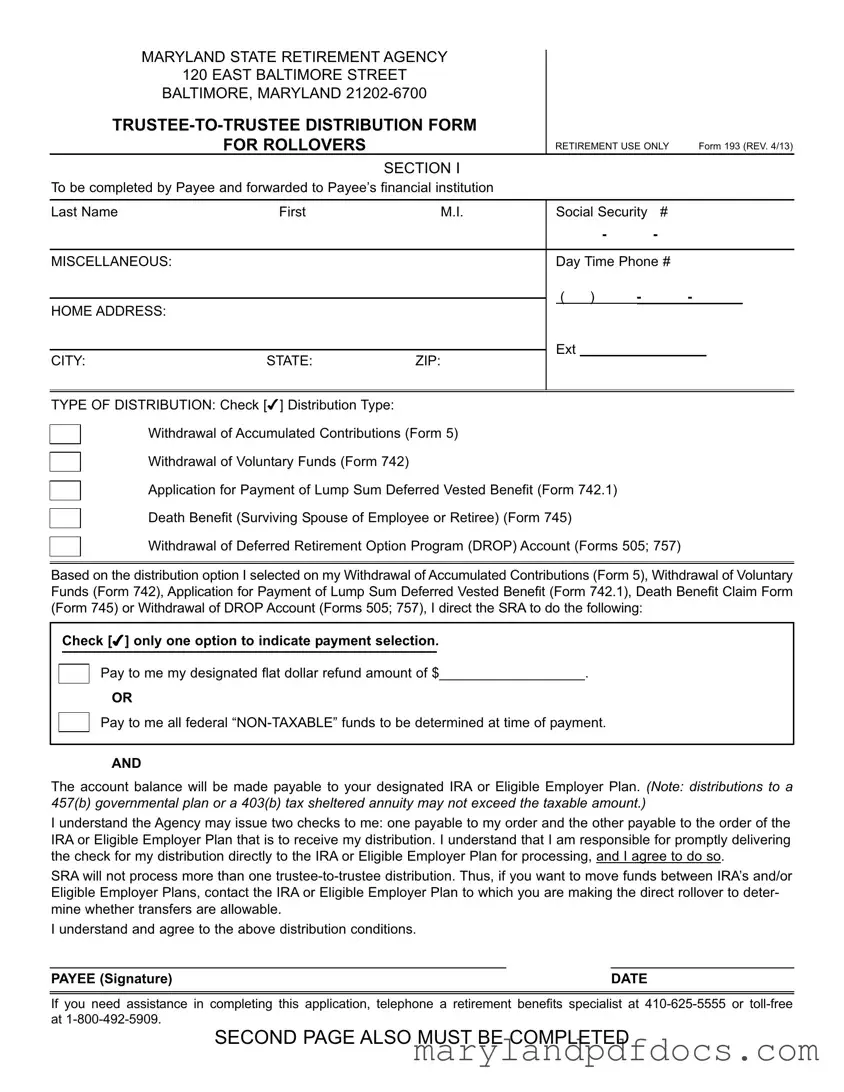

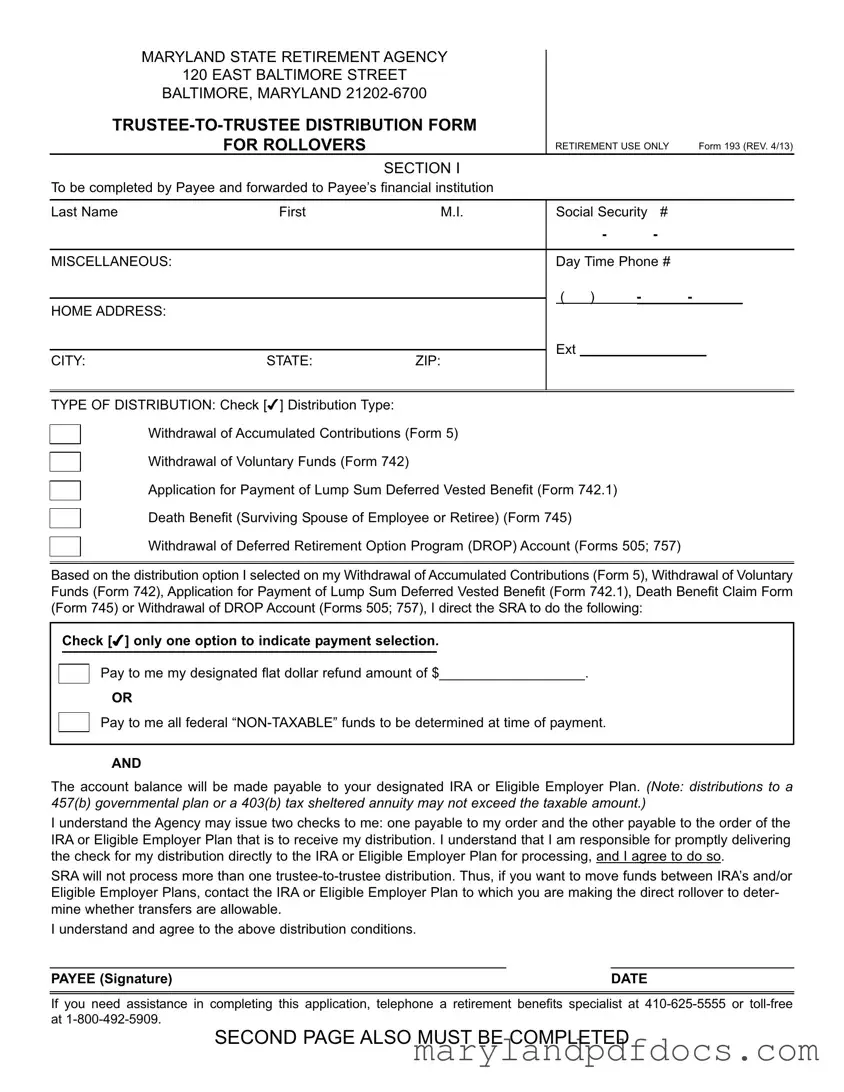

What is the Maryland 193 Form?

The Maryland 193 Form is a Trustee-to-Trustee Distribution Form specifically designed for rollovers related to retirement accounts. This form is utilized when an individual wishes to transfer funds from a retirement account to an Individual Retirement Account (IRA) or an Eligible Employer Plan without incurring taxes on the distribution. It ensures that the funds are moved directly from one financial institution to another, maintaining their tax-deferred status.

Who should complete the Maryland 193 Form?

The form should be completed by the payee, who is the individual receiving the funds from their retirement account. This includes retirees, employees who have left their jobs, or beneficiaries of deceased members. It is essential that the payee provides accurate personal information and details regarding the distribution type to ensure a smooth transaction.

What types of distributions can be requested using this form?

The Maryland 193 Form allows for several types of distributions. These include withdrawals of accumulated contributions, voluntary funds, lump-sum deferred vested benefits, death benefits for surviving spouses, and withdrawals from the Deferred Retirement Option Program (DROP) account. The payee must select the appropriate distribution type when completing the form.

What information is required on the Maryland 193 Form?

When filling out the Maryland 193 Form, the payee must provide their name, Social Security number, daytime phone number, home address, and the type of distribution being requested. Additionally, the payee must indicate their payment selection, whether they want a flat dollar refund or all federal non-taxable funds. Accurate information is crucial to avoid delays in processing the request.

How does the payment process work after submitting the form?

Once the Maryland 193 Form is completed and submitted, the State Retirement Agency will issue two checks if necessary. One check will be payable to the payee, and the other will be made out to the designated IRA or Eligible Employer Plan. The payee is responsible for delivering the check intended for the financial institution to ensure it is processed correctly.

Can I use the Maryland 193 Form to transfer funds between different IRAs?

No, the Maryland 193 Form only allows for one trustee-to-trustee distribution at a time. If you wish to transfer funds between different IRAs or Eligible Employer Plans, you must first contact the receiving institution to confirm that such transfers are permitted. This step is vital to ensure compliance with regulations and to avoid potential tax implications.

What should I do if I need help completing the Maryland 193 Form?

If you encounter difficulties while filling out the Maryland 193 Form, assistance is available. You can contact a retirement benefits specialist at the State Retirement Agency by calling 410-625-5555 or toll-free at 1-800-492-5909. They can provide guidance and answer any questions you may have about the form or the rollover process.

Pay to me my designated flat dollar refund amount of $___________________.

Pay to me my designated flat dollar refund amount of $___________________.

Pay to me all federal

Pay to me all federal