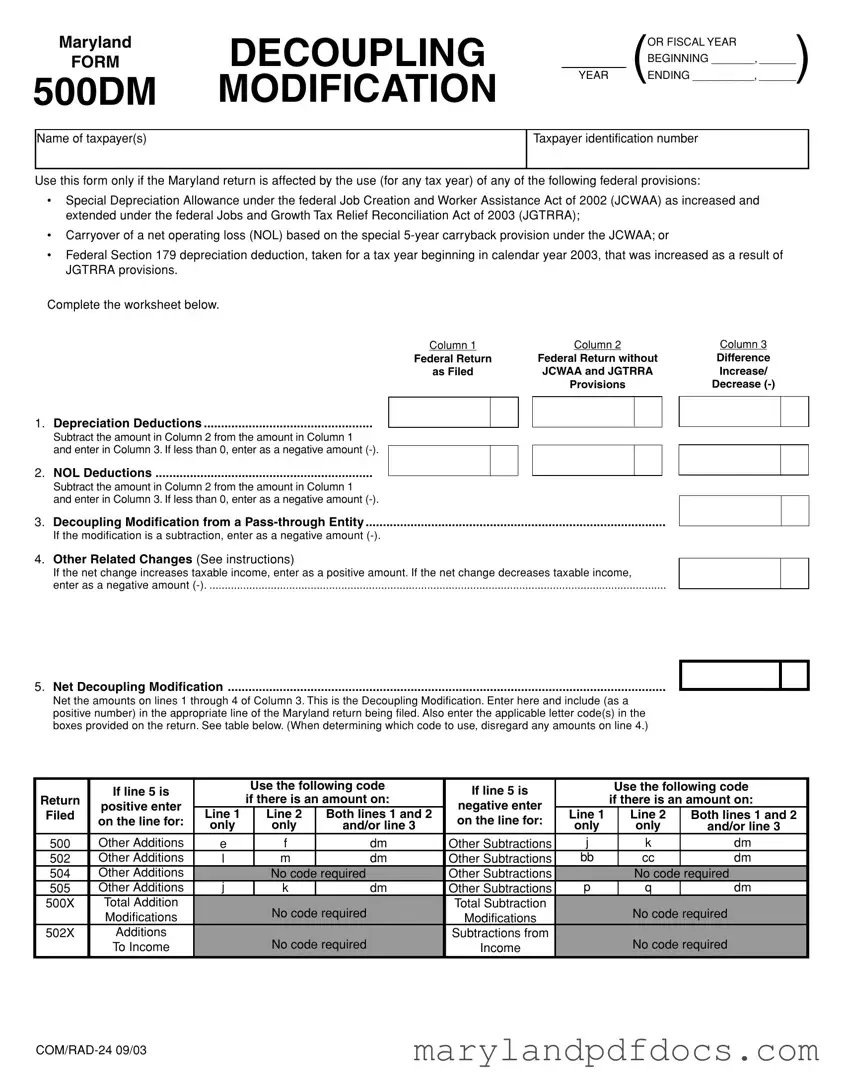

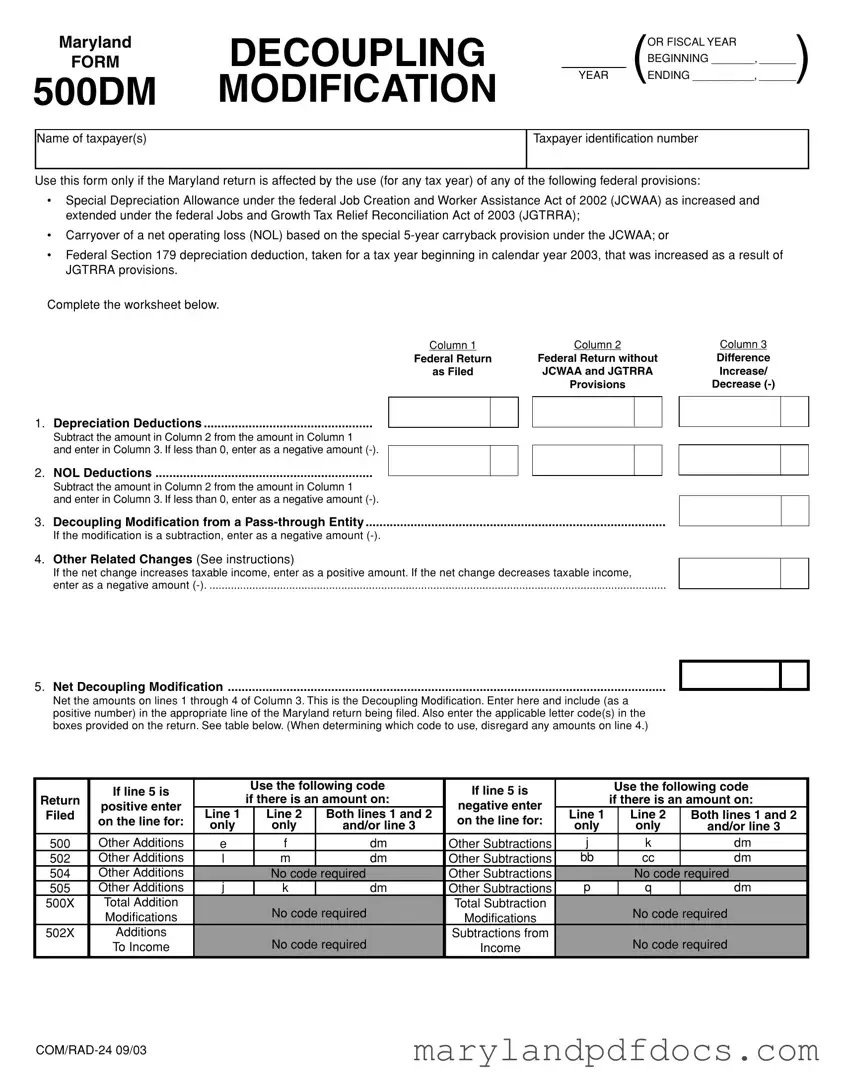

Use this form only if the Maryland return is affected by the use (for any tax year) of any of the following federal provisions:

•Special Depreciation Allowance under the federal Job Creation and Worker Assistance Act of 2002 (JCWAA) as increased and extended under the federal Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA);

•Carryover of a net operating loss (NOL) based on the special 5-year carryback provision under the JCWAA; or

•Federal Section 179 depreciation deduction, taken for a tax year beginning in calendar year 2003, that was increased as a result of JGTRRA provisions.

Complete the worksheet below.

Column 1 |

Column 2 |

Column 3 |

Federal Return |

Federal Return without |

Difference |

as Filed |

JCWAA and JGTRRA |

Increase/ |

|

Provisions |

Decrease (-) |

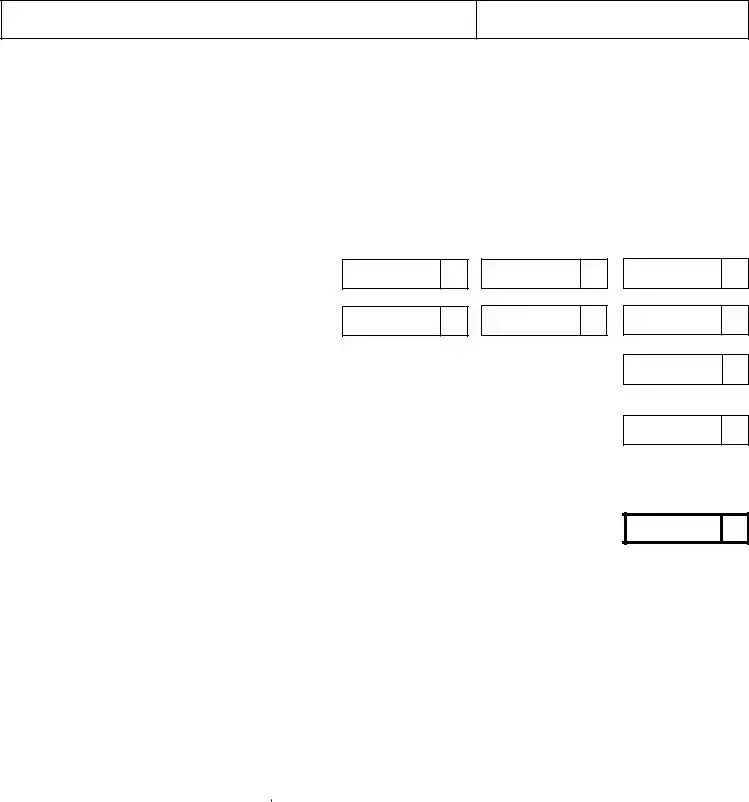

1. Depreciation Deductions .................................................

Subtract the amount in Column 2 from the amount in Column 1

and enter in Column 3. If less than 0, enter as a negative amount (-).

2.NOL Deductions ...............................................................

Subtract the amount in Column 2 from the amount in Column 1

and enter in Column 3. If less than 0, enter as a negative amount (-).

3.Decoupling Modification from a Pass-through Entity .......................................................................................

If the modification is a subtraction, enter as a negative amount (-).

4.Other Related Changes (See instructions)

If the net change increases taxable income, enter as a positive amount. If the net change decreases taxable income,

enter as a negative amount (-). .....................................................................................................................................................

5.Net Decoupling Modification ...............................................................................................................................

Net the amounts on lines 1 through 4 of Column 3. This is the Decoupling Modification. Enter here and include (as a positive number) in the appropriate line of the Maryland return being filed. Also enter the applicable letter code(s) in the boxes provided on the return. See table below. (When determining which code to use, disregard any amounts on line 4.)

|

If line 5 is |

|

Use the following code |

If line 5 is |

|

Use the following code |

Return |

|

if there is an amount on: |

|

if there is an amount on: |

positive enter |

|

negative enter |

|

Filed |

Line 1 |

|

Line 2 |

Both lines 1 and 2 |

Line 1 |

|

Line 2 |

Both lines 1 and 2 |

on the line for: |

|

on the line for: |

|

|

only |

|

only |

and/or line 3 |

only |

|

only |

and/or line 3 |

|

|

|

|

|

500 |

Other Additions |

e |

|

f |

dm |

Other Subtractions |

j |

|

k |

dm |

502 |

Other Additions |

l |

|

m |

dm |

Other Subtractions |

bb |

|

cc |

dm |

504 |

Other Additions |

|

|

No code required |

Other Subtractions |

|

|

No code required |

505 |

Other Additions |

j |

|

k |

dm |

Other Subtractions |

p |

|

q |

dm |

500X |

Total Addition |

|

|

No code required |

Total Subtraction |

|

|

No code required |

|

Modifications |

|

|

Modifications |

|

|

502X |

Additions |

|

|

No code required |

Subtractions from |

|

|

No code required |

|

To Income |

|

|

Income |

|

|