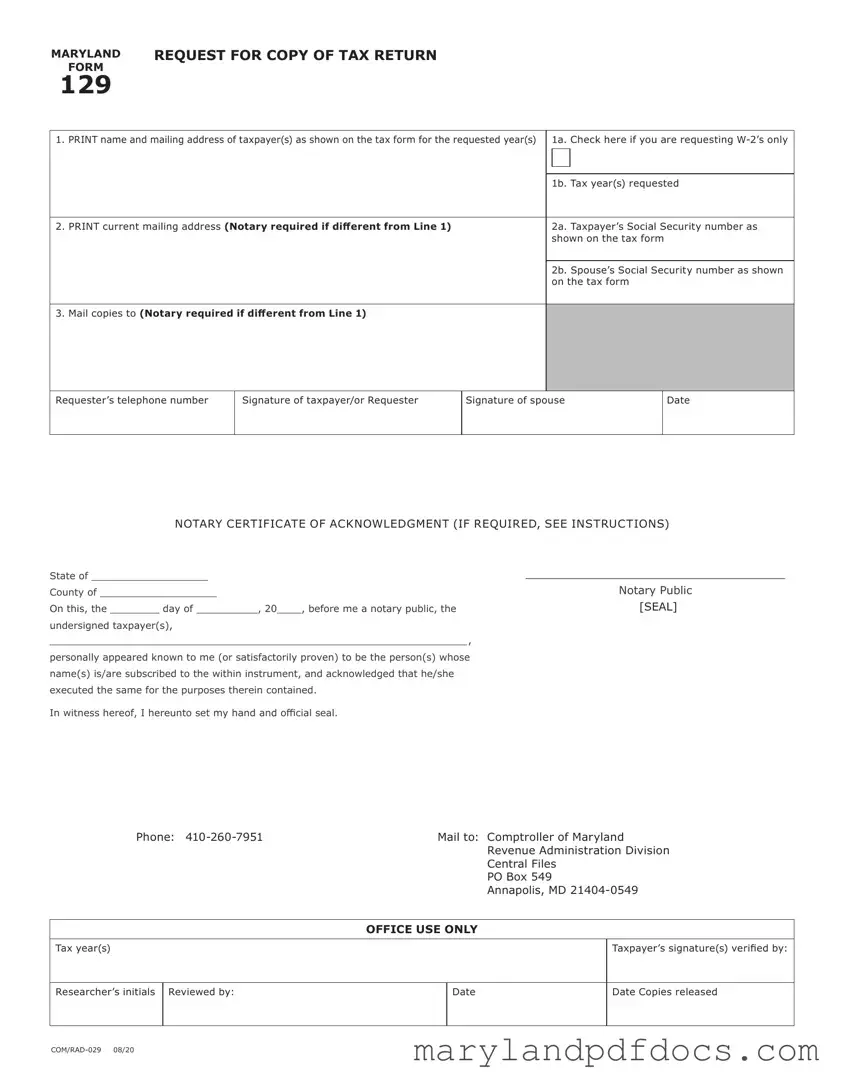

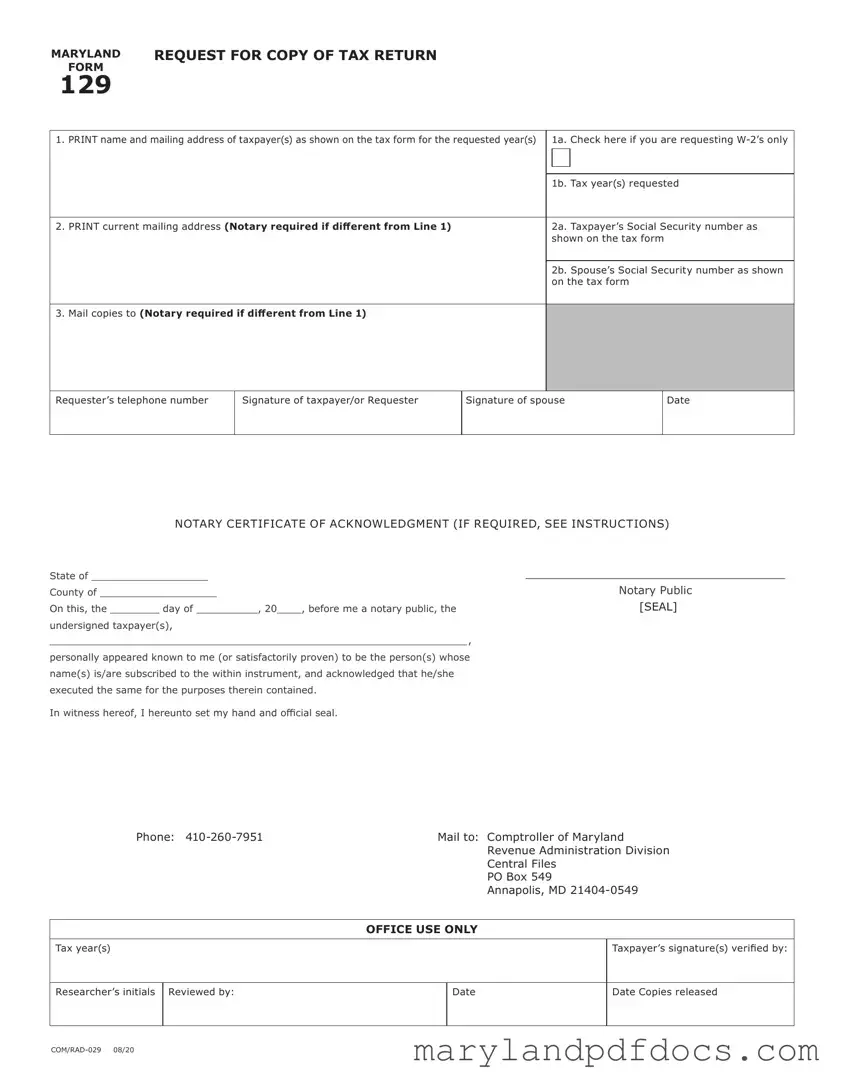

What is the purpose of the Maryland 129 form?

The Maryland 129 form is used to request a copy of a Maryland tax return or W-2 forms as originally filed with the Comptroller of Maryland. This form allows individuals to obtain their tax documents for various purposes, such as applying for loans or verifying income.

Who needs to fill out the Maryland 129 form?

Any taxpayer who wishes to obtain a copy of their Maryland tax return or W-2 forms must complete the Maryland 129 form. This includes individuals who filed as single, married, or joint filers. If you are a personal representative of a deceased taxpayer, you can also fill out this form on their behalf.

How do I submit the Maryland 129 form?

You can submit the Maryland 129 form in two ways: in person or by mail. If you choose to go in person, bring valid photo identification to any office of the Comptroller of Maryland. If you prefer to mail the form, ensure it is signed and notarized, and send it to the address provided on the form.

Is notarization required for the Maryland 129 form?

Notarization is required if the current mailing address (Line 2) is different from the taxpayer’s address (Line 1). If both addresses are the same, you can skip the notarization process. This requirement helps ensure the security and confidentiality of your tax information.

What information do I need to provide on the form?

When filling out the Maryland 129 form, you will need to provide your name, mailing address, Social Security number, and the tax year(s) you are requesting. If you are requesting W-2 forms, you should also include the employer's name and identification number, if known. Make sure to complete all required fields to avoid delays in processing your request.

Can I request tax documents for someone else?

You can request tax documents for someone else if you have been granted authority through a valid Maryland Power of Attorney (Form 548). In such cases, you must include a copy of this form with your Maryland 129 request. If the taxpayer is deceased, a personal representative can sign the form, but must include a letter of administration.

How long does it take to receive the requested documents?

The processing time for the Maryland 129 form can vary. If submitted in person, you may receive your documents on the same day, depending on the office's workload. If mailed, it may take several weeks for the request to be processed and for you to receive your documents via U.S. Postal Service.

Where do I send the completed Maryland 129 form?

You should mail your completed Maryland 129 form to the Comptroller of Maryland, Revenue Administration Division, Central Files, at the address provided in the instructions. You can also submit it in person at any of the branch offices listed in the form.

What if I have more questions about the Maryland 129 form?

If you have additional questions or need special assistance, you can visit the Maryland taxes website or call the provided phone numbers for help. The staff is available to guide you through the process and answer any concerns you may have.