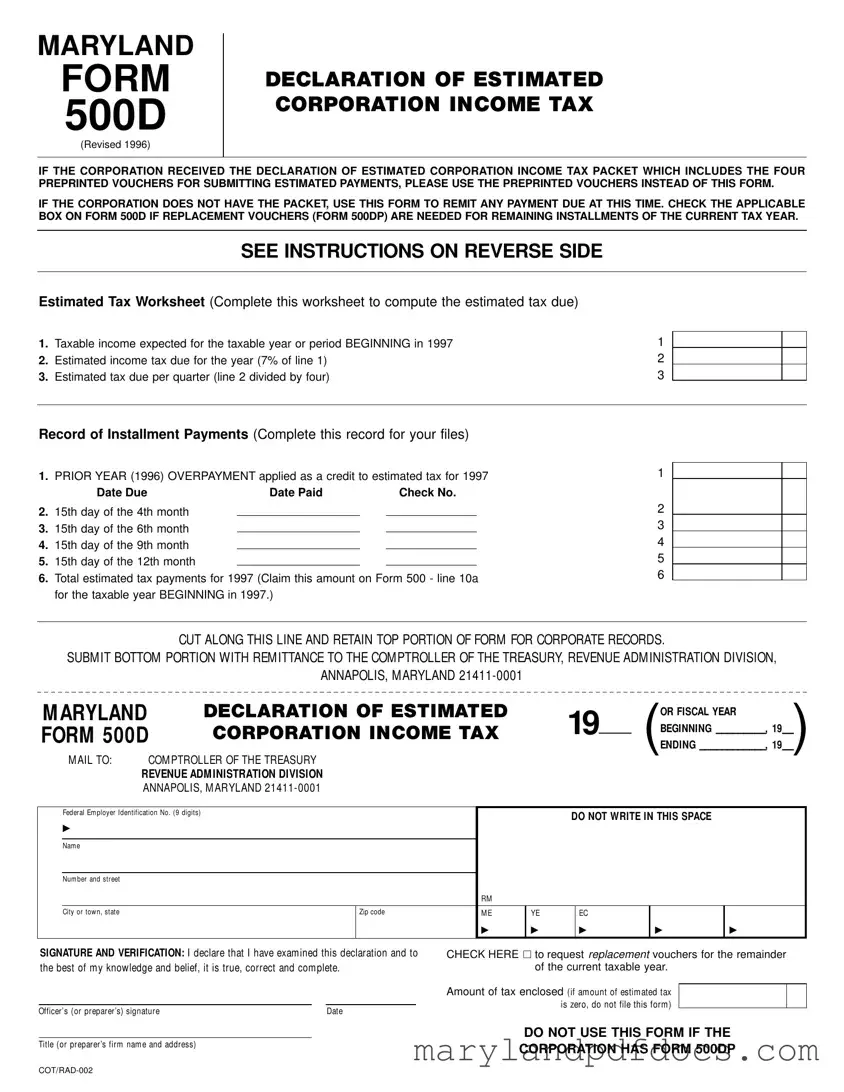

What is the purpose of the Maryland Form 500D?

The Maryland Form 500D is used by corporations to declare and remit estimated income tax when they do not have access to the preprinted Form 500DP. This form is essential for corporations that expect to owe more than $1,000 in tax for the taxable year. It allows them to make estimated payments based on their expected taxable income.

Who needs to file the Maryland Form 500D?

Any corporation with Maryland taxable income that anticipates owing more than $1,000 in taxes for the taxable year must file Form 500D. This requirement applies to corporations expecting to meet the estimated tax thresholds and is not applicable to pass-through entities such as S corporations.

When is the Maryland Form 500D due?

Form 500D must be filed on or before the 15th day of the 4th, 6th, 9th, and 12th months following the beginning of the taxable year. Timely filing is crucial to avoid penalties and interest on unpaid taxes.

How is the estimated tax calculated on Form 500D?

To calculate the estimated tax, corporations should complete the Estimated Tax Worksheet included with the form. They need to determine their expected taxable income for the year, calculate 7% of that amount, and then divide the total by four to find the quarterly estimated tax due.

What should a corporation do if it needs replacement vouchers?

If a corporation requires replacement vouchers for the remaining installments of the current tax year, it should check the designated box on Form 500D. This request will ensure that the corporation receives the necessary vouchers to continue making its estimated payments.

Can a corporation apply prior year overpayments to the current year’s estimated tax?

Yes, a corporation can apply any overpayment from the prior year’s Form 500 to its estimated tax obligation for the current year. This can help reduce the amount that needs to be paid with Form 500D.

What information is required on Form 500D?

Form 500D requires several pieces of information, including the corporation's name, address, Federal Employer Identification Number (FEIN), taxable year dates, and the amount of tax enclosed. Accurate and complete information is essential for proper processing.

How should payments be made when submitting Form 500D?

Payments should be made via check or money order, payable to the Comptroller of the Treasury. It is important to include the FEIN, type of tax, and the applicable tax year dates on the payment. Cash should never be sent with the form.

Where should Form 500D be mailed?

Form 500D should be mailed to the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland 21411-0001. Using the envelope provided in the tax booklet can help ensure proper delivery.