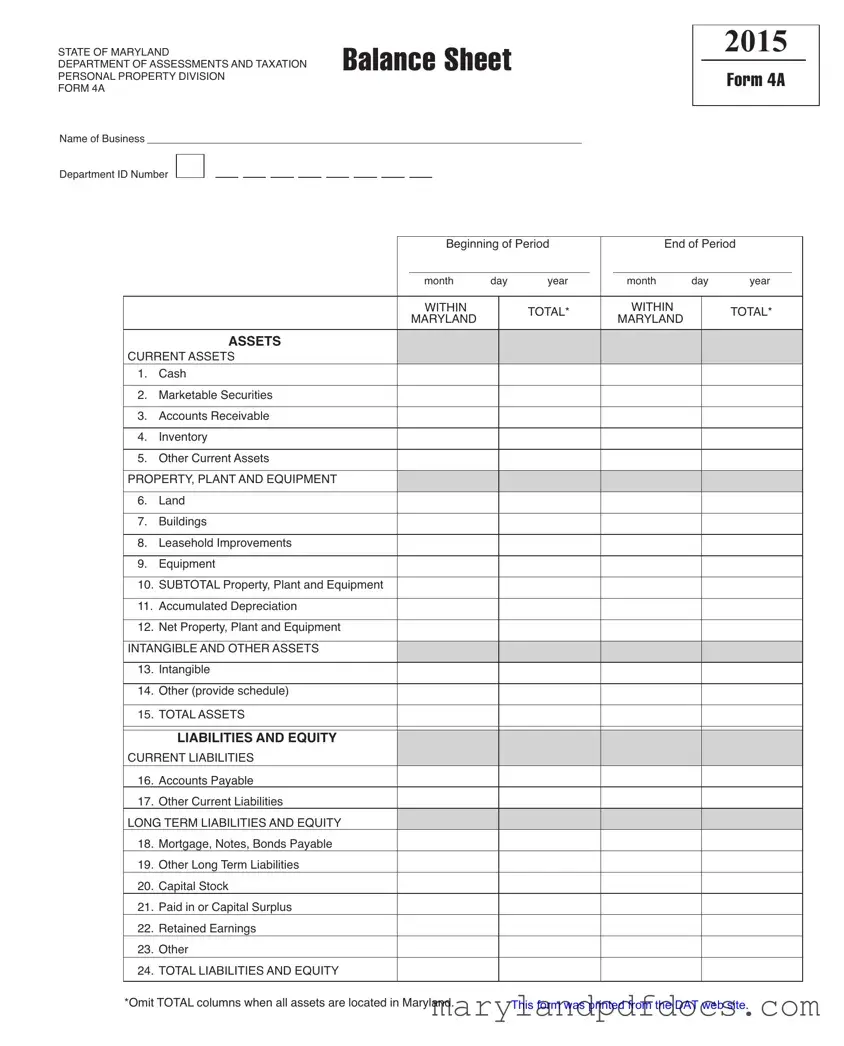

What is the 4A Maryland form?

The 4A Maryland form is a balance sheet used by businesses in Maryland to report their financial position. It provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. This form is essential for the Department of Assessments and Taxation, particularly for personal property tax purposes.

Who needs to file the 4A Maryland form?

Any business operating in Maryland that holds personal property must file the 4A form. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). If your business has assets located in Maryland, you are required to submit this form to ensure compliance with state regulations.

What information is required on the 4A Maryland form?

The form requires detailed information about your business's assets and liabilities. You’ll need to list current assets such as cash, accounts receivable, and inventory. Additionally, you must report property, plant, and equipment, including land and buildings, along with any accumulated depreciation. Finally, you will need to provide details on liabilities, including accounts payable and long-term debts, as well as equity components like capital stock and retained earnings.

When is the 4A Maryland form due?

The 4A form is typically due by April 15th each year. It’s important to keep this deadline in mind to avoid any potential penalties or interest charges. If you need more time, you may be able to request an extension, but be sure to check the specific guidelines provided by the Maryland Department of Assessments and Taxation.

What happens if I don’t file the 4A Maryland form?

Failing to file the 4A form can lead to penalties, including fines and interest on unpaid taxes. Additionally, your business may be subject to an estimated assessment, which could result in a higher tax bill. It’s crucial to stay compliant to avoid these unnecessary costs.

Can I amend my 4A Maryland form after filing?

Yes, you can amend your 4A form if you discover errors or omissions after submission. It’s advisable to correct any mistakes as soon as possible. You may need to provide documentation to support the changes. Contact the Maryland Department of Assessments and Taxation for guidance on the amendment process.

Is there a fee associated with filing the 4A Maryland form?

There is no fee for filing the 4A Maryland form itself. However, keep in mind that any taxes owed based on the information reported may still apply. Ensure that you calculate your tax liability accurately to avoid surprises.

Where can I find the 4A Maryland form?

The 4A Maryland form can be accessed online through the Maryland Department of Assessments and Taxation website. You can download a copy, fill it out, and submit it electronically or by mail, depending on your preference.

What if I have questions while filling out the 4A Maryland form?

If you have questions or need assistance while completing the form, you can reach out to the Maryland Department of Assessments and Taxation directly. They can provide guidance and clarify any aspects of the form that may be confusing. Additionally, consulting with a tax professional can be beneficial for more complex situations.