What are the Articles of Incorporation in Maryland?

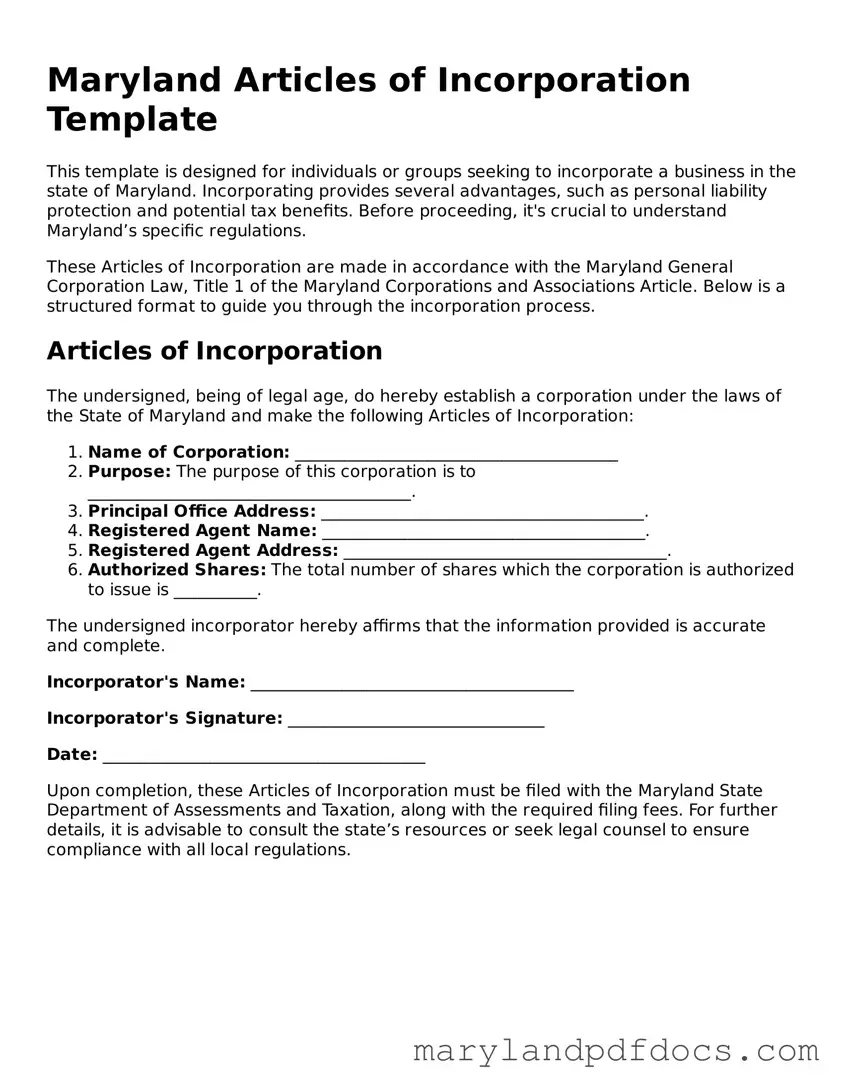

The Articles of Incorporation is a legal document that establishes a corporation in Maryland. It serves as the foundation for the business entity, outlining key details such as the corporation's name, purpose, and the number of shares it is authorized to issue. This document is filed with the Maryland State Department of Assessments and Taxation (SDAT) to officially create the corporation.

What information do I need to include in the Articles of Incorporation?

When preparing the Articles of Incorporation, you must provide several important pieces of information. This includes the corporation's name, which must be unique and not similar to existing entities. Additionally, you will need to state the purpose of the corporation, the address of its principal office, the name and address of the registered agent, and the total number of shares the corporation is authorized to issue. It's also advisable to include the names and addresses of the initial directors.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation in Maryland can be done online or via mail. If you choose to file online, visit the Maryland SDAT website, where you can complete the form and pay the required filing fee electronically. Alternatively, you can download the form, fill it out, and send it along with the payment to the appropriate address. Ensure that you follow all instructions carefully to avoid delays in processing.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Maryland varies based on the type of corporation you are forming. As of October 2023, the fee for a standard corporation is typically around $100. However, additional fees may apply if you choose expedited processing or if your corporation will issue more than a specified number of shares. Always check the Maryland SDAT website for the most current fee schedule.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary depending on the volume of applications received by the Maryland SDAT. Generally, if filed online, you might receive confirmation of incorporation within a few business days. Mail submissions may take longer, sometimes up to several weeks. For those needing quicker confirmation, consider opting for expedited service, which is available for an additional fee.

Do I need to include any additional documents with my Articles of Incorporation?

In most cases, the Articles of Incorporation can be submitted on their own. However, if your corporation has specific requirements, such as a unique business structure or additional bylaws, you may need to include those documents as well. It’s wise to review the instructions provided by the Maryland SDAT to ensure compliance with all necessary regulations.

What happens after my Articles of Incorporation are approved?

Once the Maryland SDAT approves your Articles of Incorporation, your corporation is officially formed. You will receive a Certificate of Incorporation, which serves as legal proof of your corporation's existence. After this, you can begin operating your business, but remember to comply with any ongoing requirements, such as obtaining necessary licenses and permits, holding annual meetings, and filing annual reports.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation after they have been filed. If there are changes to your corporation’s name, purpose, or other key information, you will need to file an amendment with the Maryland SDAT. This process involves submitting a specific form and paying a fee. Keeping your Articles of Incorporation up to date is crucial for maintaining good standing with the state.

Is it necessary to hire a lawyer to file the Articles of Incorporation?

While hiring a lawyer is not a requirement for filing the Articles of Incorporation, it can be beneficial, especially if you are unfamiliar with the process or have complex business needs. A legal professional can provide guidance on the best structure for your corporation, help ensure compliance with state laws, and assist with any additional documentation. If you feel confident navigating the process on your own, you can certainly file without legal assistance.