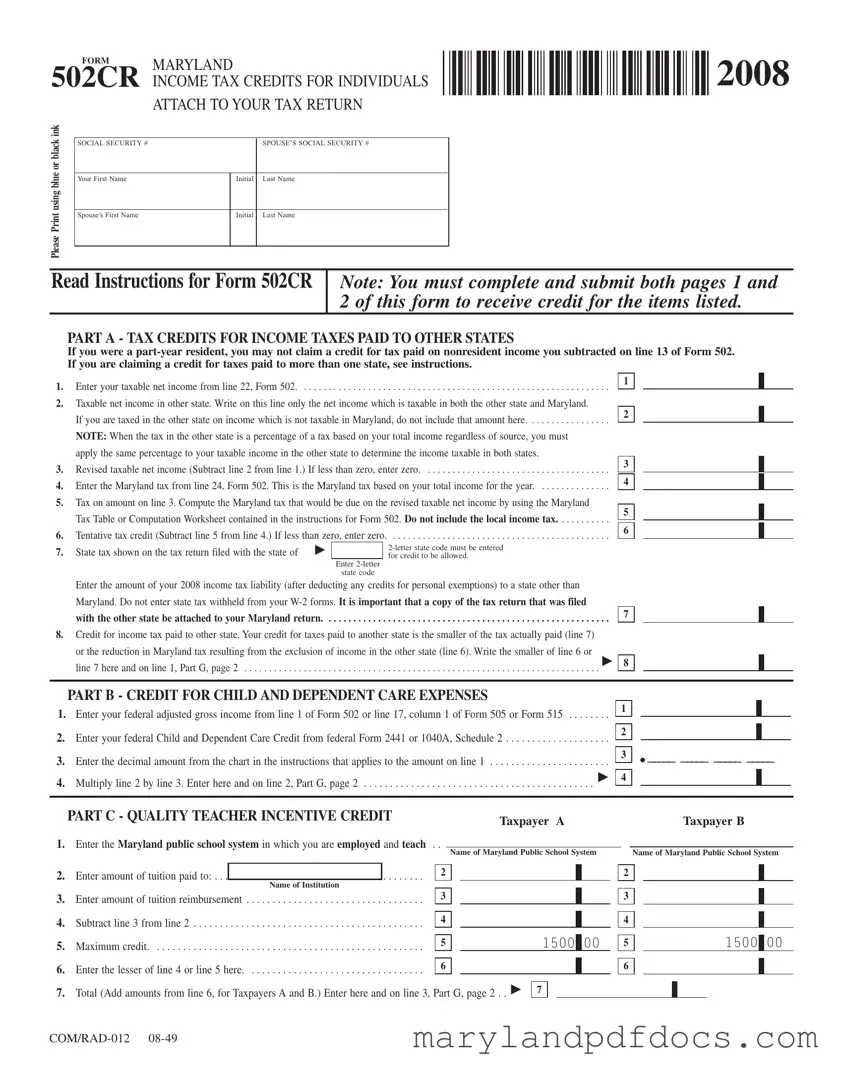

What is the purpose of the Maryland 502Cr form?

The Maryland 502Cr form is designed for individuals to claim various personal income tax credits. These credits may include those for income taxes paid to other states, child and dependent care expenses, tuition for teachers, long-term care insurance, and conservation easements, among others. By completing this form, taxpayers can potentially reduce their overall state tax liability.

Who is eligible to use the Maryland 502Cr form?

Eligibility for the Maryland 502Cr form primarily extends to Maryland residents who have incurred certain expenses or tax liabilities that qualify for credits. For example, individuals who paid income taxes to another state or incurred expenses for child care may qualify. Non-residents filing a Maryland tax return are generally not eligible for the credits listed on this form.

How do I claim a credit for income taxes paid to other states?

To claim a credit for income taxes paid to other states, complete Part A of the Maryland 502Cr form. You will need to report your taxable net income and the taxable net income in the other state. After calculating the tentative tax credit, ensure to attach a copy of the tax return filed with the other state. The credit is limited to the lesser of the tax paid to the other state or the reduction in Maryland tax resulting from excluding that income.

What documentation is required when filing the 502Cr form?

When submitting the Maryland 502Cr form, it is essential to attach any required documentation, such as copies of tax returns filed with other states for credits related to taxes paid. Additionally, documentation supporting claims for child and dependent care expenses, tuition payments for teachers, or long-term care insurance premiums may also be necessary. Failure to include the appropriate documentation may delay processing or result in the denial of the claimed credits.

Can I claim multiple credits on the Maryland 502Cr form?

Yes, taxpayers can claim multiple credits on the Maryland 502Cr form. Each credit has its own section within the form, allowing individuals to report various qualifying expenses or tax liabilities. However, it is crucial to ensure that each claim is supported by the necessary documentation and adheres to the specific eligibility criteria outlined in the instructions.

What is the maximum credit for child and dependent care expenses?

The credit for child and dependent care expenses starts at 32.5% of the federal credit allowed, but it phases out for individuals with federal adjusted gross incomes exceeding $41,000. For those married filing separately, the phase-out begins at $20,500. The credit is not available for individuals whose federal adjusted gross income exceeds $50,000.

How does the Quality Teacher Incentive Credit work?

The Quality Teacher Incentive Credit allows eligible Maryland teachers to claim a credit for tuition paid for graduate-level courses that are necessary for maintaining certification. To qualify, teachers must be employed by a Maryland public school, receive a satisfactory performance evaluation, and not be fully reimbursed by their employer for these expenses. The maximum credit allowed is $1,500 per qualifying individual.

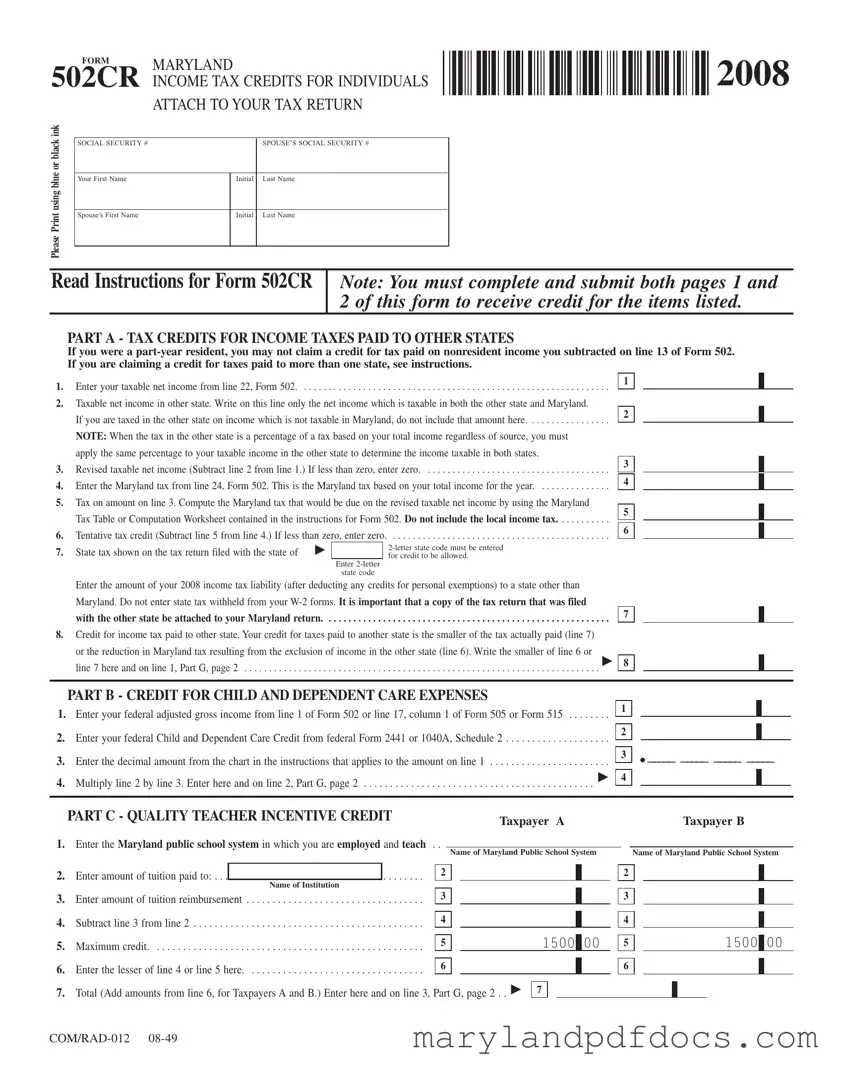

What is the Long-Term Care Insurance Credit?

The Long-Term Care Insurance Credit is a one-time credit available for individuals who pay qualified long-term care insurance premiums for themselves or certain family members. The maximum credit amount varies based on the age of the insured. For those aged 40 or younger, the maximum is $310, while for individuals over 40, it is $500. However, certain conditions must be met to qualify for this credit.

How do I submit the Maryland 502Cr form?

The Maryland 502Cr form must be attached to your annual income tax return, which can be Form 502, Form 505, or Form 515. Once completed, submit the entire package to the Comptroller of Maryland, Revenue Administration Division, in Annapolis. Ensure that all necessary documentation is included to avoid processing delays.

2008

2008