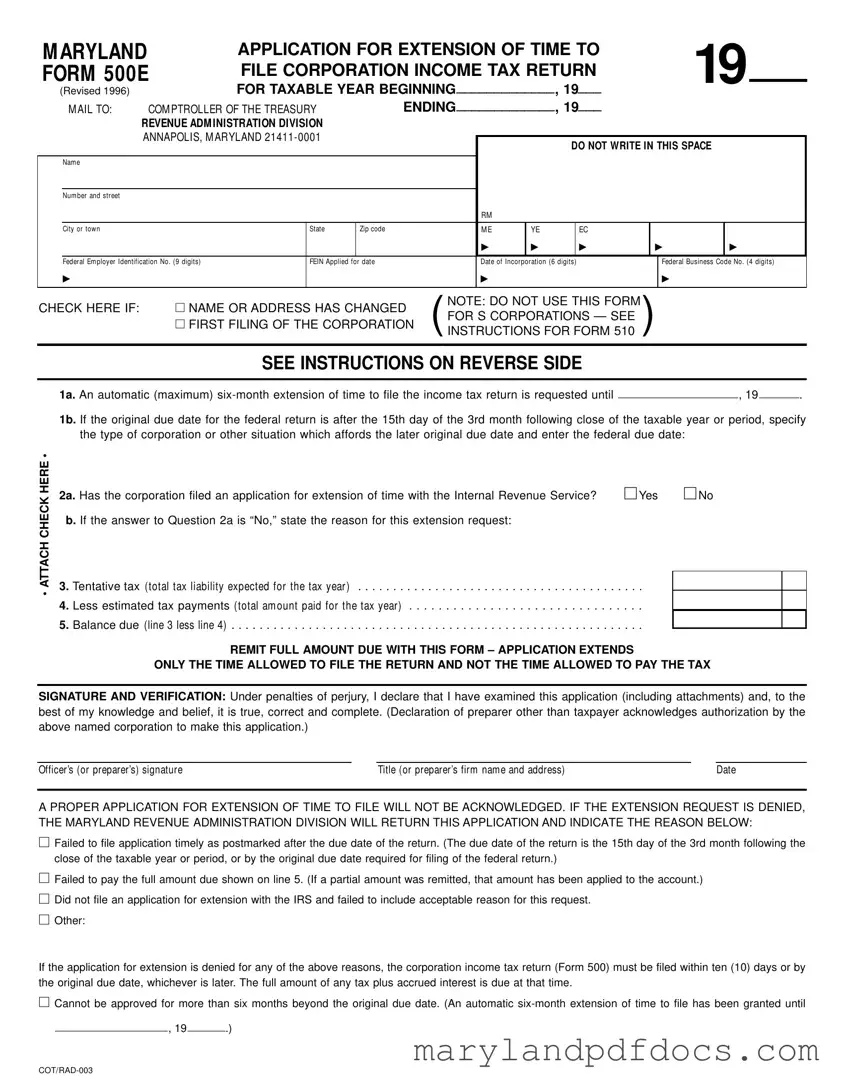

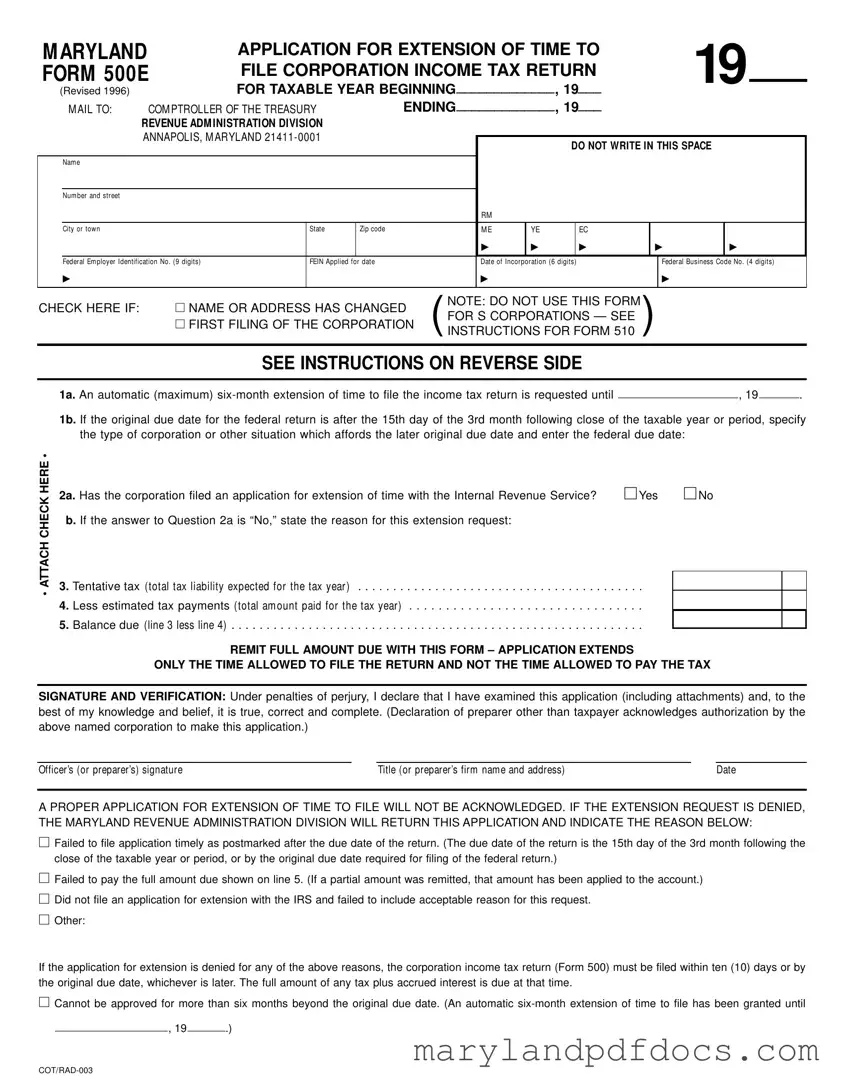

Fill Out Your Maryland 500E Template

The Maryland 500E form is an application used by corporations to request an extension of time to file their income tax return. This form allows businesses to extend their filing deadline by up to six months, provided certain conditions are met. For those needing additional time, filling out the Maryland 500E form can be a straightforward solution; just click the button below to get started!

Launch Maryland 500E Editor

Fill Out Your Maryland 500E Template

Launch Maryland 500E Editor

Launch Maryland 500E Editor

or

Free Maryland 500E PDF

You’ve already started — finish it

Fill out Maryland 500E digitally in just minutes.