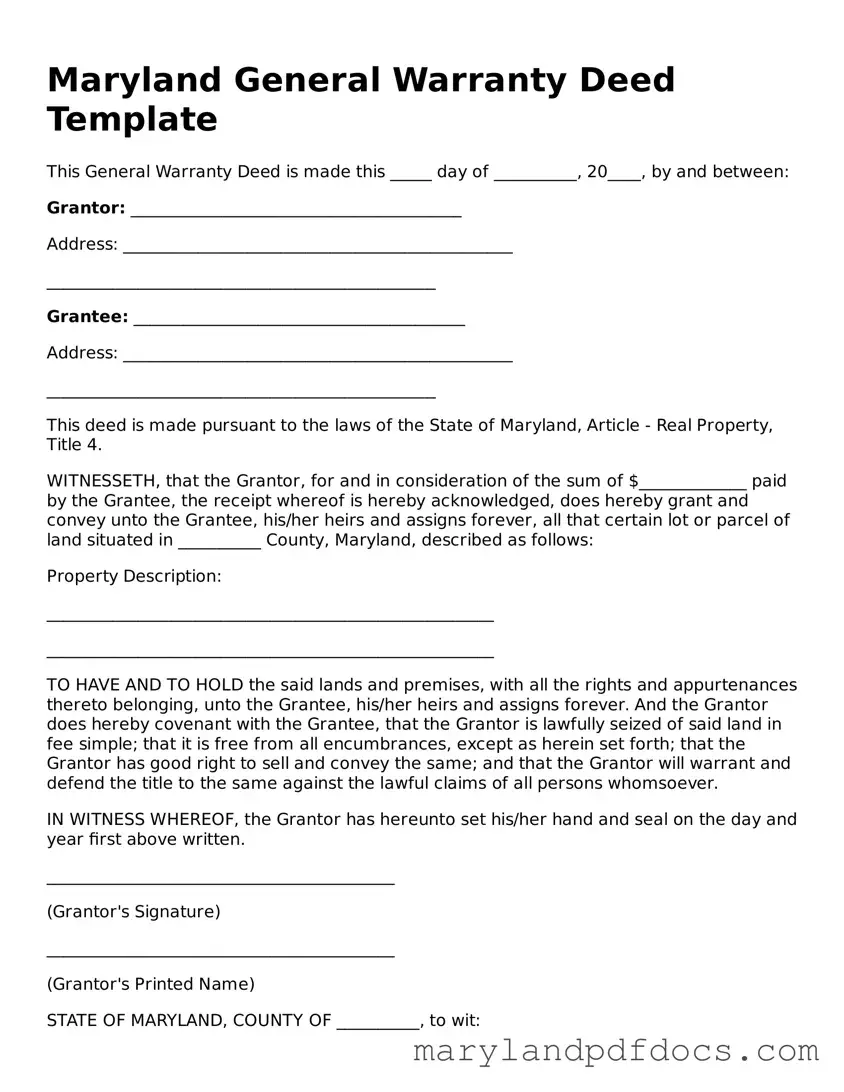

Maryland General Warranty Deed Template

This General Warranty Deed is made this _____ day of __________, 20____, by and between:

Grantor: ________________________________________

Address: _______________________________________________

_______________________________________________

Grantee: ________________________________________

Address: _______________________________________________

_______________________________________________

This deed is made pursuant to the laws of the State of Maryland, Article - Real Property, Title 4.

WITNESSETH, that the Grantor, for and in consideration of the sum of $_____________ paid by the Grantee, the receipt whereof is hereby acknowledged, does hereby grant and convey unto the Grantee, his/her heirs and assigns forever, all that certain lot or parcel of land situated in __________ County, Maryland, described as follows:

Property Description:

______________________________________________________

______________________________________________________

TO HAVE AND TO HOLD the said lands and premises, with all the rights and appurtenances thereto belonging, unto the Grantee, his/her heirs and assigns forever. And the Grantor does hereby covenant with the Grantee, that the Grantor is lawfully seized of said land in fee simple; that it is free from all encumbrances, except as herein set forth; that the Grantor has good right to sell and convey the same; and that the Grantor will warrant and defend the title to the same against the lawful claims of all persons whomsoever.

IN WITNESS WHEREOF, the Grantor has hereunto set his/her hand and seal on the day and year first above written.

__________________________________________

(Grantor's Signature)

__________________________________________

(Grantor's Printed Name)

STATE OF MARYLAND, COUNTY OF __________, to wit:

I HEREBY CERTIFY that on this _____ day of __________, 20____, before me, a Notary Public in and for the State and County aforesaid, personally appeared _____________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

WITNESS my hand and notarial seal.

_______________________________________

(Notary Public's Signature)

My Commission Expires: _____________