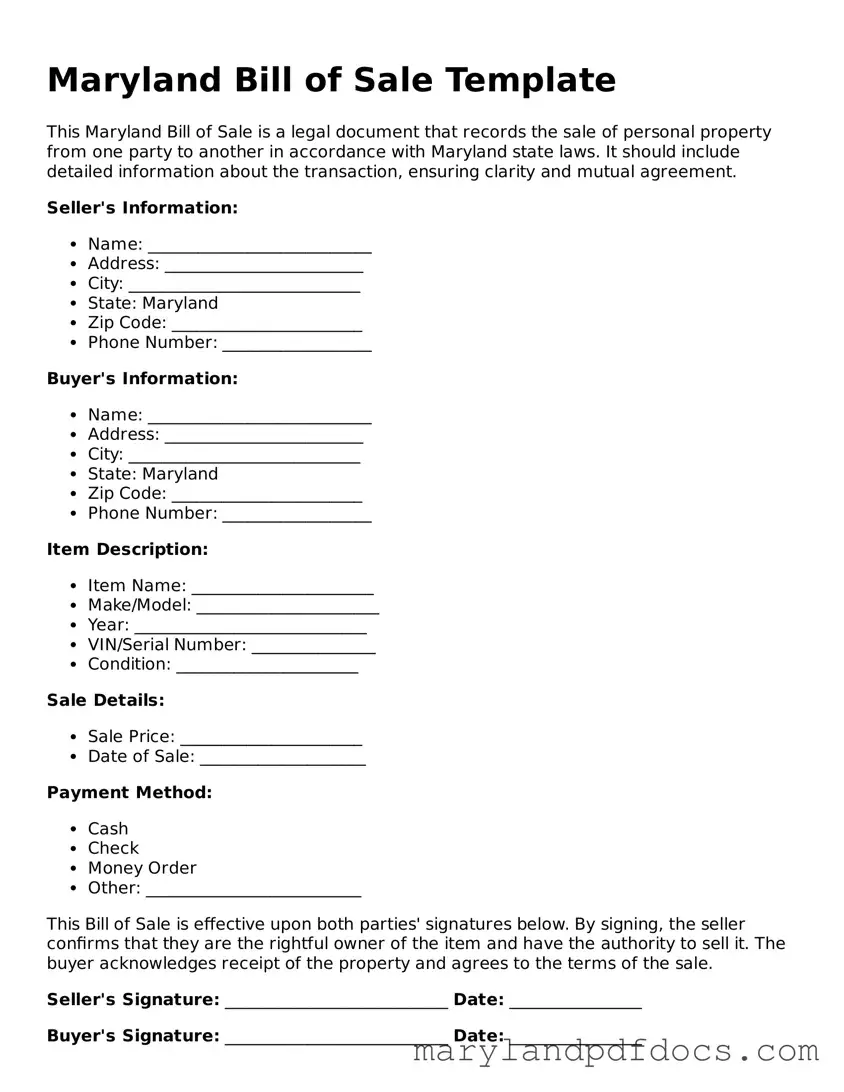

What is a Maryland Bill of Sale form?

A Maryland Bill of Sale form is a legal document that records the transfer of ownership of personal property from one party to another. This document serves as proof of the transaction and outlines the details of the sale, including the item being sold, the sale price, and the names and addresses of both the buyer and the seller.

When do I need a Bill of Sale in Maryland?

A Bill of Sale is typically needed when selling or purchasing personal property, such as vehicles, boats, trailers, or other tangible items. While not always required by law, having a Bill of Sale can provide protection for both parties in the event of disputes regarding ownership or the condition of the item sold.

What information should be included in a Maryland Bill of Sale?

Essential information includes the names and addresses of both the buyer and seller, a description of the item being sold, the sale price, the date of the transaction, and any warranties or guarantees made by the seller. It is also helpful to include the signatures of both parties to confirm the agreement.

Is a Bill of Sale required for vehicle sales in Maryland?

Yes, a Bill of Sale is required for vehicle sales in Maryland. It helps facilitate the registration process and provides proof of ownership transfer. The Maryland Motor Vehicle Administration (MVA) requires a Bill of Sale when you are applying for a new title or registration.

Do I need to have the Bill of Sale notarized?

Notarization is not typically required for a Bill of Sale in Maryland, but it can add an extra layer of authenticity and security to the document. If both parties agree, having the document notarized can help prevent disputes later on.

Can I create my own Bill of Sale form?

Yes, you can create your own Bill of Sale form as long as it includes all the necessary information. There are also templates available online that can guide you in drafting a proper Bill of Sale. Ensure that the form meets Maryland's requirements for it to be valid.

What happens if I lose my Bill of Sale?

If you lose your Bill of Sale, it may complicate future transactions involving the property. It is advisable to keep a copy for your records. If necessary, you can create a new Bill of Sale to document the transaction again, but both parties must agree to this and sign the new document.

Can I use a Bill of Sale for gifts or trades?

Yes, a Bill of Sale can also be used for gifts or trades. In such cases, the document should clearly state that the item is being given as a gift or exchanged rather than sold for a specific price. This helps clarify the nature of the transaction for future reference.

Where can I obtain a Maryland Bill of Sale form?

You can find Maryland Bill of Sale forms online, at legal stationery stores, or through the Maryland Motor Vehicle Administration for vehicle-related transactions. Many websites offer free or paid templates that you can customize to suit your needs.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a signed copy for their records. If the transaction involves a vehicle, the seller should provide the buyer with the signed Bill of Sale when transferring the title at the MVA. This ensures that both parties have proof of the transaction.