What is the Maryland 4B form?

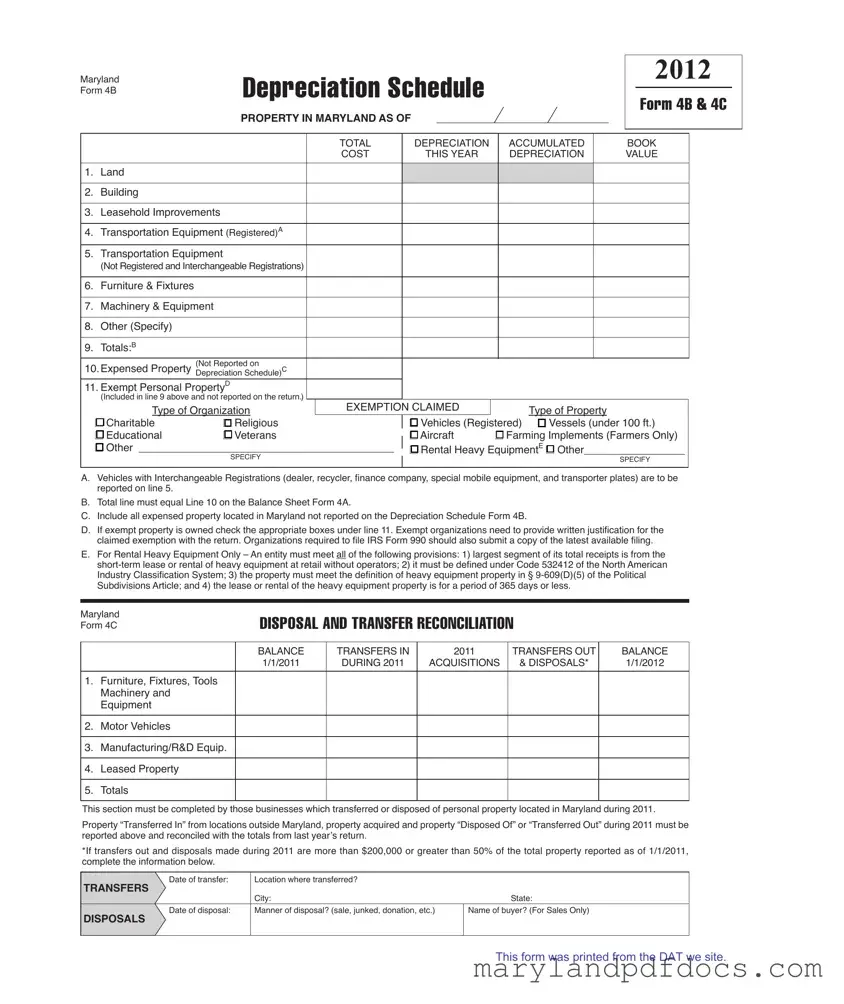

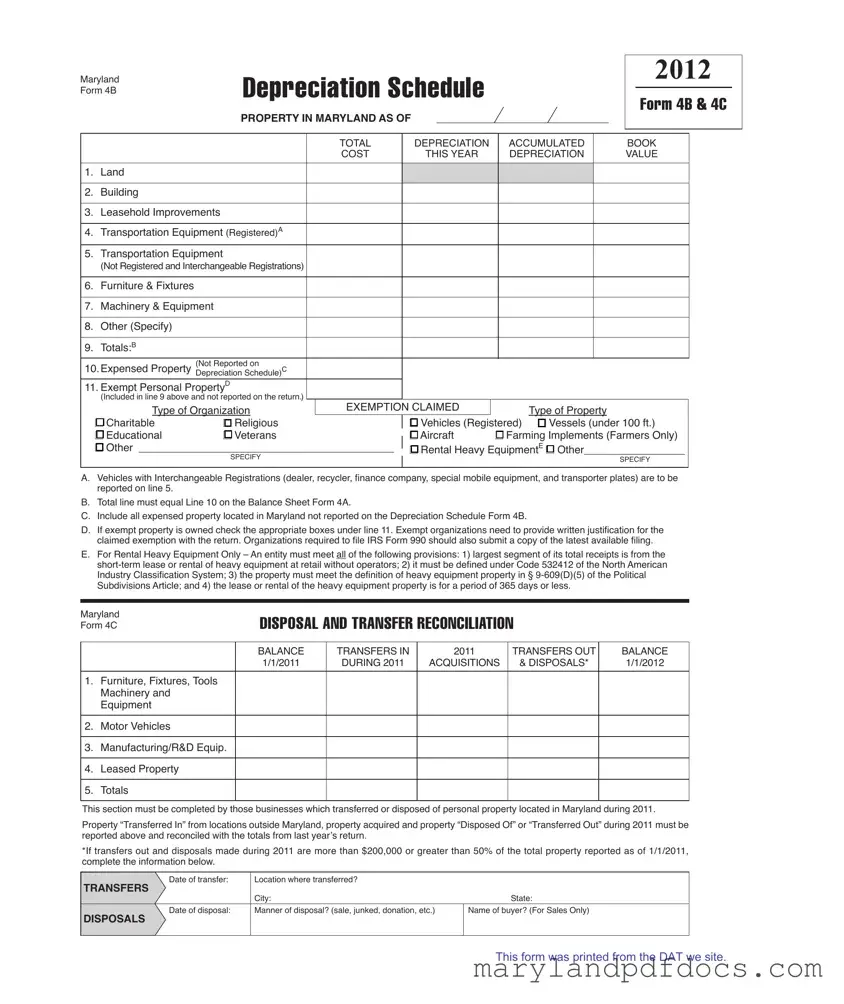

The Maryland 4B form is a Depreciation Schedule used by businesses to report the depreciation of personal property located in Maryland. It is essential for determining the taxable value of property and must be completed accurately to comply with state regulations.

Who needs to file the Maryland 4B form?

Any business or organization that owns personal property in Maryland and is subject to property tax must file the Maryland 4B form. This includes entities that own land, buildings, machinery, and equipment, among other types of property.

What types of property should be reported on the Maryland 4B form?

The form requires reporting various categories of property, including land, buildings, leasehold improvements, transportation equipment, furniture and fixtures, machinery and equipment, and any other specified property. Each category must be listed with its corresponding book cost and accumulated depreciation.

What is the purpose of the depreciation schedule?

The depreciation schedule serves to calculate the reduction in value of the reported assets over time. This information is crucial for determining the taxable value of the property and ensuring compliance with Maryland tax laws.

How is the total depreciation calculated on the form?

Total depreciation is calculated by summing the accumulated depreciation for each category of property reported on the Maryland 4B form. This total should match the corresponding line on the Balance Sheet Form 4A, ensuring consistency in financial reporting.

What exemptions are available on the Maryland 4B form?

Exemptions may be claimed for certain types of property, such as vehicles, vessels under 100 feet, and property owned by charitable, religious, or educational organizations. To claim an exemption, the appropriate boxes must be checked, and written justification must be provided with the return.

What is the significance of the expensed property section?

The expensed property section allows businesses to report property that has been expensed but not included in the depreciation schedule. This ensures that all property located in Maryland is accounted for, even if it does not qualify for depreciation.

What are the requirements for reporting rental heavy equipment?

To report rental heavy equipment, the business must derive the majority of its receipts from short-term leases of heavy equipment without operators. Additionally, the property must meet specific definitions outlined in the Maryland tax code, and the lease period must be 365 days or less.

What should businesses do if they transferred or disposed of property during the year?

Businesses that transferred or disposed of personal property during the year must complete the disposal and transfer reconciliation section of the Maryland 4B form. This includes reporting property transferred in, acquired, disposed of, or transferred out, along with relevant details such as dates and methods of disposal.

Where can businesses find more information about the Maryland 4B form?

Additional information about the Maryland 4B form, including instructions and guidelines for completion, can be found on the Maryland State Department of Assessments and Taxation website. It is advisable for businesses to consult this resource to ensure compliance with all filing requirements.