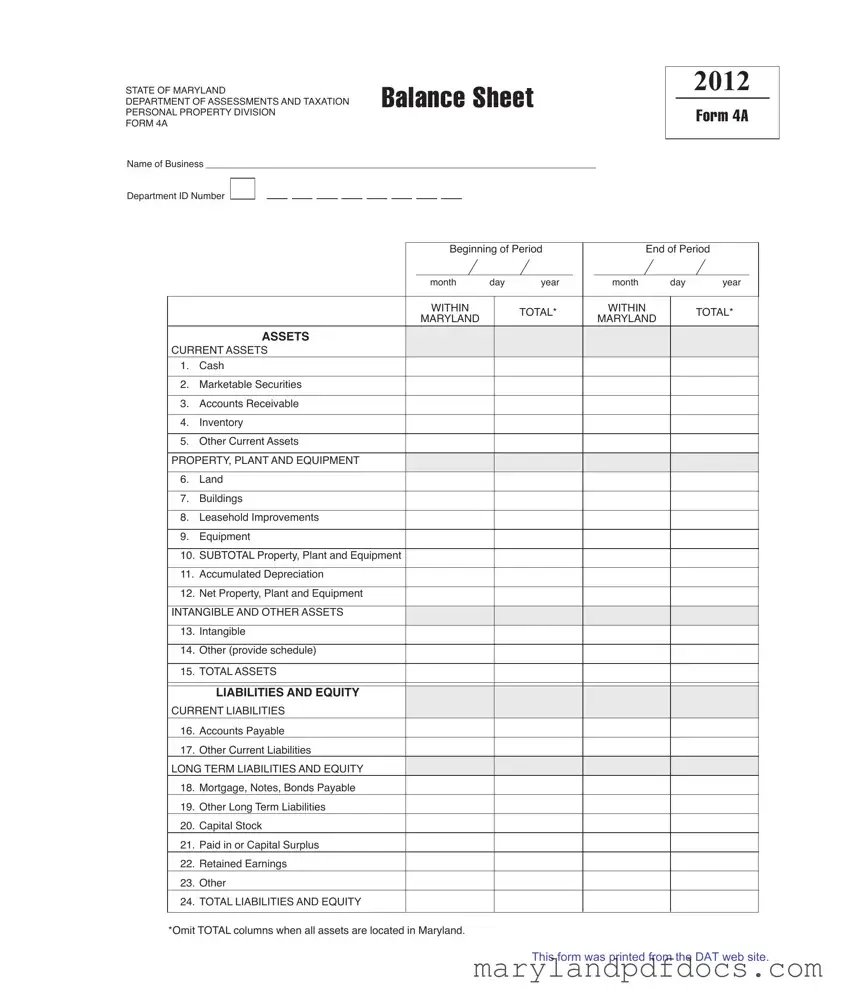

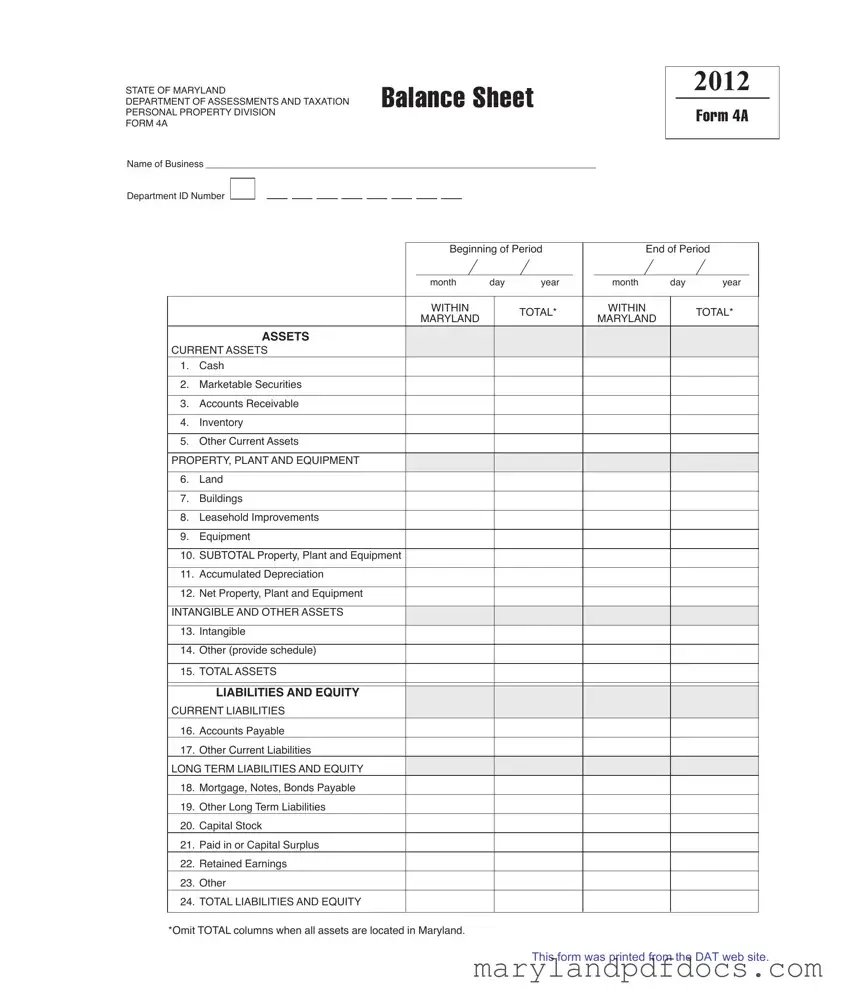

Fill Out Your Maryland 4A Template

The Maryland 4A form is a financial document used by businesses to report their balance sheet information to the Department of Assessments and Taxation. It details assets, liabilities, and equity, providing a snapshot of a business's financial position at a specific point in time. Completing this form accurately is essential for compliance with state regulations; fill it out by clicking the button below.

Launch Maryland 4A Editor

Fill Out Your Maryland 4A Template

Launch Maryland 4A Editor

Launch Maryland 4A Editor

or

Free Maryland 4A PDF

You’ve already started — finish it

Fill out Maryland 4A digitally in just minutes.